What’s one of the surest ways to make money investing?

Find a big lie that everyone believes...

Bet against it...

And wait for the truth to come out.

For example, have you seen the movie The Big Short?

It tells the story of a few clever investors who made a killing betting on the US housing collapse in 2007–8.

As crazy as it sounds now, in the mid-2000s, most folks believed that US house prices “never go down.”

A handful of investors figured out this was a huge lie… and placed bets to profit on the housing collapse.

When it all came crashing down, they walked away with over a billion dollars profit.

- There’s a new big lie floating around about US housing today...

I’m sure you’ve heard this “fact” before:

Today’s generation of young adults, known as “millennials,” aren’t like their parents. They don’t want to buy a house and spend 30 years paying it off. In fact, they don’t want to buy houses at all. Instead they’ll rent for life.

Like all believable myths, there’s a grain of truth to it.

A 2016 Pew Research study found more than two-thirds of Americans under 35 rent. And of the 46 million renters in the country, roughly half were millennials.

Young folks will never buy houses like their parents did, the story goes, which will keep a cap on house prices forever.

In Ireland where I’m from, this is what you call “malarkey.”

What did you do after you graduated college? If you’re like me, you probably moved to a city, found a job, and rented a place.

Research from the University of Minnesota tells us most Americans in their 20s rent instead of buying a home. And it’s been this way for 60 years.

In other words, our 20s are peak “renting” years. Every generation of Americans follows this path.

But then you get married… and start thinking about having kids. And what comes soon after? Buying a home.

- Millennials tricked everyone into thinking they were different.

As I mentioned a few weeks back, record levels of student debt forced many young folks to put off buying a home.

And many millennials graduated college into a job market that had been decimated by the 2008 financial crisis.

This pushed millennials to wait a little longer to buy their first homes.

But the average millennial isn’t a kid anymore. This year the average millennial turns 31. The average age of a first time homebuyer in the US is... 31!

- Millennials are finally growing up and buying houses...

According to the National Association of Realtors, one in three homebuyers today is a millennial.

As you may know, millennials are the biggest generation in US history—bigger even than baby boomers. And they’re hitting prime home-buying age right now.

The largest generation in history is piling into the housing market... and hardly anyone believes it!

Quicken Loans is America’s largest mortgage broker. Last month, it broke the record for the best lending year in the company’s 34-year history... with three months still left to go in 2019.

- Back in February I told you why buying homebuilder stocks was a near lock to make you money in 2019.

I recommended buying homebuilder NVR Inc. (NVR).

If you bought NVR in February, nice call. You’re sitting on a 40% gain.

If you aren’t invested in the “quiet housing boom” yet, it’s not too late...

- Here’s a surefire way to profit from the American housing boom...

What’s the first thing you do when you buy a new house?

You start thinking about putting your own “touch" on the house.

What color sofa should go in the living room? How to remodel the old bathroom? What color to paint the kitchen?

As the tidal wave of young homebuyers hits the market, home improvement stocks are BOOMING.

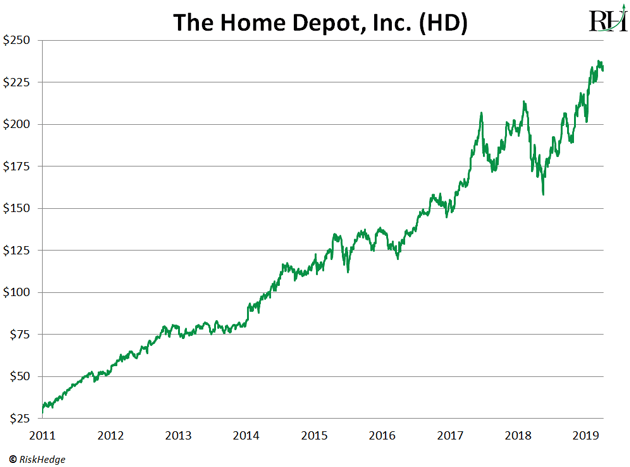

I’m sure you’ve been inside a Home Depot (HD) store. But have you seen its stock lately? It’s hitting all-time highs, as you can see here:

