It’s ugly out there.

Thursday was the worst day for US stocks since June 2020. Friday was worse, with the S&P 500 tumbling 6%. Stocks continue to sink today.

When I (Chris Reilly) check the news and the reaction to it on Twitter—a great real-time sentiment indicator—it’s hard to find anything positive. People are panicking over Trump’s tariffs, which are much bigger, broader, and more haphazard than expected.

First, let’s put this selloff in context. Then, we’ll discuss what you as an investor should do about it.

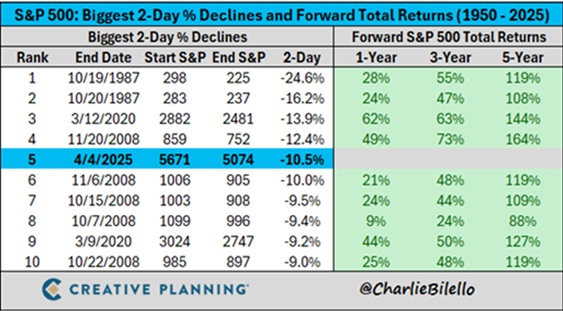

The S&P 500 plunged 11% Thursday–Friday. It was the fifth-biggest two-day decline since 1950. As you can see from the data below, from analyst Charlie Bilello, the only worse two-day declines were Black Monday in 1987, the financial crisis in 2008, and the COVID lockdown crash of 2020.

To the right of the table, Charlie calculated the market’s returns one, three, and five years after the crash. Notice stocks went substantially higher 100% of the time:

Source: Charlie Bilello, Creative Planning

What does this data say to you? To me, it says two things.

One, we really are living through a “who’s who” of fast market crashes. This isn’t just the financial media exaggerating.

Two, invest for the long term and stay the course. I know it’s not what people want to hear in times like this. But picture yourself in 2026 or 2028. You’ll be glad you held onto the great businesses in your portfolio.

(And cut the ones that aren’t so great, as we’ve been urging lately).

If you’ve been following RiskHedge, you expected a rough start to 2025. In January, while all of Wall Street was publishing bullish forecasts, Stephen McBride waved the caution flag.

He wrote: “Expect at least a 10% drawdown at some point. That’s happened in two out of every three years going back to 1928. And with investor expectations so high, don’t be surprised if stocks dip further.”

- Stocks are down 20%. Now what?

Stephen and Chris Wood recently held a members call for Disruption_X subscribers, covering the state of the market and more.

Chris said:

It's wild times right now, but the most important thing to do is tune out the noise as much as you can. Don't pay attention to “hot takes” from social media gurus or headlines from mainstream financial reporters. It just confuses otherwise smart people into doing dumb things with their money.

You don't need to think back far, just to the tech selloff of 2022. Tons of folks cut amazing stocks like Nvidia (NVDA) from their portfolios because they believed the headlines that tech was dead, artificial intelligence (AI) was a fad, all that nonsense. NVDA is up 1,000% since then.

Many other great tech/AI names are up 100%, 200%, 300%. So many investors got left behind because they were scared by doomsdayers who sounded smart.

Chris Reilly again. I’ve been in the investing research business since 2013, and while the industry has gone through a lot of change, one thing never changes: Fear sells. You’ll see over-the-top headlines this week. Don’t let them knock you off your long-term plan.

Meanwhile, in our flagship Disruption Investor advisory (which just published Thursday), Stephen and Chris said it’s time to focus on under-the-radar megatrends. Cybersecurity and solar fit the bill.

|

And if you’re a Disruption Investor member, you received an alert on Friday to take profits on our S&P 500 hedge, which was up 203% as of writing.

Stephen and Chris recommended this options trade last year as cheap “insurance” to guard against a selloff. While Disruption Investor primarily focuses on recommending the 20 best disruptor stocks, we also use strategic hedges at times to protect gains and blunt losses.

A 203% gain during rough times like today can make a real difference in helping any investor stick to their long-term plan.

If you’ve ever been interested in trading options but didn’t know where to start... our good friend Jared Dillian (who’s been doing it for 26 years) just launched an Options Masterclass. Right now there’s a special 50% off discount, so go here now for the full details and course breakdown.

- Finally, remember these wise words from investing legend Peter Lynch...

In his 1993 book “Beating the Street,” he said:

We are confronted with the latest reasons that mankind is doomed: global warming… recession… inflation… the high cost of health care… fundamentalist Muslims… the budget deficit… the brain drain. Even the sports pages can make you sick.

Investors worry about the exact same things today.

The lesson: There’s always a reason not to invest. And yet the S&P 500 is up tenfold since Lynch wrote those words.

Of course, right now the “reason not to invest” is tariffs and the trade war.

But here’s what Chris Wood told me:

We knew they were coming. But I think what made investors panic is they thought big tariffs would be short-lived and mostly used as a threat for negotiating. Now, they're realizing that big tariffs could be in place for a long time and they're trying to get their heads around the effects of that.

But the principles don’t change. I’ve seen countless selloffs like this over the years for all kinds of reasons and every single one has proven to be a long-term buying opportunity... and we know that because stocks have always gone on to make new highs at some point in the future... and then new highs again, and again, and again. And that's what's going to happen here.

If you’re nervous, I get it.

This is a serious selloff. But stick to the plan. Don’t get caught up in the fear. And get your watchlist ready. Some great bargains are forming out there.

And lastly (this is important):

If you’re a member of any of our premium advisories, be on the lookout for a special email tomorrow morning.

We’re celebrating a big milestone at RiskHedge, and I think you’ll like what we put together.

Regards,

Chris ReillyExecutive Editor, RiskHedge