Teams don’t typically win games when their best players are out.

It’s the same with stocks.

When the best stocks aren’t doing well, the market tends to struggle.

I mention this because the world’s biggest, most important stocks just ran into a brick wall.

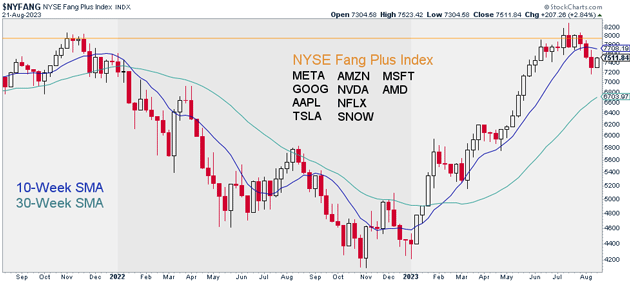

Take a look at the equal-weighted NYSE Fang Plus Index, which tracks 10 stocks including Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOG).

It went on a heck of a run, more than doubling between November and July. It even hit new all-time highs.

But it couldn’t hold that level...

Source: StockCharts

Source: StockCharts

In trader speak, the Fang Plus Index had a “false breakout.” And false moves like this often lead to powerful moves in the opposite direction.

In other words, we could see a deep correction in America’s biggest stocks. That would clearly be a problem if you own those stocks. It would also be a problem for the broader market.

Most of the stocks in the Fang Plus Index are technology stocks. And “tech” is by far the most important sector. It makes up 27% of the S&P 500 and more than 50% of the Nasdaq 100.

In other words, a pullback in these leaders would weigh heavily on the indices. But that doesn’t mean it will be impossible to make money.

Remember, there’s always a bull market somewhere. Last year, the indices were under severe pressure but energy stocks still rallied 66%. I recommended energy stocks in Feb 2022, and I like them again today.

So, consider increasing your allocation to energy stocks if you haven’t yet.

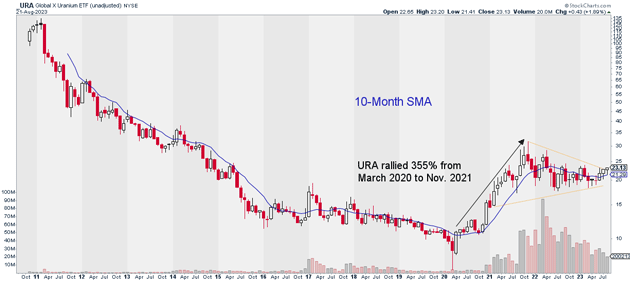

On August 1, I explained why I’m bullish on the Global X Uranium ETF (URA), and I remain very bullish on this group.

Source: StockCharts

Source: StockCharts

I’m also bullish on the Energy Sector ETF (XLE) as a “one-click” way to profit off energy stocks in the current environment.

Justin Spittler

Chief Trader, RiskHedge