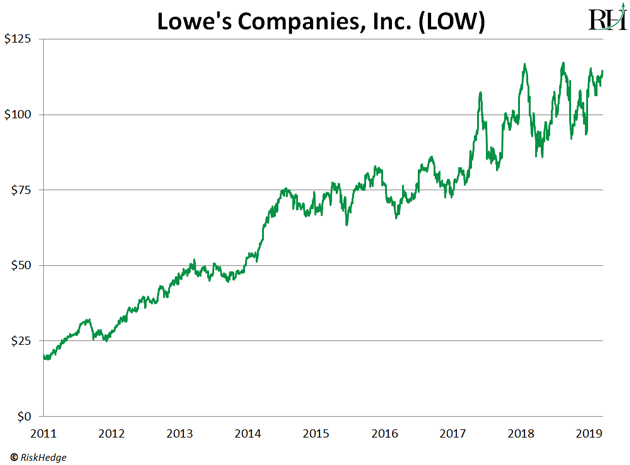

America’s second largest home improvement chain, Lowe’s (LOW), is surging too after reporting record earnings:

On the last earnings call, Lowe’s CEO said the company added a record 35,000 new “pro” customers in the past three months. This tells us business for professional renovators, carpenters, and contractors is booming.

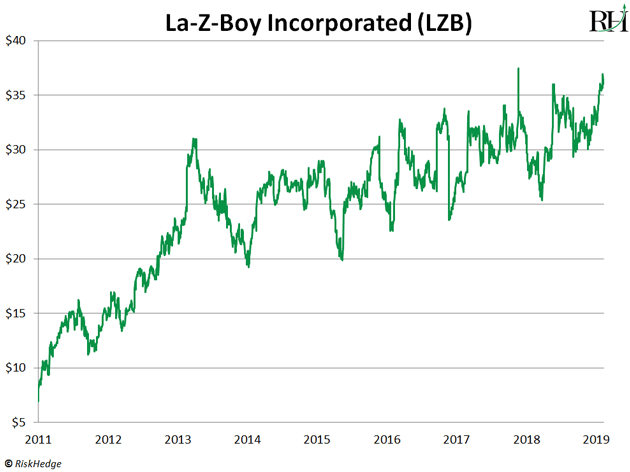

Furniture company La-Z-Boy (LZB) is smashing through record highs too...

The furniture business isn’t exactly exciting. And its certainly not a rapidly growing or disruptive industry.

But La-Z-Boy’s retail sales have shot up 20% in the past year!

I could go on and on with examples. Stocks of paint suppliers… plumbing companies… and window makers are hitting record highs too.

- The home improvement industry is absolutely booming, and it’s likely just getting started...

Over 85% of American homebuyers don’t buy brand new homes. Instead, they buy existing homes that have already been lived in. And a lot of old houses need a total facelift.

Roughly four in 10 homes in America was built before 1970. And when folks buy an old house, they often turn around and invest tens or even hundreds of thousands of dollars into refreshing it.

As I showed you, record numbers of young homebuyers are hitting the market...

And most of them will buy homes that are 30… 40… 50 years old.

Don’t be surprised if “home renovation” stocks keep making new highs for years to come.

- Speaking of hot stocks, mark you calendar for this Monday, November 18 at 8pm...

I’m getting on camera for the first time with RiskHedge Senior Analyst Justin Spittler.

He’ll reveal the results of a special four-month project he’s been working on... and we’re going to discuss a lucrative class of stocks he calls “honeymoon stocks.”

You don’t want to miss it this coming Monday at 8pm. Hope to see you there!

How’s the housing market in your neighborhood? Tell me at stephen@riskhedge.com.

Stephen McBride

Editor — Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen's top "disruptor" stock pick and to try a risk-free subscription.

Reader Mailbag

In last week’s letter, I explained how 100-years’ worth of data is screaming at us to buy stocks. Here are a few reader responses:

Stephen, I find RiskHedge fascinating and useful. I invest small amounts in many recommendations, and it’s exciting to participate in multiple well researched and exciting companies.

As far as investing at a new high, I created a written investment plan that uses valuation to adjust how aggressively I invest. Right now, I have about 45% of my financial assets in stocks. Thanks again for a very interesting and helpful newsletter.

—Rick

Your note today makes some good points. But perhaps the guide should be that stock price all-time highs are only one indicator of when to buy or sell.

Keep writing—I'll certainly keep reading!

—Roger

My wife and I have amassed $2.5 million in our 401K over the last 28 years. The way we were able to do that was keep maxing out the 401K rain, monsoon, or shine.

Love your work, thanks.

—Steve