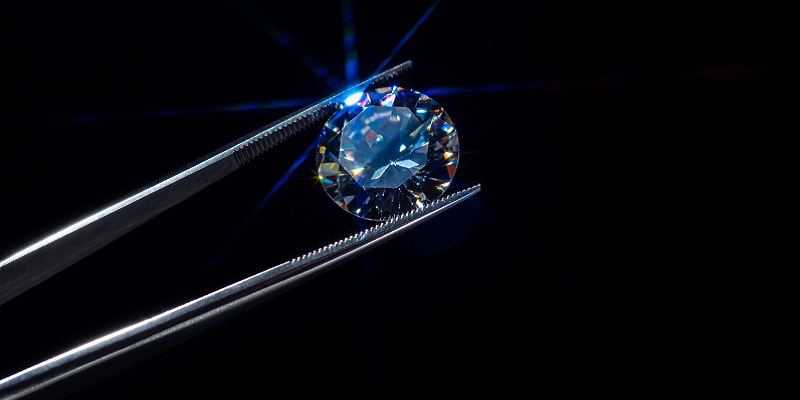

You might expect to see a jaw-dropping, 15-carat emerald-cut diamond in Vegas…

But not at a microcap stock conference.

This diamond was special, though. And not just because it was the size of a large grape.

It was “grown” in a lab.

And this wasn’t some cubic zirconia “faux” diamond. It was real. It had the same properties as a diamond mined from the Earth after forming over millions of years.

A tiny company called Adamas One (JEWL) made this diamond.

I sat down with the CEO Jay Grdina last week in Las Vegas at the Planet MicroCap Showcase. It turned out to be one of the best microcap conferences I’ve ever attended.

In 2019, Jay bought the patents and assets to make lab-grown diamonds using a process that turns gases into solids.

Adamas One’s lab-grown diamonds are great for customers because they cost about half as much as mined diamonds. And they don’t come with the human rights and environmental issues mined diamonds do.

Today, JEWL trades for about $0.73… so it’s flying under most investors’ radars.

While I’m interested in Adamas One as an investment opportunity… I’m not recommending it as a buy today. I have more research to do.

Next month, I’ll meet with Jay again in Greenville, South Carolina, to tour the company’s new factory. I’ll see the diamond-growing operation firsthand.

Then, I’ll decide if I want to recommend JEWL. My paid-up Project 5X subscribers will be the first to know. (By the way, the special offer to join my Project 5X advisory closes at midnight tonight. Details here.)

Jay was one of 12 microcap CEOs I met one-on-one in Vegas. But before I tell you about two other companies from the conference, let me be clear…

Microcaps are not for everyone.

You need to be comfortable sitting with volatility as your investment thesis plays out. For example, many microcap names are down more than 90% from their highs in 2021.

Investing in microcaps requires lots of patience and conviction.

But if you can stomach the volatility, you can realize some truly massive gains over the long run.

The last tough market environment for microcaps was during the March 2020 COVID crash.

At one point, two stocks I held in my Project 5X portfolio fell significantly. Kopin (KOPN) plummeted 85%, and Magnite (MGNI) dropped 60%.

But I told readers to stick to their guns and hold on because their stock prices made absolutely no sense.

Kopin went on to soar 5,657% over the next 11 months…

And Magnite soared 1,409% over the next 10 months.

We ended up booking gains of 399% and 422% on those two stocks, respectively. And some of my subscribers locked in even bigger gains.

So, while the microcap market remains tough today, things will turn around for the good stocks in the space. That’s the way it works. And I think it’ll happen sooner than later.

Many venture capitalists and fund managers I talked to at the Planet MicroCap Showcase agree. They think a big turnaround is coming in the second half of this year.

In fact, the Fed just all but guaranteed they’re done raising rates at the latest meeting. Once investors are convinced rate hikes are officially over, microcaps could really take off.

Already, eight of my Project 5X picks are up more than 80% from their 52-week lows.

2 more microcaps to put on your radar

With that in mind, here are two more exciting microcap companies I met with last week:

LogicMark (LGMK) is about to come out of stealth mode with a new hardware and software platform for the personal emergency response system (PERS) market.

You probably remember those “I’ve fallen, and I can’t get up” commercials from a few years ago. That’s basically the PERS business.

LogicMark’s new tech will be able to detect falls much better than anything on the market today. It will also be able to predict potential future falls. And the “wearable” hardware component will look like something senior citizens would actually want to wear.

Tantalus Systems Holding (TNTLF) is a smart grid tech company. Its edge computing devices replace traditional electricity meters for homes. And they make utility companies’ electricity distribution more efficient using predictive software.

Again, I’m not recommending these stocks today. They’re tiny companies with little trading volume. But they’re worth putting on your radar.

What makes these two companies extra interesting is they’re both using AI to drive their businesses.

I’ve recently recommended two tiny stocks in my Project 5X service that are also harnessing AI. Both are flying under the radar right now.

The first stock is a little-known satellite imagery company specializing in “dynamic hourly monitoring.” Its AI platform scans satellite images and offers analysis that would take a human days or weeks to perform. I share all the details in my new report: How to Go for 7X Gains from My #1 Undercover AI Play.

The second AI stock I just recommended in the latest issue. It uses an AI-based machine vision system for law enforcement, citation, and public safety. Already, it’s helping to crack down on crime across the US.

If you want to access these stocks, and all my AI research, go here to discover more.

But keep in mind, this special, one-time deal closes tonight at midnight.

So if you want in, you’ll have to act fast.

Chris Wood

Chief Investment Officer, RiskHedge