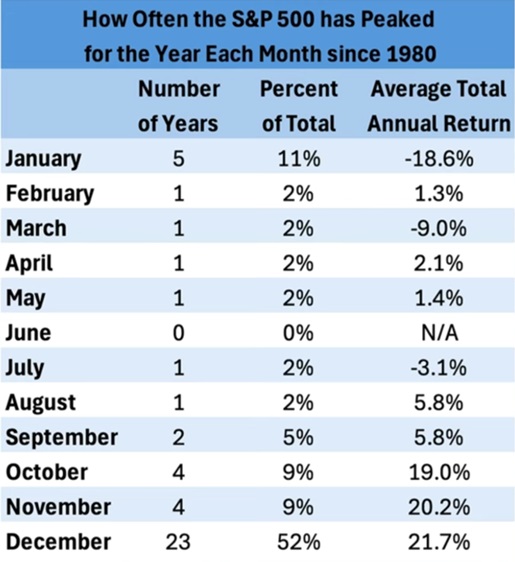

My friend and DataTrek Research founder Nick Colas shared this great table with me last week.

It breaks down—by month—when the S&P 500 usually tops out for the year.

You can see stocks have peaked in December 23 times in the past 44 years. Throw in January, and the S&P tops out around the holidays two-thirds of the time!

Source: @SethCL on X

Our research suggests we could be headed for a repeat in 2024.

Expect markets to stay volatile until after November’s big election, then head higher.

Keep some cash dry and use any potential weakness to scale into great businesses in long-term megatrends.

- Should you buy Nvidia (NVDA) here?

When I first recommended Nvidia almost six years ago, it was selling $800 million worth of artificial intelligence (AI) chips every three months.

It’s now shipping $26 billion worth of these AI processors every quarter. Nvidia reported another A+ quarter on Wednesday, with sales more than doubling to new record highs.

My big takeaway from earnings: We’re only getting warmed up.

Nvidia’s largest customers: Microsoft (MSFT)… Amazon (AMZN)… Google (GOOG)… and Facebook (META) told us it’s full steam ahead on AI spending.

Elon Musk’s AI startup xAI just built a cluster of 100,000 AI chips, tripling the previous record. And the AI models being trained today make ChatGPT look like a toy.

Why did Nvidia’s stock drop if results were so good?

Fundamentals don’t drive stock prices in the short them. Prices move based on positioning and expectations. And everyone expected Nvidia to knock it out of the park, again.

I suspect this post-earnings dip will get bought up fairly quickly.

Disruption Investor members have taken profits on Nvidia twice, and we’re investing in lesser-known winners from the AI infrastructure boom. (You can access the Disruption Investor portfolio by upgrading here.)

But with Nvidia now trading below its five-year average price-to-earnings ratio, I’m a buyer.

- We’re launching an all-out assault on cancer…

In the past month or so:

- US and UK researchers debuted a new blood cancer treatment that cuts the risk of the disease coming back in half.

- BioNTech (BNTX) launched trials for its new (lung) cancer-killing jab in seven countries.

- Moderna (MRNA) and Merck (MRK) announced that patients injected with their personalized skin cancer “vaccine” were 49% less likely to die than those who didn’t take it.

Regular Jolt readers know biotech is the next transformational megatrend. mRNA, gene-editing, and wonder drugs like Ozempic are helping us fight today’s biggest killers.

Innovation typically “clusters” around one or two technologies at a time. Entrepreneurs are drawn to breakthrough ideas like moths to a flame.

The 2010s were all about creating food-delivery and dog-walking apps. Yawn.

Now, we’re launching an all-out assault on cancer. Yeehaw!

|

As my friend and the original Rational Optimist Matt Ridley said in a recent essay on cancer vaccines:

Even when cancer was treatable, the treatment was often brutal. On top of surgery, months of radiotherapy and chemotherapy made the lives of patients almost as bad as the disease itself. That is now changing…

Let's finish what President Nixon started in 1971 and win the "War on Cancer."

Biotech will become a breeding ground for great businesses over the next decade.

We own one of America’s top biotech companies in Disruption Investor. Its products make it easier to administer cancer drugs.

Its stock has surged 65% since January, and it has the ability to double in the next year. You can access this pick by upgrading to Disruption Investor here.

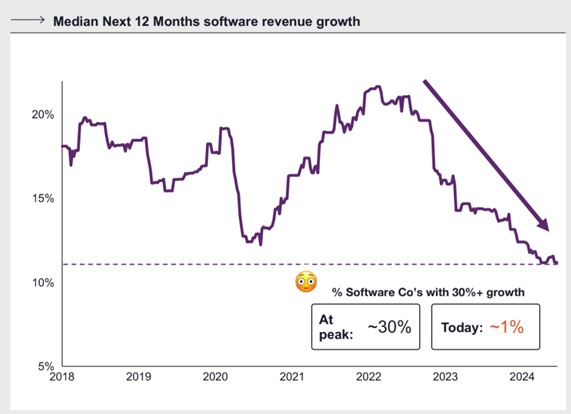

- Software was the hottest group of stocks on Earth…

Companies like Salesforce (CRM), Abode (ADBE), and Workday (WDAY) printed money for investors over the past decade.

But the most popular software ETF—iShares Expanded Tech-Software Sector ETF (IGV)—has gone nowhere for three years. And did you know CRM, ADBE, and WDAY all underperformed the S&P 500 over the past year?

Software’s legendary run is over. And investors must adjust.

Check out this chart from top venture capital firm Coatue. Roughly one-fourth of software firms were growing revenues at 30% per year in 2022. Now, less than 1% have hit that threshold:

Source: Coatue

Semiconductors—aka computer chips—are the “new” software stocks. Names like Nvidia, Arm Holdings (ARM), and Taiwan Semiconductor (TSM) are leading the market and handing investors huge gains.

The rise of AI is driving this shift.

ChatGPT-like bots will rip out and replace much of the expensive software tools that dominate American offices today.

Meanwhile, chip sales are hitting new highs on the back of strong AI demand. As ChatGPT and Claude get bigger and better, we’re going to need more chips.

Buy the winners; sell the losers.

We own five leading chip companies powering the AI boom in Disruption Investor.

- Today’s dose of optimism…

Americans started almost 1,000,000 new businesses in the first six months of 2024.

Business formation surged during COVID and never looked back, as this chart shows. Who said American entrepreneurship is dead?

Source: Federal Reserve Economic Data

My two cents…

Less people sitting in cubicles counting down the days until their next vacation… more folks working hard, pursuing success on their own terms. That’s great for America and the world.

Have a great weekend. I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge