Warren Buffett’s latest move might surprise you… US stocks are passing the torch... Plus, a dead-simple way to invest in this big shift…

- When Warren Buffett makes an unusual move… pay attention.

Buffett is likely the best investor of all time.

His firm Berkshire Hathaway (BRK.A) delivered an average annual return of 20% from 1965 to 2022, which turned a $1,000 investment into $38 million.

Buffett is known for buying large stakes in iconic American companies. He’s invested billions of dollars into brands like Apple (AAPL), Coca-Cola (KO), and American Express (AXP).

In a 2021 shareholder letter, he wrote: “Never bet against America.”

Which makes his latest move all the more surprising...

Warren Buffett is buying Japanese stocks. Specifically, he just increased his stakes in five Japanese conglomerates—including Mitsubishi and Sumitomo—that are plugged into important areas of the Japanese economy.

Buffett has repeatedly praised how “cheap” Japanese stocks are.

- This is your second chance to act on my “top idea for 2023.”

I dedicated a whole essay to convincing you to buy non-US stocks.

If you didn’t listen, I can’t blame you. For the past 15 years, it’s been a complete waste of time for American investors to look outside of the US. All the greatest stocks were American.

But a changing of the guard is underway that’s obvious to anyone who’s paying attention.

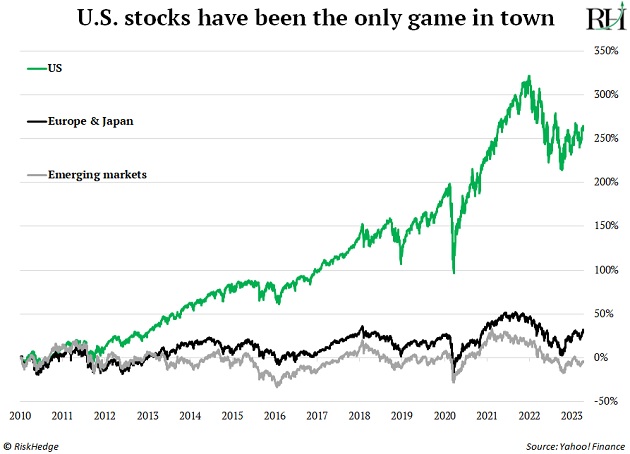

This chart maps the performance of the S&P 500 ETF (SPY) versus stocks from emerging markets (VWO) and those from Europe and Japan (VEA) since 2010:

US stocks went up; foreign stocks went nowhere. For 13 years!

That’s a long, long time. Long enough for most investors to practically forget that foreign stocks even exist.

- Which is why this next chart is so important.

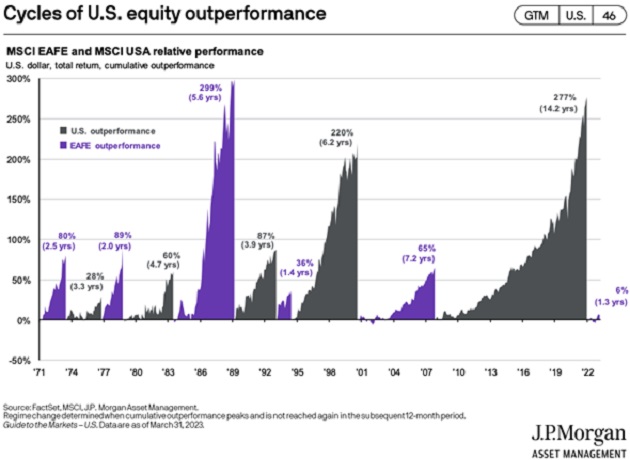

Stock market leadership is a pendulum that swings back and forth.

This chart from JPMorgan shows that US stocks (grey) outperformed international stocks for most of the last 15 years.

But as you can see… that’s not a permanent state of affairs. Foreign stocks outperformed in the purple periods.

Source: JPMorgan

Source: JPMorgan

We haven’t experienced international outperformance in a LONG time.

But notice the tiny purple bump at the far right?

After more than a decade of US outperformance, international stocks are taking the lead once again.

You can see it all over the new highs lists…

Euro Stoxx 50, an EU version of the S&P 500, recently reached a 52-week high.

|

[AI: The $15 Trillion Opportunity] Click here to learn the best (and most unexpected) way to act on the |

Mexican stocks, as measured by the iShares MSCI Mexico ETF (EWW), reached new eight-year highs last week. EWW surged 18% since 2022, while the S&P fell 13%.

The FTSE 100 Index, which represents top UK stocks, is less than 2% away from reaching new all-time highs.

