Can semiconductor stocks keep it up?

Last week, they went ballistic...

Nvidia (NVDA)—the world’s largest semiconductor company—surged 25% after sharing what many are calling “revenue guidance for the ages.”

The company expects to generate $11 billion in sales for the current quarter. That’s 52% higher than Wall Street expected.

The news sparked an industry-wide rally.

Advanced Micro Devices (AMD) soared 20% higher on the week. Broadcom (AVGO) spiked 19%, hitting new all-time highs. Onto Innovation (ONTO) and KLA Corporation (KLAC) also surged to new record highs on the news.

After such an explosive move higher, many traders are wondering… what’s next?

Some think this jolt will mark the top.

Others think the hot money in tech will rotate into underperforming sectors such as healthcare or energy.

I’m much more optimistic. I think it’s far too early to fade this move in semiconductor stocks.

But there could be even more near-term upside for new positions in other corners of the tech market, specifically software stocks.

And that brings us to our Trade of the Week, ServiceNow (NOW)—one of today’s best-performing, larger software stocks.

We’re putting on this trade today because software is the second-strongest industry in the market. However, these stocks are way less extended than high-flying semi names.

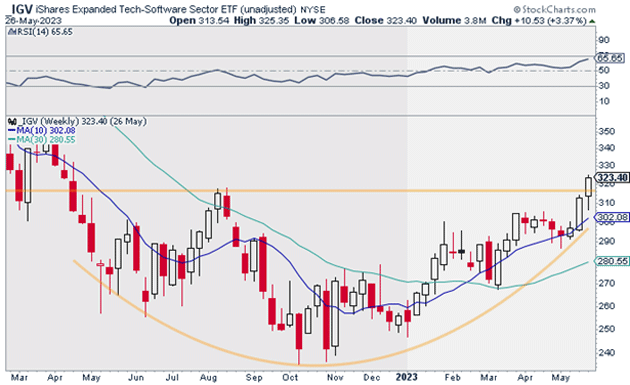

Below, you can see the Software Sector ETF (IGV) is just starting to emerge from a multi-month base. So, we’re not chasing software stocks.

Source: StockCharts

Source: StockCharts

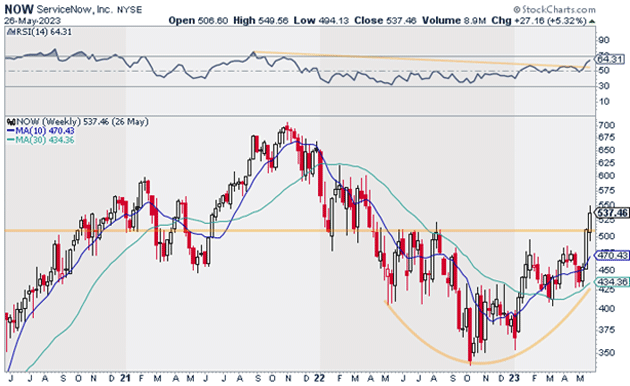

When we turn to ServiceNow’s weekly chart, we can see it’s slightly ahead of schedule relative to its peers. That’s a plus.

We want to buy market leaders at this stage, not laggards. And ServiceNow is certainly a leader. On Friday, the stock closed at new 52-week highs:

Source: StockCharts

Source: StockCharts

And ServiceNow didn’t just break out on an absolute basis. It broke out on a relative basis. As you can see in the chart above, its relative strength index (RSI) just broke the downtrend it had been in since late 2021.

I suggest buying a starter position in NOW today and turning it into a full position on weakness.

I’m targeting $700 for NOW over the next 12 months. I also suggest placing a daily stop-loss at $450. That gives us nearly 27% upside, and a risk-reward ratio of 2:1.

However, both our upside and our risk-reward ratio will be far more attractive if we add to our position in NOW at lower prices.

Action to take: Buy a starter position in ServiceNow at current market prices. Look to buy a second half position in NOW on dips.

Risk management: Exit your position if NOW closes below $450.

Justin Spittler

Chief Trader, RiskHedge