I’m no “bitcoin maxi.”

I’ll trade anything.

But there are times when it makes sense to be very overweight bitcoin (BTC)… and now is one of those times.

As I’m sure you’ve heard, bitcoin broke out to new all-time highs last week. It’s now trading just below $88,000.

That’s a big deal. But it’s likely just the start. Let me explain…

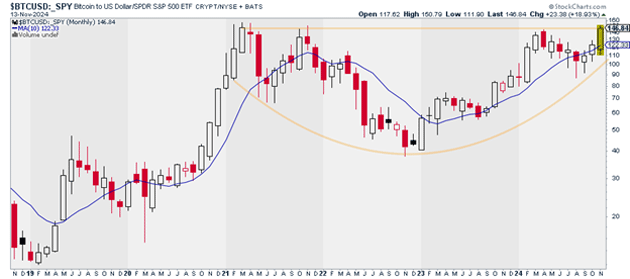

Until recently, bitcoin was basically doing nothing. It had been trading sideways for months.

Source: StockCharts

Source: StockCharts

Consolidation periods like this are normal after big rallies, which bitcoin had at the beginning of this year. They allow an asset to “catch its breath” before beginning its next leg higher.

In this case, bitcoin’s sideways pattern was a long one. It’s stored up a ton of energy.

So, I wouldn’t be surprised if bitcoin doesn’t stop running until around $115,000.

Of course, there are no guarantees in trading. But, in any case, expect bitcoin to massively outperform every major asset in the coming months.

Bold statement. But I’ve got the goods to back it up.

Take a look at this chart. It shows the performance of bitcoin versus the S&P 500. The ratio is on the verge of a massive breakout:

Source: StockCharts

Source: StockCharts

If it does, BTC should massively outperform the S&P 500 in the coming months.

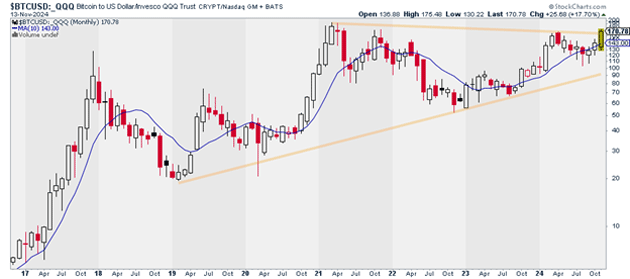

That’s a bet I’m willing to make. After all, we aren’t just seeing this pattern form in one area of the market. We’re seeing it everywhere.

BTC is also attempting to break a three-year downtrend relative to the Invesco QQQ Trust (QQQ), which contains more tech stocks than the S&P 500.

Source: StockCharts

Source: StockCharts

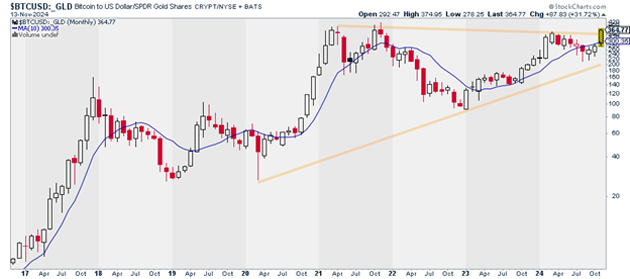

Bitcoin looks extremely bullish relative to gold as well:

Source: StockCharts

Source: StockCharts

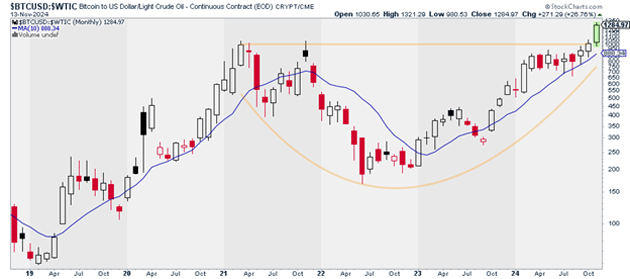

And finally, I favor BTC over commodities. As you can see, BTC just broke out to new all-time highs relative to oil:

Source: StockCharts

Source: StockCharts

It’s rare when the stars align on a big trade like this. When they do, it’s best not to overthink it.

In other words, got bitcoin?

Justin Spittler

Chief Trader, RiskHedge

PS: In my RiskHedge Live trading room, we’re trading the iShares Bitcoin Trust ETF (IBIT), up 24%... and own another crypto (up 328%), plus a leveraged play on bitcoin (+49%).

Our portfolio is mostly stocks, and we’re taking full advantage of the market boom. Right now, we’ve got 22 open positions—21 are up; one is down slightly.

With RiskHedge Live, you get my real-time trade recommendations and analysis, so you never miss a thing. You get to trade “over my shoulder” and ask me questions directly.

Join the room here—we’re having a blast.