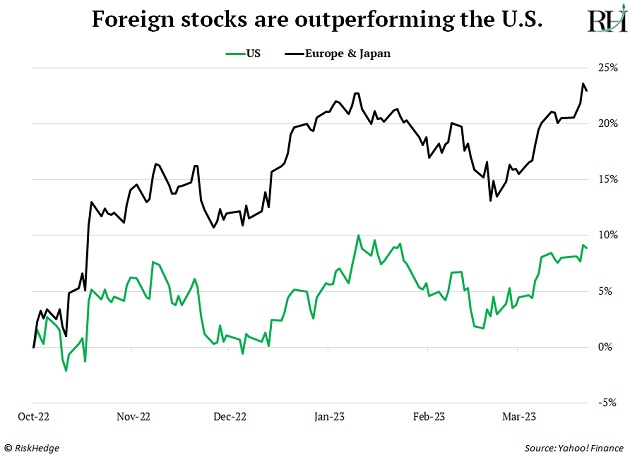

Add it all up, and the returns of foreign stocks over the past few months are double that of the S&P 500:

Don’t underestimate the change in this trend.

The last time leadership shifted, international stocks outperformed for seven long years.

And for every $1 US stocks returned, foreign stocks handed back $1.65.

And to head off any questions I’ll get…

I’ve lived on four continents, and I can confirm America is the most innovative, resilient place on Earth. I’m 100% certain it will continue producing the most disruptive companies in the world.

But facts are facts. International stocks are setting up to make a multi-year run higher. If you’re a serious investor, you simply must allocate at least a small part of your portfolio to international stocks right now.

- Here’s what I suggest to profit from this big shift…

You could buy a big international stock ETF like VEA.

Or, consider joining the ranks of Cornerstone Club… whose members have been invested in foreign stocks since December.

Cornerstone Club is different from any other advisory. It follows a systematic, rules-based way of investing. It doesn’t care about stories, themes, or “hot stocks.”

It simply helps members rotate into up-trending sectors… and out of down-trending sectors.

Cornerstone Club first recommended buying international stocks in early December 2022. And the newest issue advised club members to double their allocation to a different area of international stocks.

International stocks now represent a third of Cornerstone’s portfolio.

If you’re not a member yet and would like to discover more about how Cornerstone works, go here. Dan answers the most common questions about this unique investing club.

Stephen McBride

Chief Analyst, RiskHedge

PS: Have you bought international stocks before? What was your experience? Let me know at stephen@riskhedge.com.

In the mailbag…

RiskHedge readers are still writing in about Stephen’s article “An important message to all parents.”

Here are some of the messages we received over the last few days:

Thank you again for [your] cogent, vitally important message. You are 100% correct— social media is literally killing our youth.

I have three wonderful, brilliant kids—ages 35, 27, and 14. They got their first iPhones at 18, 16, and—uh oh—12. The oldest is an underwater welder and can’t be on the phone all day! The middle is self-employed, on the phone regularly, anxious, and indecisive, but making it. The youngest would require a novelette to describe.

Lazy beyond belief and not studying in school… just doesn’t care. Yet, she picks up even the vaguest innuendos—things I didn’t “get” until [I was] MUCH older...

We “can’t” take away the screens for fear her depression and loneliness will go over the top. Seriously, it is quite scary. I hope she’ll figure it out someday. I’m not on my phone all the time but will implement rules similar to your suggestion. —John

Roger said:

While I am completely in agreement with you on the subject, I believe that this depends very much on the habits you instill at home and your relationship with your children. I have two 17-year-old kids, and they check social media regularly. Having said that, I have also stressed the importance of:

1) Playing sports: This keeps them off their phones… as well as improves their mental and physical health. If it is competitively so, much the better. That way, they have teammates with whom they will socialize and work toward a common goal.

2) Spending time with your children. It is important to do activities with them. This is beneficial on so many levels. First of all, you keep a communication line with them and will be aware of any issues they may be having. Secondly, they need to realize there are so many other things you can do instead of being on [your] phone all the time. Thirdly, it is the perfect way to teach them values. Parents don’t spend enough time with their kids.

3) No phones at the table, ever. This is a time to talk with your family about anything and everything.

4) Reading! Kids need to read books. If you read, they will learn by example. Sorry for the long-winded email, but so far, this has worked for us. —Roger

And Jeff wrote:

I think you’re definitely onto something. I believe the combination of “phones” (actually supercomputers, as you say) and social media are doing much more widespread damage. It promotes and magnifies mental illness—no question in my mind.

And not just with youngsters, although they are “ground zero” for it now. It has now become the easiest thing in the world for unbalanced people to join together in a kind of online fantasy world—and then act out their fantasies together.

I firmly believe that’s why we are seeing societal breakdown and bizarre examples of mental illness everywhere we look. The cliché is, “The inmates have taken over the asylum.” But they’re actually doing it—through the combination of phones and social media. —Jeff