Stephen here.

Today, I’m handing the reins to Executive Editor Chris Reilly, who sits down with Chief Trader Justin Spittler for a special interview regarding his RiskHedge Live beta test.

Justin hosts a unique trade room specifically designed to capture the market’s fast moves. I think you’ll benefit from hearing what Chris and Justin have to say…

***

Chris Reilly: Justin, the results are in for your RiskHedge Live beta test.

As you know, a small group of RiskHedge readers paid to gain first-look access to your private trading room last June.

During this beta test phase (June–December), we closely tracked every trade.

Let’s look at how you did. I’ll give you an official grade—between A+ and F—taking everything into account. We’ll also discuss what’s in store for 2024, and how you’re playing the current market.

Justin Spittler: Let’s do it. We should start by explaining how my advisory is different from most others.

Chris: I wouldn’t even call it an advisory. Your trading room is anything but a traditional service.

Look, we’ve been friends for eight years, and I’ve been editing your work since back when we were colleagues before RiskHedge.

You did the whole “traditional newsletter thing” very well.

For example, we launched IPO Insider in 2019 and made subscribers very happy with trades like Cloudflare (NET) +366%, VTIQ +395%, and Fastly (FSLY) +330%, among others.

You wrote up the monthly issues, updated readers on the IPO market, and sent alerts when a faster-moving opportunity presented itself.

But toward the end, you felt the format was restricting your ability to help members as much as possible.

Justin: Yes. I’ll be blunt: Writing a monthly 15-page newsletter felt “off” to me after a while. Those traditional, longer-form updates are better-suited for investing letters.

As a full-time trader, I monitor hundreds of charts a day. I look at price action and act on that price action—fast.

Simply put, I wanted my subscribers to receive my trade recommendations the moment it was time to pull the trigger... not an hour later, which often happened by the time it got edited, proofread, and loaded up in our email-sending software.

Speed matters. And RiskHedge Live has proven, I think, to be the perfect solution.

Chris: So we built RiskHedge Live to have three qualities:

- Easy to use

- Fun

- Community-oriented

“Easy to use” because people are busy.

“Fun” because many investors find trading intimidating, but this is a service anyone can benefit from.

And “community-oriented” so members could grow and share their wins along the way. And trade more profitably—regardless of experience, portfolio size, or sophistication.

After six months, I’m proud to say we’ve really built a great community in the room.

Justin: I agree. It’s been fun interacting with our members.

Chris: But at the end of the day, it all hinges on you producing great results. So, let’s talk about that.

First, your win rate. 56% of your trades were profitable. Comments?

Justin: That’s about what I shoot for. That probably sounds odd to readers who aren’t familiar with trading, because it means almost half of our trades are unprofitable.

But as most any veteran trader will tell you—and as my own personal experience confirms—a high win rate isn’t all that important. It’s far more important what you do with your profitable and unprofitable trades.

Chris: You’re talking about cutting losing trades early, and letting winning trades run?

Justin: Yes. Not to get philosophical, but the Pareto Principle rules in trading. It states that 20% of your trades will produce 80% of your results. Our real task as traders is to let the big winners flourish while keeping a tight leash on all other trades.

Chris: That being the case, while your winners won’t necessarily outnumber your losers by a wide margin, your winning trades should produce far bigger profits than your losing trades.

Let’s look at the results through that lens.

You recommended 55 trades during the beta test. That includes 49 stocks and six crypto/crypto-related investments.

Your three biggest winners were Solana (SOL) +219%, Valkyrie Bitcoin Miners ETF (WGMI) +97%, and CrowdStrike (CRWD) +77%.

Your three biggest losers were Transocean LTD (RIG) -32%, Marathon Digital (MARA) -30%, and Super Micro Computer (SMCI) -23%.

Congratulations.

Justin: Thank you. As you know, you can’t be a successful trader without managing risk, even in a year like 2023 with stocks rising 24%.

I’ll reiterate: While all the glory comes from the big wins, cutting laggards is just as important. There are thousands of stocks in the market, so there’s no reason to hang on to one that isn’t rising fast enough.

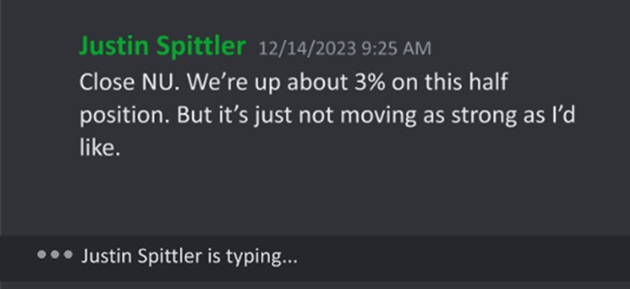

We cut NU Holdings (NU), for example, for a 3% gain for this exact reason:

There are always more opportunities coming, and I refuse to waste time or capital in a stagnant trade when we can be in a winner.

—To be continued—

On Monday: Chris will share RiskHedge Live’s total return and hand Justin a final grade.

Editor’s note: If you’re reading this, you’re eligible to join RiskHedge Live at the lowest possible price when you act during this Report Card series. Click this link to review your special deal.