Feed your winners, starve your losers.

Those six words have transformed my trading.

It’s the foundation of everything I do.

In a nutshell, I like to double down on my strongest stocks and get rid of my “dogs.”

Many traders do the opposite. They cut winners early and add to their underperformers.

And I get why people do this…

It’s only natural to think slower-moving stocks will catch up to faster stocks.

But winning stocks are winners for a reason.

When you get one, you should find ways to buy more of it.

That’s what this Trade of the Week is all about.

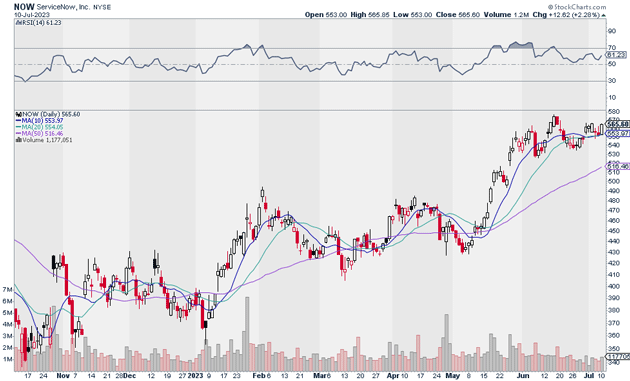

Today, I’m recommending ServiceNow (NOW) for the second time.

I originally encouraged readers to buy a “starter position” in NOW on May 30. I also suggested they use dips to add to their position.

Since then, NOW has climbed 5%. In other words, the trade is working. It’s a winner.

So, we’re going to turn our stake in NOW into a full position. And we’re doing this because NOW looks poised to begin its next leg up.

As you can see, NOW has spent the past several weeks trading sideways… storing up energy for its next leg up.

Source: StockCharts

Source: StockCharts

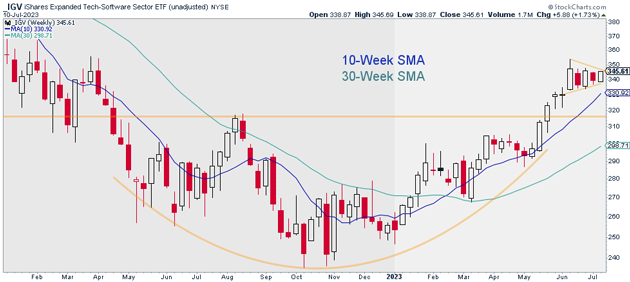

And I believe that next leg begins soon. I say that because of what I’m seeing in the Software Sector ETF (IGV).

Since breaking out of its multi-month base, IGV has spent the past month painting a “bull flag." Bull flags are formed once an uptrend has already begun. They’re continuation patterns.

Source: StockCharts

Source: StockCharts

Stocks that break out of bull flags begin their next leg up. In other words, software stocks are likely about to start rising again.

That’s great news for NOW, which has been one of the best-performing, larger software stocks.

I suggest turning NOW into a full position if you haven’t already.

I’m targeting $700 for NOW over the next 12 months. I also suggest raising your daily stop-loss to $515. That gives us nearly 24% upside, and a risk-reward ratio of 3:1.

Action to take: Turn NOW into a full position today.

Risk management: Exit your position if NOW closes below $515.

Justin Spittler

Chief Trader, RiskHedge