Remember “Made in America?”

For the longest time, buying products built in the US was a source of great pride.

These days, many folks no longer feel this way. Thanks to the rise of “globalization,” most of the things we buy are built in other countries.

But now, the world is changing once again.

A “reshoring” megatrend has started, meaning manufacturing is coming back home and more “stuff” is being built in the US.

In today’s Trade of the Week, I’ll show you one of the best ways to profit from this reshoring effort.

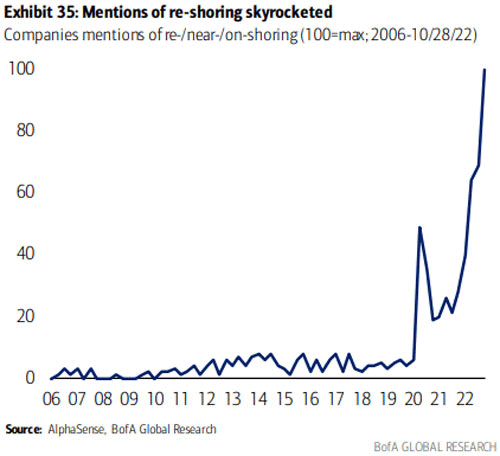

But first, let’s look at this chart from Bank of America. It shows how often publicly traded companies mention “reshoring,”—or some variation of the term—in earnings calls.

As you can see, interest in reshoring spiked in 2020 and is now going parabolic:

Source: Bank of America

Source: Bank of America

This is happening for a few reasons.

For one, COVID revealed how vulnerable global supply chains are during a crisis… and why it’s so important to manufacture goods in your own backyard.

The other factor at play is rising geopolitical tensions…

It’s no secret the US and China have been political rivals for a long time. But they’re increasingly becoming outright enemies because of disagreements over the Russia-Ukraine war and Taiwan.

Most people view rising tensions between China and the US as something to fear. But I see it as an opportunity, specifically as it relates to semiconductors.

You see, Taiwan is ground zero for global semiconductor production.

And the Biden Administration has made the reshoring of semiconductor production a top priority—giving us an opportunity to profit from this trend.

Enter GlobalFoundries (GFS).

GlobalFoundries operates the world’s fourth-largest semiconductor “foundry,” meaning it manufactures chips for other semiconductor companies.

GFS has the potential to emerge as one of the biggest winners from the reshoring megatrend. And I’m not the only one who thinks so.

Bank of America recently named GlobalFoundries as one of the biggest beneficiaries of the reshoring trend.

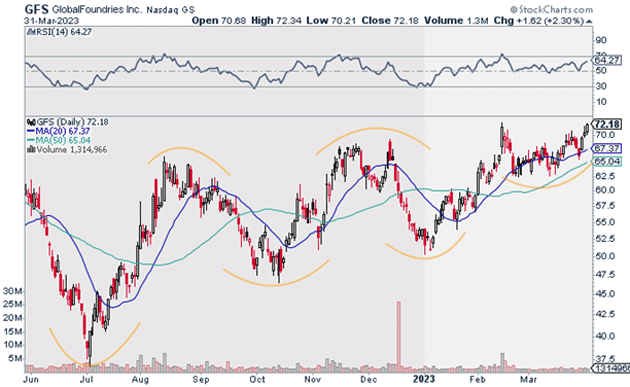

But that’s not the reason I’m recommending GFS today. Its chart is screaming “buy!”

As you can see below, GFS has been in a clear uptrend since last summer.

Source: StockCharts

Source: StockCharts

It also recently closed at its highest price since March 2022.

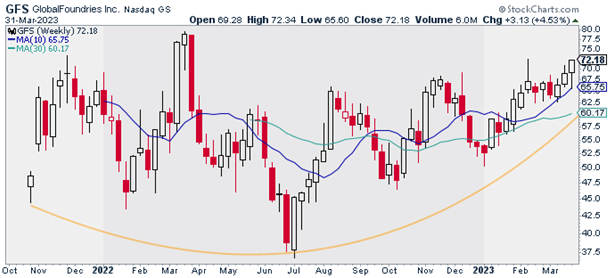

GFS looks just as compelling on its weekly chart.

It’s emerging from a massive Stage 1 base. A breakout of this consolidation pattern should ignite a long-term uptrend.

Source: StockCharts

Source: StockCharts

I could see GFS heading to $90 in the coming months and higher in time, giving us a minimum risk-reward ratio of nearly 2:1 on this trade.

Action to take: Buy GFS at current prices.

Risk management: Sell GFS if it closes below its 50-day moving average, or around $65 per share.

Justin Spittler

Chief Trader, RiskHedge