What dips are you buying?

Whenever the market pulls back, there’s a tendency to “buy the dip.”

It’s a knee-jerk reaction.

But here’s the thing…

Not all dips are created equal. Some stocks slice through support when they pull back. Others pull back into support, where buyers step in.

We want to buy the latter.

I mention this because many traders are itching to buy the dip in tech stocks… without understanding the risks.

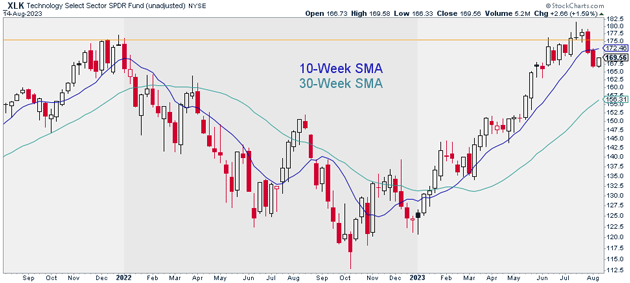

To see what I mean, look at this chart of the Technology Select Sector SPDR Fund (XLK).

XLK broke out to new all-time highs a couple weeks ago. That would have been bullish... but XLK couldn’t stick the landing:

Source: StockCharts

Source: StockCharts

In other words, we may have just seen a “false breakout” in tech stocks. This kind of price action can often produce powerful moves in the opposite direction.

That’s why you need to be careful buying the dip in tech stocks… at least large- and mega-cap names.

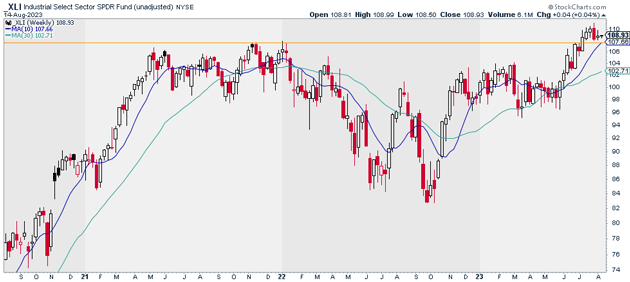

It’s a different story when we look at industrials.

This chart shows the performance of the Industrial Select Sector SPDR Fund (XLI). Like XLK, XLI recently broke out to new all-time highs. Unlike XLK, XLI is still trading above its late 2021 highs:

Source: StockCharts

Source: StockCharts

In short, industrials are stronger than technology stocks… making them better bets for traders and investors looking to buy the dip.

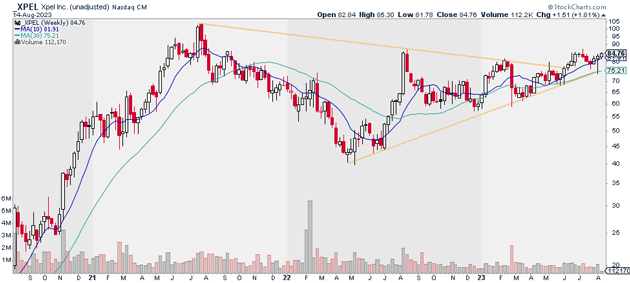

That brings me to our new Trade of the Week: Xpel (XPEL).

XPEL is a $2 billion auto parts distributor. It sells products that protect cars, boats, and even planes from the elements.

It might not sound exciting. But that’s no reason to write off this trading opportunity. As you can see below, XPEL is trending beautifully.

The stock bottomed in May 2022, well ahead of the indices. Since then, it’s more than doubled in value:

Source: StockCharts

Source: StockCharts

This is the kind of strength I look for in stocks. But make no mistake: We’re not chasing here.

A few weeks ago, XPEL pulled back into its rising 10- and 30-week simple moving averages. Buyers stepped in both times.

XPEL now looks poised to begin its next big leg up. I recommend buying a half position today.

I’m targeting $120/share over the next 12 to 18 months. That’d be about a 42% move higher from today’s prices.

Exit your position if XPEL closes below $74. That gives us a risk-reward ratio of more than 3:1 on this trade.

Action to take: Buy XPEL at current market prices.

Risk management: Exit your position if XPEL closes below $74.

Justin Spittler

Chief Trader, RiskHedge