Taiwan Semiconductor (TSM), the world’s largest chipmaker, just delivered a show-stopping earnings report.

Its artificial intelligence (AI) chip revenues tripled last year and are set to double again in 2025.

Longtime RiskHedge readers know Taiwan Semiconductor—or TSMC for short—is the only company in the world capable of making the latest, greatest computer chips.

TSMC has a chipmaking monopoly and is growing like a startup. A trillion-dollar company growing total revenues by 40% is almost unheard of. Its stock is surging to record highs:

Here’s the kicker: The company every tech giant depends on trades at just 19X earnings. That’s cheaper than the S&P 500!

Congratulations to Disruption Investor members who are sitting on 100% gains since we bought TSMC, accounting for our “Free Ride.”

It’s the definition of a great business profiting from a disruptive megatrend. And here’s why it can keep on winning.

- Want to run AI? You need cutting-edge chips.

Want cutting-edge chips? You need TSMC. All the big tech giants bow at its altar.

TSMC has made the chips inside every iPhone since 2014. Apple essentially sends Taiwan Semiconductor an email once a year with a new chip design.

Then, engineers in Taiwan use $300 million machines to print these designs onto large silicon wafers, which power the pocket-sized supercomputer you’re probably reading this on.

According to WIRED Magazine: “Every six months, just one of TSMC’s 13 foundries… carves and etches a quintillion transistors for Apple.”

I first introduced Disruption Investor members to the new AI “law” back in 2020. Back then, my team and I were combing through GPT-3 (the precursor to ChatGPT) documents and noticed a new law of computing: Every time you multiply an AI’s training data by 10, its intelligence doubles.

This “law” has unleashed a gold rush. To make AI smarter, you need exponentially more computing power. In the past decade, the processing power needed for cutting-edge AI has jumped one billion percent.

It’s the equivalent of turning $1 into $10 million.

Nvidia (NVDA), which I first recommended in 2018, has been the biggest winner from the AI boom, handing investors 1,000% gains over the past two years.

Nvidia’s H100, the chip behind ChatGPT, squeezes 80 billion microscopic switches onto a slice of silicon the size of your dinner plate.

And all of Nvidia’s chips are made by… TSMC. In fact, TSMC is the only company in the world capable of making the latest, greatest chips.

- Yet… Wall Street analysts are having a panic attack.

JPMorgan Chase & Co. (JPM) recently sounded the alarm about how little money companies earn from AI relative to the amount they spend on it.

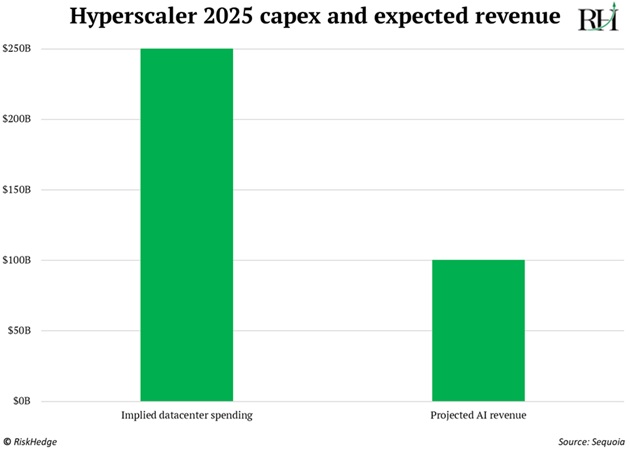

Apple (AAPL)… Amazon (AMZN)… Alphabet (GOOG)… Meta Platforms (META)… Microsoft (MSFT)… and Oracle (ORCL) are on track to spend $250 billion–$300 billion this year building data centers. Yet their AI revenues are projected to be a less than $100 billion in 2025:

Wall Street is looking in the wrong places. AI is much more than ChatGPT and Gemini subscription fees.

Credit card giant Mastercard (MA) processes $8 trillion in payments annually. AI is now letting it catch 20% more fraud attempts “on top of all the amazing things we had already been able to do.”

How many millions (billions?) of dollars is that worth?

Amazon recently estimated it saved the equivalent of “4,500 developer years of work” by tasking AI with upgrading its internal software.

These real-world AI success stories aren’t counted in the “official” AI revenue numbers. That’s our opportunity.

Many investors look at the AI buildout and scream, “It’s a bubble! Where’s the return on investment?” They think Nvidia and TSMC’s AI-fueled growth is unsustainable.

The skeptics love comparing today’s AI boom to the dot-com bubble. But there’s a crucial difference.

In 1999, Cisco Systems (CSCO) was selling routers to cash-burning startups. In 2024, TSMC is selling chips to the most profitable companies in history racing to create “digital God.”

|

Our research suggests the AI boom will continue until at least the end of 2025.

As more “traditional” companies reveal their AI wins—from fraud prevention to automation to cost savings—the market will have its “aha” moment.

There will once again be a mad scramble for AI chips as companies wake up to AI’s potential.

And guess who they’ll all call? TSMC.

Folks who think AI isn’t going to change the world simply aren’t paying attention. You must invest in the AI buildout. And you absolutely must use this technology, too.

Stephen McBride

Chief Analyst, RiskHedge