Stephen McBride: Chris, we need to talk about artificial intelligence (AI). This is an atomic-bomb-level disruption that just dropped squarely on investors’ portfolios, even if most don’t realize it yet.

Chris Wood: You and I both got the same feeling in researching this independently. I’ve been investing a long time and I’m not easily excited. But this is different. It feels like an emergency. AI is going to reshape the whole investing landscape. It’s already happening.

Legendary investor Bill Ackman nailed it when he recently said of AI: “The world has changed. Things are different now. We just haven’t noticed it yet.”

Stephen: One moment really hit home for me when I was studying the origin story behind the wildly popular ChatGPT.

People seem to think it’s just a really good chatbot. Like one of those automated customer service chat features, but highly accurate and humanlike.

This is not widely understood—but the neural net upon which GPT is based taught itself to write computer code.

Chris: This was a mind-blowing moment for me, too. In a nutshell, the engineers set out to build a chatbot that could mimic humans' reading and writing abilities.

So they fed ChatGPT millions of webpages to read. Those webpages contained code. The AI took it upon itself, unprompted, to learn to write code. Even though it wasn’t designed to do so.

Stephen, “software coder” is one of the most sophisticated, highest-paying, and respected jobs in America… and AI is going to take it over, at least at the junior levels.

Stephen: And that was the “old” GPT! The new GPT-4 was released last month. It’s absolutely stunning how much better it got and how quickly. It scored in the top 10% of a law school exam. The old version scored in the bottom 10%.

Chris: Let’s give readers a little peek behind the scenes. We’ve been having meetings all year about AI, trying to figure out how to best help our readers profit from it. We set out to write a special report, but it’s all moving so fast, it started to go stale as we wrote it.

So we’re trying something new. You and I are going to talk. We’ll have a no-holds-barred conversation about this and email it to subscribers every day for a week.

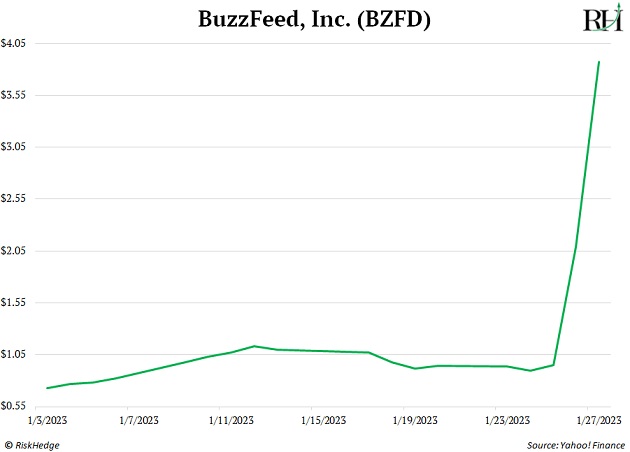

We’ll go through the major players. Our favorite AI stocks. Our most-hated AI stocks. Our favorite “undercover” AI stocks. And even tiny stocks that could do what BuzzFeed (BZFD) did. We’ll be taking reader questions, too... readers can write in at stephen@riskhedge.com.

Stephen: BuzzFeed announced it will start using AI to write articles and its stock tripled overnight!

I’m sure readers want to know where to find the next one of those.

There’s one subsector of AI where I think moves like that are most likely to come from next.

Chris: We should be clear, we don’t like BuzzFeed. It’s what you call an AI promoter. They’re good at telling the world, “Hey look, we use AI.” It’s unclear how much it will actually help its business. You can make money on these if you’re in and out quick, but they’re a flash in the pan.

Then there are stocks quietly working on AI that aren’t promoting it. Those are where I’m focused. I think getting positioned in those names could be a game-changer.

Stephen: And this isn’t just about stock picks. AI is something you must understand… even if you don’t plan on buying any AI stocks. That’s because the stocks or ETFs you do own could be obliterated in what will feel like an instant by upstarts using AI. It’s simply not an option to stick your head in the sand on this one.

It’s one of those rare times where if you make the right investments, it can change what’s possible financially. And if you make the wrong investments, you might be wiped out. And you probably won’t even know what hit you.

I like what IBM’s CEO said: “Every company will become an AI company—not because they can, but because they must.”

Chris: Right. Big companies have a lot to lose from AI, while small companies have a lot to gain.

OpenAI, the creator of ChatGPT, was founded as a non-profit. Then it got partially acquired for $29 billion by Microsoft. Ever see a company go from a non-profit to a $29 billion payout in a few years? By the way, that happened while tech stocks were tanking 30%. It was not a valuation inflated by frothy markets.

Stephen: That’s a first as far as I’m aware. AI can turbocharge a business like nothing else. The story of upstart clothing brand SHEIN is a great example.

In short: SHEIN’s proprietary AI combs competitors’ websites to see which designs are selling best... then quickly makes its own, better versions.

Zara—a European brand that’s known for being the fastest from concept to market—adds 500 items every week. SHEIN adds 8,000 every day.

SHEIN’s explosion is nothing short of remarkable. It’s now worth more than Zara and other clothing brand competitor H&M combined.

SHEIN even overtook Amazon as the #1 shopping app on Android.

Chris: It’s a great story. But one regular investors unfortunately can’t invest in, as SHEIN isn’t publicly traded. (Although, some reports say an IPO is in the works for later this year.)

Of course, there are plenty of other ways to capitalize on the AI explosion. More on that soon.

Tomorrow, we’ll look at exactly how this AI boom is following in the footsteps of other breakthrough technologies—the computer, the internet, and the iPhone—and how it’s on the cusp of releasing a huge wave of wealth as a result...

Stephen: Looking forward to it.

Stephen McBride

Chief Analyst, RiskHedge