After a slow start to the week, stocks have climbed back. The S&P 500 is up 8% this year.

As I’ve been saying, it would be perfectly normal for stocks to pull back here. Stocks need to take a breather, even in bull markets like this.

We dodged a correction in February. But the S&P 500 dips 14% in a given year, on average.

Let’s get after it…

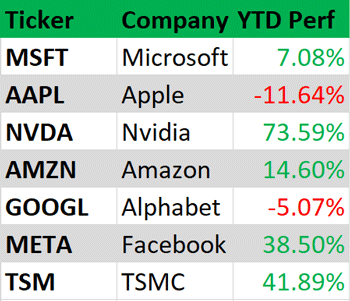

- Apple and Google are losing.

But they’re outliers. Five of the other seven biggest tech stocks are up this year:

We’ve avoided both Apple (AAPL) and Google (GOOG), for reasons discussed many times over the past few months.

Now, Apple is breaking down to new multi-year lows. And Google is stuck below its 2021 highs.

These companies are no longer nimble tech disruptors. They’ve grown too big and bureaucratic to innovate.

Apple spent a decade trying to build electric self-driving cars. It hired 2,000 people to create the Apple Car. News broke the other day that Apple shut the project down.

We discussed Google’s artificial intelligence (AI) calamity last week.

The old Google that invented search, reinvented online maps, and pioneered digital ads is gone. It’s been replaced by a politically correct “borg” paralyzed by fear of offending people.

Google’s co-founders created its search engine in a garage. Today, Google employs 182,000 people. There’s a lot of fat to trim.

We’ll be watching “The Downfall of Google” docuseries on Netflix in 2030.

Avoid Google. Instead, buy great businesses profiting from megatrends.

- PROOF: Innovation will fix America’s most broken industry.

The average family’s health insurance premium in the US just topped $24,000. That’s like paying a second mortgage.

Healthcare’s problem is heavy, nonsensical regulation. Uncle Sam shows up and promises to help. Instead, he wraps the industry in red tape, stifles innovation, and drives costs sky-high.

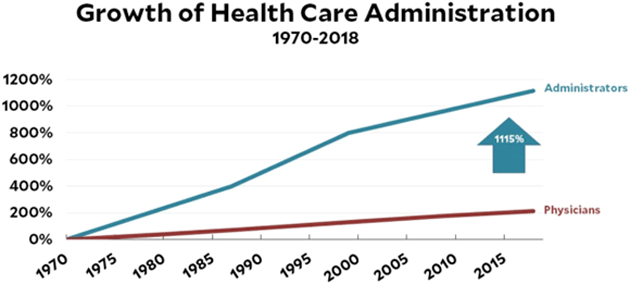

Healthcare regulation has been a total disaster for everyone except those in busybody admin jobs. Healthcare “administrator” jobs are growing 5X faster than the number of doctors!

Source: Kevin Drum

Source: Kevin Drum

How do I know it’s the government’s fault?

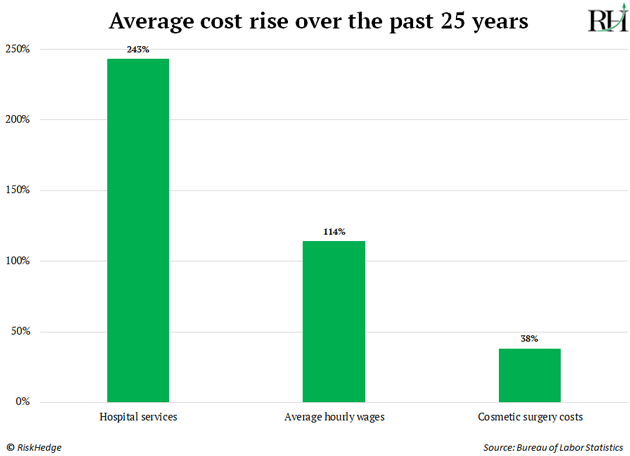

Look at cosmetic surgery.

