Artificial intelligence (AI) stocks just got a major boost.

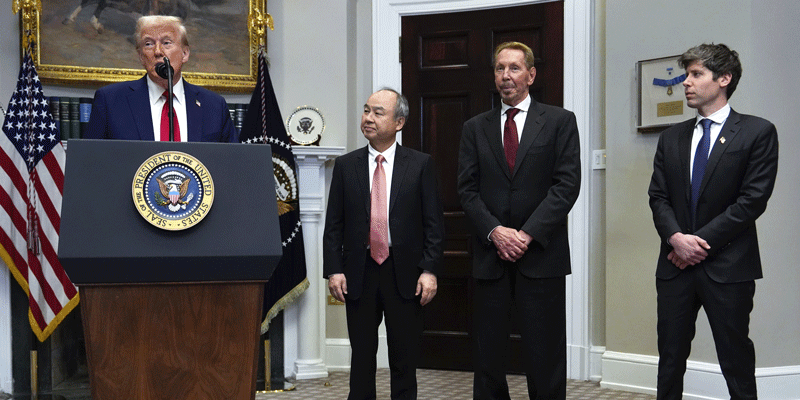

Yesterday, newly inaugurated President Trump unveiled Project Stargate—an initiative that will invest $500 billion into AI infrastructure in the United States over the next four years.

Stargate is a partnership between OpenAI, Nvidia (NVDA), Oracle (ORCL), Japan’s SoftBank, and MGX—a tech investment arm of the United Arab Emirates.

Trump is calling this “the largest AI infrastructure project by far in history.” It’s clearly a major catalyst.

Oracle has rallied 17% over the past two days on the news. Oklo (OKLO)—an AI energy company that OpenAI CEO and cofounder Sam Altman is an investor in—has spiked 23%. Nvidia also got a big boost. It’s gained 5.5% over the past two days.

But this isn’t just bullish for the companies I just mentioned. It’s bullish for the entire AI industry.

Many other semiconductor stocks, AI energy companies, and infrastructure plays are spiking on the news.

So, does this mean you should go all in on AI stocks right now?

Well, the Stargate announcement is certainly a game-changer. But I’m not one to chase stocks on bullish news. I prefer to position myself before the big move happens.

Easier said than done, right? Sure. But the market has a knack for sniffing out major news before it makes headlines.

And AI stocks have been setting up beautifully for weeks.

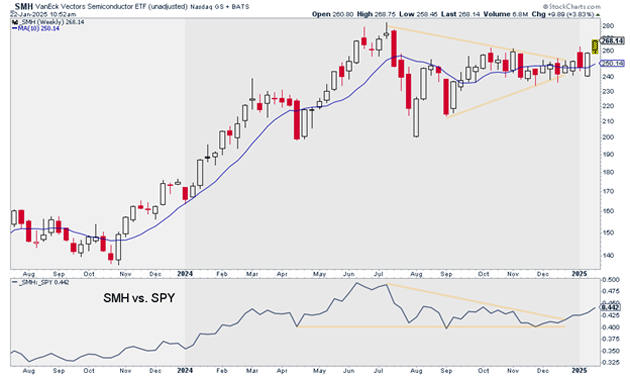

Just look at this chart of the VanEck Semiconductor ETF (SMH). It’s spent the past several months building out a massive wedge pattern. This sort of setup often precedes major moves.

In this case, SMH broke out on both an absolute and relative basis compared to the S&P 500 (SPY):

Source: StockCharts

Source: StockCharts

This is a big reason why I’ve encouraged my subscribers to increase their AI stock exposure in recent weeks.

For example, we recently picked up shares in a little-known hardware company in Express Trader. This “AI gem” has surged 29% over the past month and is hitting new all-time high after new all-time high. It’s one of the market’s true leaders.

I believe 2025 will be another big year for AI, but you have to be selective and buy the right names.

As a full-time trader, I monitor hundreds of charts a day and over a thousand charts a week. I then drill down into the strongest sectors to identify the three best trades to make each week in Express Trader. It’s a simple trading approach that’s working, and you can join us today by going here.

Justin Spittler

Chief Trader, RiskHedge