Legendary venture capitalist Marc Andreessen hit the bullseye in 2011 when he said: “Software is eating the world.”

Over the next decade, software companies devoured entire industries. Paper records became Dropbox (DBX). File cabinets became Salesforce (CRM). Local servers became Amazon Web Services.

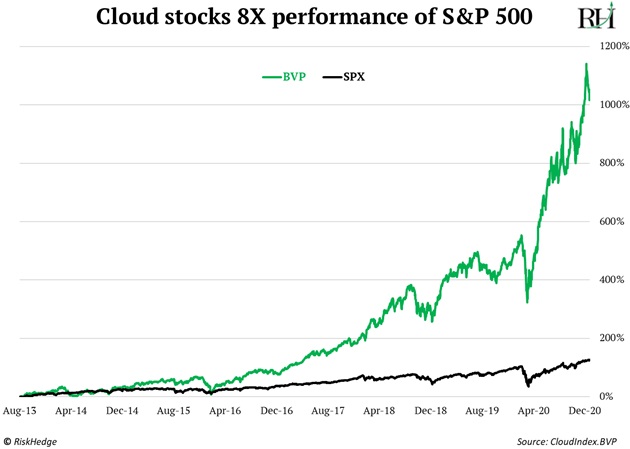

Software stocks—as measured by the BVP Cloud Index—10Xd from 2013–2020, while the S&P gained just 150%:

Salesforce led the gold rush.

It pioneered a brilliant business model: Instead of selling software once, rent it forever. Its stock soared 600% as companies worldwide paid monthly fees for its digital tools.

It was a historic run...

But now it’s artificial intelligence’s (AI’s) turn to eat the world.

- I had my first AI withdrawals at 35,000 feet over the Atlantic.

No internet meant no access to Claude, my AI sidekick I use 50+ times daily.

AI is a unique disruption. Not only can we make money investing in AI disruptors like Nvidia (NVDA)... we can also use it to do previously impossible tasks.

My team and I are doing a very deep dive into the best-performing stocks of the last 20 years. We pulled decades’ worth of data on thousands of stocks, then created a special computer program to analyze them.

Claude showed us how to code this program from scratch. And we had never written a line of code in our lives! More on this project soon.

But we’re about to leap from “AI that talks” to “AI that acts.”

While ChatGPT can show you how to do something, AI agents will simply do it for you. Agents are like tireless digital employees that complete jobs.

You could tell an AI agent to “plan me a week in Tokyo with my wife,” and it’ll compare flights, book hotels, and even make restaurant reservations. All while you sleep.

All the major AI companies launched agents in the past few weeks.

At its recent developer day, ChatGPT creator OpenAI demoed its agent. It phoned up a local store and ordered 400 chocolate-covered strawberries, speaking just like a human.

Consulting giant McKinsey is already using AI agents. McKinsey used to spend dozens of hours signing up new clients. It coordinated paperwork across legal, finance, and other departments through endless email chains.

Now an AI agent handles it all, cutting the process down by 70%.

- “AI will replace software.”

Those words came from Marc Andreessen—same guy who predicted the software revolution in 2011. Nvidia's CEO Jensen Huang agrees: “AI is going to eat software.”

Today, we buy expensive digital tools and hand them to humans who spend hours feeding them data.

What if software could just... do the job itself?

That’s what AI agents do. And our research suggests they’ll disrupt giants like Salesforce.

|

Salesforce is the central nervous system of modern sales teams. It sells software helping companies manage their relationships with customers.

Companies pay Salesforce hundreds of dollars per month for each human who needs to access this system. A company with 100 salespeople might spend half a million dollars a year just on Salesforce licenses. That’s before paying the humans to use it.

AI agents totally blow up the “pay-per-human” model. What happens when your customers don't need humans to run your software anymore and instead have AI agents do the selling?

These digital workers will be able to notice that your biggest customer hasn't opened your last three emails, spot similar patterns from past churned accounts, and call them up and offer a sweet deal… all without a human.

Today, sales reps spend their days on Salesforce hunting for prospects’ email addresses and crafting cold outreach messages. AI agents will make that look archaic.

The disruption is already here. “Buy Now, Pay Later” pioneer Klarna recently announced it had ditched Salesforce entirely in favor of AI systems.

Amazon (AMZN) saved $700 million by letting AI handle code updates.

- Salesforce must destroy its existing business to survive.

Salesforces’ entire empire is built on humans logging into screens, clicking buttons, and updating records. AI agents don't need any of that.

Salesforce could build its own AI agents. But to succeed, it would have to tell customers to fire teams that use Salesforce… retrain all its employees to sell a new product… and cannibalize its business before someone else does.

This is a classic innovator’s dilemma. Disrupting yourself is one of the hardest things for successful companies to do.

The graveyard of business history is filled with dominant companies that saw the future coming but couldn't bring themselves to cannibalize themselves.

It’s like watching Kodak in 1995. It saw digital cameras coming. It even invented one. But killing its film business? That was unthinkable.

While Salesforce tiptoes around disrupting itself, AI startups are building the future from scratch.

Insurance company Nsure deployed an AI agent that handles 60% of all customer interactions—everything from quotes to problem-solving. The agent even uses a human employee’s voice, trained on just 300 hours of recordings.

This is why startups will win. They're not protecting billions in revenue. They're not babysitting thousands of legacy customers. They're building the future from scratch.

- This is Salesforce's Wile E. Coyote moment.

It’s run off the cliff, but it hasn’t looked down yet.

Salesforce will sprinkle some AI features into its products, acquire a few AI startups, and tout its “AI-first strategy” at every investor conference.

None of that solves the problem of AI agents replacing whole sales teams and eliminating dozens of Salesforce subscriptions in the process.

A lot of companies that pay a lot of money for Salesforce will switch to AI.

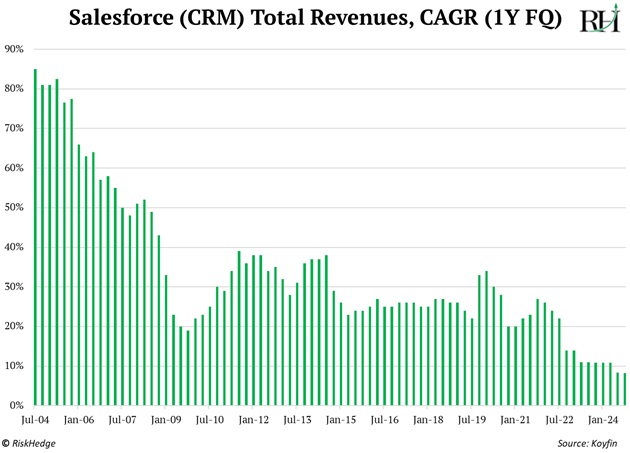

Salesforce’s revenue growth has already slowed to record lows, even as its stock price sits at all-time highs:

Avoid Salesforce and any software company whose products can be replaced by AI agents.

The software era made Salesforce a giant. The AI era will make it a case study.

Expect Salesforce to be one of the worst-performing tech stocks over the next five years.

Stephen McBride

Chief Analyst, RiskHedge

PS: I’ve been receiving a ton of crypto-related questions ever since Trump won the US presidential election. Readers want to know how to take advantage.

So, I’ve created a 19-lesson Crypto Masterclass that breaks down everything you need to know about crypto in plain English—including how to buy your first crypto and safely store it.

If you’ve ever wanted to invest in crypto but found it overwhelming… confusing… or downright intimidating, this course is for you. Go here to sign up today.