“Follow the leaders.”

If you’ve been following my work, you know this is a motto I live by.

These stocks ignite market rallies… and deliver the biggest gains.

But many market leaders have already made big moves. It would only be natural for many of them to pull back or, at the very least, consolidate before moving higher.

That doesn’t mean there aren’t still incredible trading opportunities out there. In fact, now is the perfect time to put on some “catch up” trades.

That brings us to my latest Trade of the Week: Cloudflare (NET).

Cloudflare is one of the world’s most important software companies. It’s a pioneer of edge computing and a leading cybersecurity stock.

(Longtime readers know I’m a huge cybersecurity bull—and that I have a long history with NET. I first recommended it in November 2019 in my former advisory, IPO Insider.)

Two weeks ago, I also encouraged readers to buy Palo Alto Networks (PANW)—another industry leader. Since then, PANW has rallied 13%.

And we just picked up shares of CrowdStrike (CRWD) in my premium advisory, RiskHedge Live, back in October. CRWD has since climbed more than 22%.

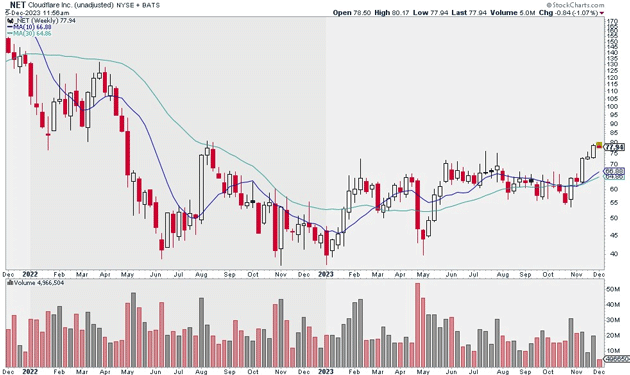

I’m recommending NET today because it hasn’t gotten going yet, unlike PANW and CRWD. You can see what I mean below…

NET is starting to climb out of a base it’s been building since last summer. From here, I see a ton of upside:

Source: StockCharts

Source: StockCharts

I suggest buying a starter position in NET today. I believe it can hit $120 within the next 12 months.

Exit your position if NET closes below $71. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy NET at current market prices.

Risk management: Exit your position if NET closes below $71.

Justin Spittler

Chief Trader, RiskHedge