Welcome back to my special New Year’s series on why I believe America has officially awoken from its innovation slumber. If you missed my first two essays, you can catch up here and here.

“Made in the USA” is being reborn before our eyes. And in today’s final installment, I share three more industries that will reshape America’s economy.

***

- Space exploration makes a comeback.

Space hasn’t been this exciting since NASA was operating like a nimble startup.

Elon Musk’s SpaceX built the largest and most powerful rocket ever—Starship—which is designed to get us to Mars. SpaceX already launched the 400-ft. rocket into space twice last year.

Look at this incredible photo of Starship’s 33 huge engines firing. Man-made beauty at its finest:

Source: @elonmusk on X

Source: @elonmusk on X

Then you have Starlink, which is bringing high-speed internet to the world.

SpaceX is launching thousands of small satellites into space to create a network that can provide cell and internet access almost anywhere on Earth.

Of the roughly 7,500 satellites in orbit, SpaceX owns two-thirds of them. And it’s launching more every month!

Starlink is like telecom towers in space that bring fast internet to you from all over the world… even when you’re flying. Hawaiian Airlines became the first major airline to sign up for SpaceX’s internet.

Already, Starlink has 2 million paying customers.

- New medical advances will help save millions of lives.

I’m sure you’ve heard of the “wonder drug” Ozempic. It suppresses hunger and helps folks lose weight in a hurry.

It was originally prescribed as a diabetes drug. But 2023 was the year Ozempic was retooled into a “cure for all.” The research I’m reading on it is mind-blowing.

A new study in The Journal of Clinical Psychiatry found Ozempic basically makes alcoholics not want to drink. It’s also been shown to dramatically reduce sugar, smoking, and gambling addictions.

Ozempic could give the iPhone a run for its money as the most successful product on the market. I wouldn’t be surprised if creator Novo Nordisk (NVO) sells a trillion dollars’ worth of it.

I’ve also said before that artificial intelligence (AI) will help save millions of lives. Here’s further proof: Using AI, Harvard and MIT researchers discovered a whole new class of antibiotics to tackle the most hard-to-kill superbugs.

Antibiotic resistance killed over a million people last year. But with AI’s help, these hard-to-treat illnesses could become less lethal.

2023 also brought us cancer-killing pills.

According to researchers at California’s City of Hope National Cancer Center, a new drug eliminated all solid tumours derived from breast… prostate… brain… ovarian… cervical… skin… and lung cancers in pre-clinical trials!

Yeah, you read that right: A cancer-killing pill.

- Biotech will “rewrite” today’s deadliest diseases.

Scientists are now using mRNA technology to develop vaccines to eradicate killer diseases, including malaria and pancreatic cancer. That’s huge!

Then there’s gene editing.

Often referred to as “CRISPR,” gene editing allows scientists to “cut” out bad genes that cause disease and replace them with healthy genes.

Gene editing was in “demo mode” for the past decade. Then 2023 hit.

The first-ever CRISPR therapy was approved in America and the UK. It will target sickle cell disease, a debilitating illness affecting some 100,000 Americans.

All this has led me to one conclusion…

America has awoken from its innovation slumber.

We’re no longer talking about dating and food delivery apps. We’re building Mars-bound rockets and developing cancer-killing pills!

The number of game-changing breakthroughs that occurred in 2023 tops every other year in recent memory. It’s not even close.

It even brought back the hope of flying cars. The “overlord” of America’s skies, the FAA, set a goal to get air taxis up and running by 2028. It’s already issued air-worthiness certifications to several flying-car startups.

Can all this innovation counteract, and ultimately undo, the ruinous “WTF shift” from 1971?

I think so.

Remember, technology is deflationary. It makes luxuries affordable. (For example, the price of TVs has declined 99% since 1950.)

Innovation has been confined to the digital world since the 1970s. But as innovation gets physical, I think we’ll soon see lower prices in the physical world, too.

Finally… all the studies I’ve read on AI tools like ChatGPT show they give a much bigger boost to low-performers than to high-performers. AI is the great equalizer.

The shifts I’ve described will create more opportunities to generate wealth than ever before. Those who ignore it will be left behind, just like many 1970s-era workers.

That’s why it’s up to each of us to seize this opportunity. Will you ride the coattails of the disruptive megatrends transforming our world, or will you sit back and miss the freight train whizzing by?

You must seize the opportunity. No one can do it for you.

Maybe you think I’m mad for suggesting we’re on the cusp of a major positive turning point for America.

But clearly, something BIG changed in 2023.

Our grandkids will pull up a bunch of charts and wonder, “WTF happened in 2023?”

Lastly, let’s quickly touch on the investment implications of this innovation shift.

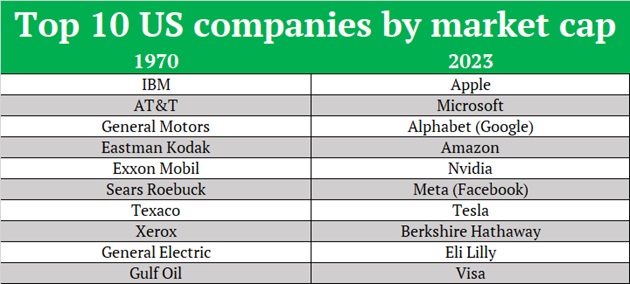

On Friday, I showed you this table of the 10 most valuable US companies in 1970 vs. 2023:

In 1970, businesses that made and sold physical stuff ruled.

In 2023, the digital world dominated.

My prediction: Businesses that make physical “stuff” will soon control the top 10 list once again.

I’m not saying Kodak and Xerox will be resurrected.

I’m saying where innovation happens will dramatically shift from just software (cloud computing and apps) to the combination of software and hardware (tech you can touch).

That includes:

- AI-powered self-driving cars

- Factory robots

- Robo-tutors

- Cancer-killing pills

- Malaria vaccines

- High-speed internet on planes

- Next-generation nuclear plants

…and many more opportunities.

Forget the malaise of the past few decades and dream big. The future’s bright.

I’ll have a lot more to say about this shift—and the ways to profit from it—in Disruption Investor.

Stephen McBride

Chief Analyst, RiskHedge