Smart hunters prey on the weak.

That may sound heartless...

But lions instinctually know not to chase fast, young gazelles.

Instead, they run down the old limping gazelle in the back of the pack.

Smart disruptors also target easy prey.

Amazon (AMZN) first went after bookstores like Barnes & Noble and Borders. What could be easier than selling books online?

Books are easy and cheap to mail... don’t spoil like food... don’t come in different sizes like clothes... and book buyers rarely demand refunds.

Then there’s Netflix (NFLX). It didn’t challenge mighty Disney (DIS) right away. It went after the limping gazelle known as Blockbuster, a company that hadn’t evolved much in decades.

- But one “hall of fame” disruptor broke all the rules...

It went after the world’s tech giants from the very beginning... and won!

This company quietly went public in June 2004.

There wasn’t a media circus around its initial public offering (IPO) like we often see. In fact, most investors didn’t even notice. Everyone was focused on Google (GOOGL), which was set to go public just two months later.

But you would have made far more money buying this under-the-radar stock than buying Google.

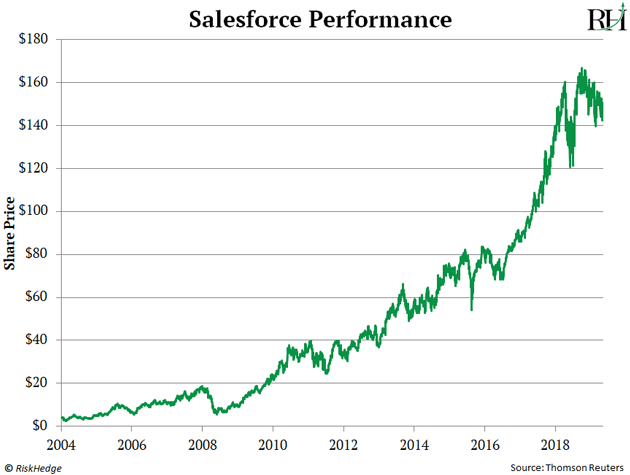

The company I’m talking about is Salesforce (CRM). It has surged an incredible 4,400% since it went public in 2004—nearly doubling Google’s return!

- Salesforce is one of the world’s most dominant companies…

It’s worth over $120 billion—in the same ballpark as Netflix (NFLX), McDonald’s (MCD), and Nike (NKE).

Still, it’s something of a mystery.

Everyone’s heard of the company… but most investors couldn’t tell you what it does.

Salesforce sells customer relations management (CRM) software. Hence its ticker, CRM.

Its software helps sales teams retain clients, provide better customer service, and acquire new customers.

But that’s NOT why Salesforce’s business grew more than a hundredfold in just 15 years.

Instead, it became a world dominator by disrupting how software is sold.

Remember back when you’d buy software from a store? It came in a shrink-wrapped CD case. You’d then go home and install the program on your computer.

Companies had to do the same... except they used A LOT more software.

To manage it all, a company had to hire an IT team… or at the very least, a “tech guy.”

A company needed servers to run the software. If it was big enough, it would need warehouses full of servers!

- Salesforce CEO Marc Benioff was convinced that using software should be as easy as visiting a website like Amazon.com...

And paying for it should be as simple as paying your electric bill.

So, he started selling software on a subscription basis. Customers paid monthly for access, instead of buying the software outright.

In short, Benioff reinvented software. He took it from a “product” that companies sold, to a “service” that it managed for its clients.

This might seem like a subtle shift. But Benioff’s simple idea ignited one of the biggest stock booms of the century... a boom that’s still going strong today.

Salesforce pioneered the SaaS—or software as a service—model. Hundreds of other companies then copied it.

The stocks of many of these SaaS companies have shot to the moon, handing investors massive profits.

- SaaS stocks are the hottest on the planet…

It’s really no contest.

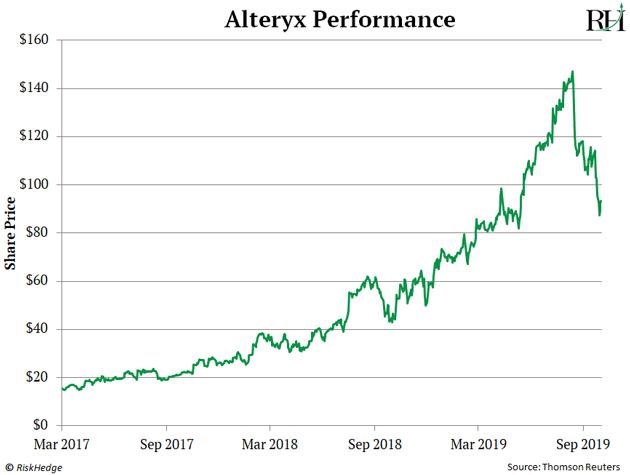

Look at Alteryx (AYX)—an SaaS company that helps businesses better analyze their data. It’s spiked 883% since its March 2017 IPO.

