Justin’s note: Longtime readers know I’m bullish on crypto—in fact, I’ve recently recommended several new cryptos in my trading advisory, RiskHedge Live.

Everything I’m seeing tells me the crypto market is about to heat up in a big way, spurred by an event that only happens once every four years.

We’re now just 10 days out from bitcoin’s (BTC) upcoming halving event, which has historically kicked off a 12- to 18-month bull market in crypto.

My colleague Stephen McBride—our resident crypto expert at RiskHedge—recently published an article explaining exactly what the halving event is and why it’s so important.

With Stephen’s permission, I’m sharing that article with you today...

***

Thanks to everyone who answered our recent crypto survey.

You made it clear you want to know more about bitcoin’s (BTC) big “halving” event that’s less than two weeks out.

Even for seasoned crypto investors, it’s worth reiterating why the halving is so important.

It’s the catalyst that could send bitcoin beyond $100,000, and then $150,000… and smaller cryptos soaring with it.

So today, I’m sharing the “101” on the halving. Let’s get after it…

-

I understand the arguments against bitcoin.

It’s not tangible. It’s drug-dealer money. It’s too expensive.

Some pushbacks are valid.

But I can’t understand investors who keep writing off bitcoin as a “fad.”

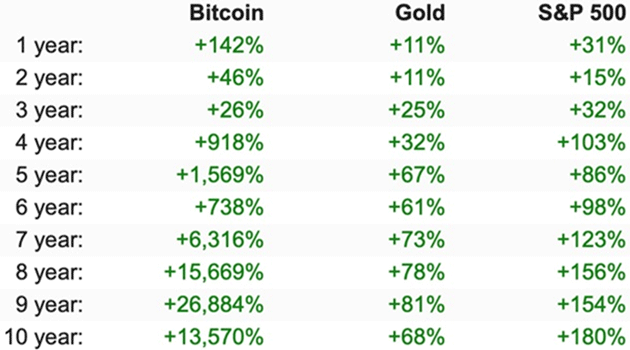

Bitcoin has been the best-performing asset in the world over almost any time frame you choose from the last decade.

It’s been the best asset for the last year. And for the last five years. And for the last 10 years. Over the last decade, it’s up 200X more than gold and 75X more than the S&P 500:

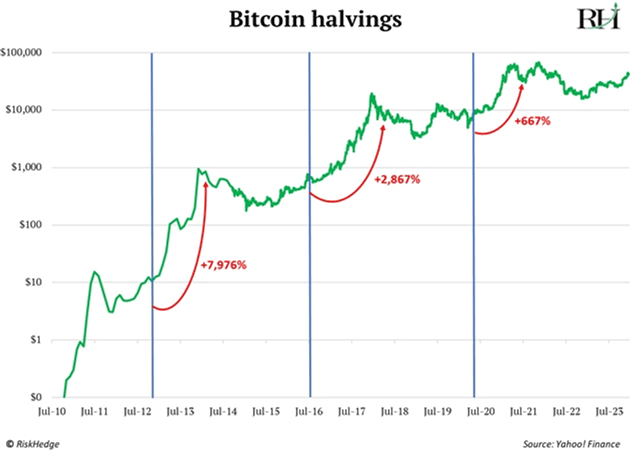

But this table is misleading in one way. It makes bitcoin’s gains look “evenly distributed” across time. They’re not. Bitcoin’s gains “cluster” around bitcoin’s halving events.

The biggest, quickest gains come in windows of 12 months or so. And that window is about to open.

-

Remember the point of bitcoin in the first place…

It’s a form of money that can be held, exchanged, spent, and tracked in any quantity without needing anyone’s permission. No banks, no Wall Street, no government, no vaults needed. It’s the only way to carry $1 billion in your pocket (and your mind).

This works because thousands of computers independently verify transactions around the world. These computers are colloquially said to be “mining” bitcoin because they’re rewarded with newly created BTC for doing their verification job.

When bitcoin started in 2009, miners earned 50 BTC every 10 minutes (or “per block”). That’s the sole way new bitcoin is created.

Bitcoin’s creator programmed it to cut these rewards in half every four years. Hence the name “halving.”

In 2012, rewards dropped to 25 BTC. Four years later, they were slashed to 12.5 BTC. The third halving happened in May 2020, with issuance being cut to 6.25 BTC.

This matters because each halving ignited a huge run-up in bitcoin’s price:

Bitcoin jumped 8,000% after the first halving… almost 30X in the year following the second one… and it handed out 6X gains after the most recent halving four years ago.

-

We’re just 10 days out from the next bitcoin halving (April 19, 2024).

That means we’re entering the best time to own crypto.

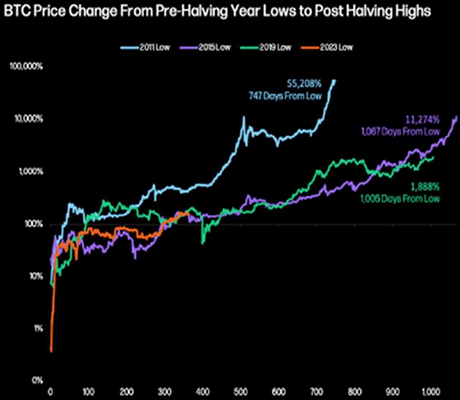

Bitcoin has followed a predictable pattern around each halving.

Crypto prices tend to bottom 12 to 18 months before bitcoin undergoes a halving. They climb slightly leading into it… then explode to the upside afterward.

Bitcoin is right on script for this cycle.

Prices bottomed 17 months before the halving and have now risen about 300% off the lows.

If this pattern holds, as I expect it will, bitcoin will surpass $150,000 within 18 months—and possibly much sooner.

Here’s a great way to visualize bitcoin’s predictable moves. It shows BTC’s price appreciation from the bottom ahead of each halving.

The orange line represents the current cycle. Right on schedule:

Source: Galaxy Research

Source: Galaxy Research

-

This time around, there’s an added bonus pressuring prices higher that we never had in prior cycles.

Each prior bitcoin halving was enough to push BTC prices up at least 500%.

Today, at the same time new bitcoin supply is about to be cut in half… a new source of demand is soaking up tens of millions of dollars of bitcoin every day.

Bitcoin ETFs, which debuted in January, are buying an average of 4,500 BTC/day. Only 900 new bitcoins are minted each day.

This supply/demand mismatch was enough to push bitcoin from $45,000 in January to $70,000.

And the impending bitcoin halving will cut the issuance of new BTC in half, from 900 to 450 per day.

What will happen when demand keeps climbing AND new supply is cut by 50%?

Econ 101 tells us prices should scream higher.

Bottom line: Each of the three crypto booms—2012/13, 2016/17, and 2020/21—have happened around a bitcoin halving.

We’re once again entering what is typically the best time to own crypto.

If you’re ready to take advantage of the upcoming halving—and discover the smaller, lesser-known cryptos I recommend buying instead of bitcoin—membership to my RiskHedge Venture crypto advisory is now open.

Stephen McBride

Chief Analyst, RiskHedge