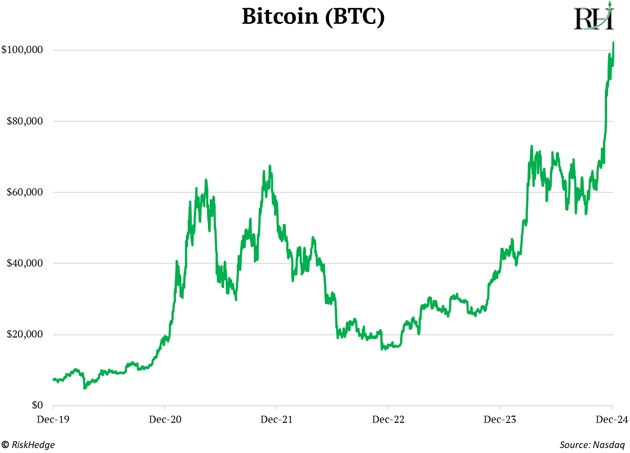

Bitcoin (BTC) just broke $100,000 for the first time in history.

What a milestone—and a huge congratulations to everyone who held on during the inevitable rocky times.

I think we’re just getting started. As I’ve said, I believe bitcoin can reach $250,000 within the next 12 months thanks in large part to the results of the 2024 election.

In short, the entire crypto industry was like a beach ball held underwater. Crypto innovation was frozen by hostile regulations. But that’s all changed now.

All that pent-up energy—the ideas, the money, the talent—is surging to the surface.

Bitcoin will continue to thrive as the world’s largest crypto, now sitting at a market cap of roughly $2 trillion (and back just below $100K, for the moment).

Today, we answer the big question: How do you best make money from this?

- In Abu Dhabi recently, a building manager asked me:

“Do you own bitcoin?”

I’ve had this exact conversation with taxi drivers in Singapore, doormen in Dubai, and waiters in Nashville. No one asks about Microsoft’s (MSFT) latest earnings or JPMorgan’s (JPM) dividend.

Young investors I talk with often own more crypto than stocks. Think about that. The next generation of investors is the first to fully embrace digital assets. Where do you think their next dollar will go as their wealth grows, and the industry grows?

Bitcoin is the “OG”... and still the most popular crypto on the planet, by far.

But at its core, bitcoin can be summed up in two words:

Digital cash.

Bitcoin was the first use of blockchain technology, which allows anyone to send and receive money on the internet… without worry… and without banks or any other financial middlemen… for the first time ever.

But bitcoin was only the first use of this incredible new technology. And bitcoin’s blockchain is pretty much used for one thing: keeping track of who owns bitcoin.

Now we have Ethereum (ETH) and Solana (SOL), platforms where anyone can create and launch “apps.” Think about how the App Store works on your iPhone. You can download thousands of apps for just about everything.

Ethereum and Solana are blockchain app stores. And the only limits to what developers can build on them is their imaginations.

- Here’s where the real opportunity lies...

Without getting political, Trump is far more pro-crypto than the current administration.

He plans to end the regulatory crackdown against crypto and encourage bitcoin mining in America. And he just picked pro-crypto Paul Atkins for SEC chair, who’s set to replace hostile Gary Gensler.

Just last night, Trump named David Sachs—a Silicon Valley investor and outspoken supporter of crypto—to the newly created position of artificial intelligence and crypto “czar.” His job description: make America the clear global leader in both areas.

Although bitcoin is soaring to new highs, the real opportunity lies in the coming explosion of great crypto businesses.

It all comes down to this: When you’re buying crypto, what are you getting?

|

When you buy Microsoft shares, you legally own a piece of the business. You’re also entitled to a slice of the profits Microsoft generates.

When you buy a bond, you get a promise that the company will pay you interest plus the principal back.

But crypto has been forced to operate differently. To avoid being labeled an “illegal security” by the SEC, crypto projects couldn’t give their tokens real ownership rights.

This led to many crypto founders purposefully designing tokens with no value accrual, or no path to accrue value. I dig into great protocols with real-world uses all the time. But many of them are uninvestable due to awful “tokenomics.”

- Expect Congress to pass pro-crypto legislation early next year.

This will be a gamechanger for tokenomics—one of the most important drivers of a crypto’s price—and open up a new set of opportunities for investors.

Earlier this year, the House approved a piece of legislation that achieves this: the Financial Innovation and Technology for the 21st Century Act (FIT21).

Now that Republicans also control the Senate, expect this bill to get signed into law in the first half of 2025. Think of this as crypto’s legalization day.

It’s the moment Wall Street will come steaming into crypto—and the moment investors get the same ownership rights as they have in the stock market.

Great crypto businesses can now be built in the open, without fear. And for the first time, investors can participate in their successes the same way they do with stocks.

- So, should you buy bitcoin?

I don’t recommend it to my RiskHedge Venture members.

It’s digital cash. It’s good to own some bitcoin. But it’s not the best crypto if you’re targeting fast growth.

My top two favorite large cryptos are still Ethereum and Solana. But our portfolio is full of tiny, lesser-known crypto businesses with much more upside. The opportunity is unfolding fast. Our portfolio has close to nine triple-digit winners, including Hivemapper (HONEY)—up +767% after our “free ride.”

It’s not too late to get on board. I’m expecting a huge 2025 now that the war on crypto is over.

If you’d like to join us at our special discounted price (which closes soon), go here.

Stephen McBride

Chief Analyst, RiskHedge