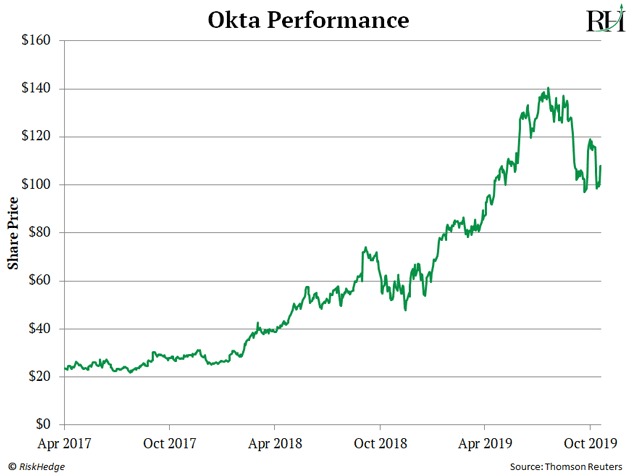

Okta (OKTA) also went on one of hell of a run. Its exploded 528% after its IPO April 2017.

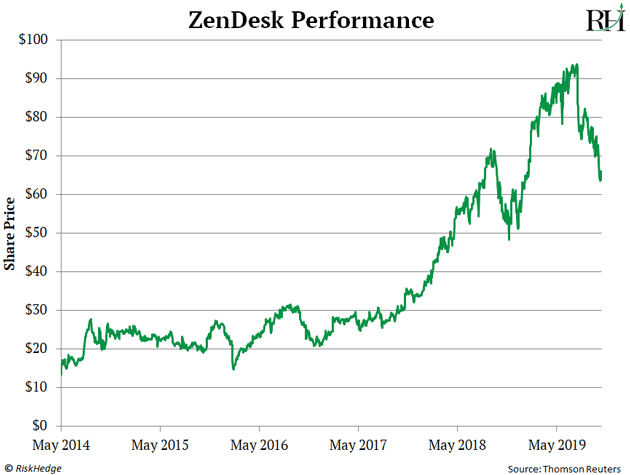

ZenDesk (ZEN) helps companies work better with their customers. Its jumped 758% after going public in 2014…

There are plenty others...

Paycom Software (PAYC) skyrocketed 1,595% in under three years... Twilio (TWLO) soared 538% after going public in 2016... ServiceNow (NOW) rallied 1,228% following its 2012 IPO… and Atlassian (TEAM) spiked 465% in under four years.

- SaaS companies are some of the fastest-growing businesses around…

Alteryx’s sales are growing at a blistering 48% per year… Okta’s at 42% per year… and ZenDesk at 35% per year.

For perspective, the S&P 500’s sales are growing at about 8% per year.

And let’s not forget about Salesforce. Its sales are still growing around 27% per year.

That’s incredible for a giant $120 billion company that went public 15 years ago.

Why are SaaS companies growing at warp speed?

For one, customers love the pay-as-you-go model. They’re happy to avoid shelling out a ton of money on software upfront. And many CEOs are thrilled they no longer need to maintain a warehouse of servers…or hire a small army of highly paid computer engineers… or worry about constantly upgrading the software.

The SaaS provider takes care of all that overhead.

- Investors love the SaaS model, too…

And not just because it supercharges growth.

Subscription revenue is recurring—which is the best kind of revenue. Subscription revenue is predictable, consistent, and comes in month after month.

Software is also what’s known as “scalable.” It’s not like selling cars where you have to pay for the material and labor to manufacture every car you sell. Once the software service is up and running, the incremental cost to serve a new customer is often dirt cheap.

Many SaaS companies enjoy sky-high gross profit margins above 70%.

- If you missed out on these incredible SaaS stock runs...

Don’t worry. There’s a new crop of cash-gushing SaaS companies getting ready to go public.

Like Salesforce, many of these companies won’t get nearly as much attention as companies like Uber (UBER) or Lyft (LYFT).

I get it... software is boring.

But these are exactly the sort of IPOs you should be buying into on the ground floor.

Here are two private SaaS to keep an eye on. Both should go public in the near future:

Snowflake Computing helps companies like Netflix, Square, and Adobe analyze their data. Like other SaaS companies, it’s growing at warp speed. Snowflake’s customer base has quadrupled over the past year, and its sales are growing about 30x faster than its peers.

In May, Snowflake brought in Frank Slootman as CEO. Slootman previously headed up ServiceNow, which—again—has surged 1,228% since it went public in 2012.

Databricks also helps companies make sense of their data… and business is booming. Its subscription revenue has tripled since last year.

Databricks is aiming to have its financials “IPO ready” before the end of the year, suggesting that an IPO is likely around the corner.

Justin Spittler

Bangkok, Thailand