Cosmetic procedures suffer far less red tape. Insurance companies don’t typically cover Botox injections or nose jobs. And because it’s a much more competitive market, plastic surgeons are incentivized to innovate and do things better… faster… and cheaper.

The average price of 16 common cosmetic surgeries have risen just 38% over the past 25 years.

Healthcare costs have surged 243% in the same period.

Repeat after me: Innovation makes stuff CHEAPER; governments make things more EXPENSIVE. Technology—not politics—is the cure for America’s healthcare ills.

I’m hopeful an AI company can sidestep the maze of red tape and disrupt healthcare.

Imagine an expert robo-doctor in your pocket who knows you’re sick before you feel the slightest bit ill. The AI knows your medical history and orders a new special drug, made for people just like you.

This future is possible if AI is allowed to work its magic.

Chris Wood and I are investing in leading AI healthcare companies in Disruption Investor.

- Amazon just bought $650 million worth of land…

Next to America’s sixth-largest nuclear power plant in Pennsylvania. Amazon (AMZN) reportedly plans to build several data centers there.

Remember when we talked about nuclear-powered data centers?

America made a horrible decision turning its back on nuclear energy in the 1970s. Atomic energy is indisputably the cleanest, safest, most reliable form of electricity generation known to man.

Thankfully, the world’s most powerful governments and corporations are all doing a synchronized U-turn and reembracing nuclear power.

The biggest hurdle for nuclear is regulation (notice a theme?). It takes roughly 14 years and billions of dollars to build a new power plant in America today.

Good news: Last week, Congress passed the first major nuclear policy update in a generation. The bipartisan bill aims to slash red tape and speed up approval times.

Now that’s a bill I can get behind. Nuclear gives us clean, cheap, abundant energy, which is the precursor to achieving that “Jetsons” sci-fi future we’ve all been waiting for.

Abundant nuclear power can give everyone in the world access to clean water with desalinization… supersonic jets that take you to from NYC to London in three hours… and energy too cheap to meter.

Imagine opening your bi-monthly energy bill and seeing “Amount owed: $1.”

In 1973, President Nixon called for Project Independence—the building of 1,000 nuclear plants by the year 2000.

Time to revive that dream.

- Today’s dose of optimism: WTF happened in 1958?

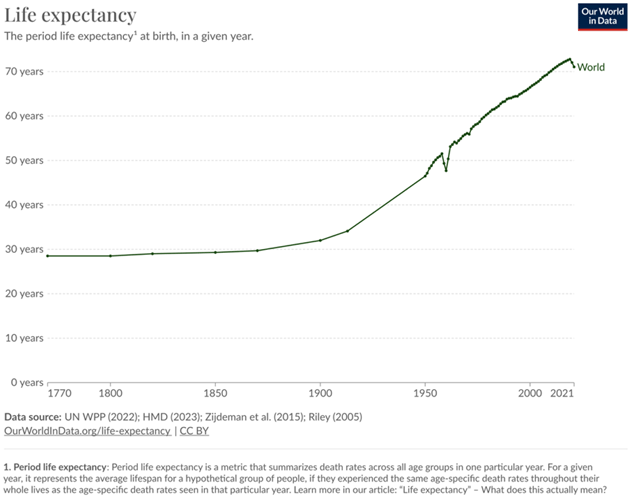

A baby born today will live twice as long as one born a century ago, on average.

Life expectancy has been in a 150-year bull market, with two notable “crashes:”

Source: Our World in Data

Source: Our World in Data

The recent drop is COVID, which prematurely killed millions of people.

See that even bigger drop about 70 years ago?

It wasn’t a World War. It was Communism.

In 1958, the Chinese Communist Party attempted to transform China from an agrarian society into a modern economy.

The “Great Leap Forward” instituted communist principles, like setting up communes where everything was collectively owned.

The result was mass starvation and death. An estimated 45 million people died over four years.

Capitalism (real capitalism) leads to prosperity, communism to carnage. Never forget.

Have a great weekend. I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge