One of my most painful memories as a kid was having my braces tightened.

The orthodontist would grip his pliers, clamp down on the metal wire cemented to my teeth, and crank.

I’m happy to have straight teeth today... but man did those things hurt.

And they were embarrassing too. Especially during those young teen years when self-confidence is fragile. There was just no good way to hide a mouthful of metal...

- Ever notice you don’t see metal braces all that much anymore?

Align Technology (ALGN) answered the prayers of millions of teenagers by creating “invisible” braces.

Instead of shiny metal brackets cemented to your teeth, Align’s Invisaligns looks like this. It sold over 80 million pairs last year.

Source: Align Technology

Invisalign was a godsend for people with crooked teeth. Not only could they fix your smile with far less pain and embarrassment. They made early investors rich!

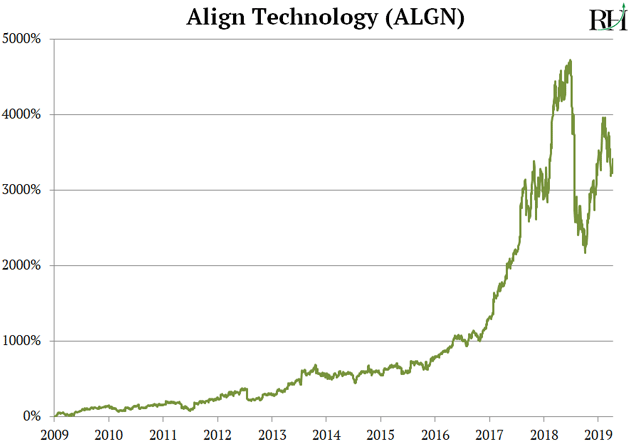

In the past decade, Align’s revenue has soared 530% to $1.97 billion. In the same time its stock has soared 3,400%, as you can see here.

- Are dentists just cruel?

Modern metal braces have been around since the 1970s. You might wonder, why did it take 40+ years to invent plastic ones?

The answer is we didn’t have the technology. Align disrupted orthodontics with 3D printing.

In short, a dentist can now scan your mouth, create a digital “map” of your teeth, then 3D “print” a customized mold.

3D printers “print” objects similar to how an inkjet prints on paper. You might remember the Super Bowl-level hype in 3D printing stocks a couple of years ago.

As I explained last year, promoters claimed that every American would soon have a 3D printer, just like we have paper printers today.

Investors ate it up and plowed billions into 3D printing stocks. 3D Systems (DDD), the largest 3D printing company, exploded to a 900% gain in two years.

But back then, these printers could make only flimsy plastic trinkets with little use. When investors realized they were duped by overhype, 3D Systems plunged 92%.

The 3D printing sector still hasn’t recovered. After five years being stuck in the mud, most investors think the opportunity to profit from 3D printing stocks is long gone.

- Little do they know the real money-making opportunity is ahead of us...

3D printers have come a long way in the last five years. Today they make important products for some of the world’s largest companies.

For example, defense contractor Boeing (BA) now 3D prints thousands of titanium parts for its 787 Dreamliner. They’ve helped shaved $3 million off the cost of each plane.

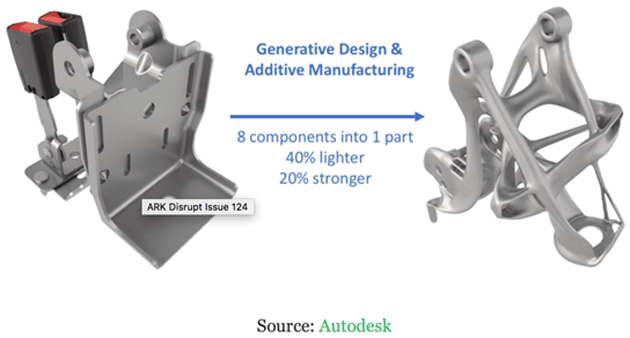

And General Motors (GM) teamed up with 3D-printing software leader Autodesk (ADSK). Together they created a 3D-printed car seat bracket. It’s 20% stronger and 40% lighter than the old seat bracket. And it’s made from only one part instead of eight, as you can see here.

3D-printed parts are often lighter, more efficient, less expensive, and more precise than anything humans could create before. Plus they’re totally customizable. This is allowing companies to reinvent how many things are made.

For example, 3D printing is disrupting dentures.

No two human mouths are identical. So, like braces, dentures require total customization.

Anyone who has dentures will tell you having them fitted is a real pain. It usually involves a half dozen trips to the dentist and lots of mouth x-rays. You also have to get multiple impressions of your teeth, which feels like biting into a tray of mud.

With 3D-printed dentures, you only need one visit to the dentist. And biting into mud is no longer required. A dentist simply takes a digital scan of your mouth, then sends the “blueprint” off to a lab that 3D prints a customized pair of dentures.

- 3D printers are getting faster...

One reason 3D printing was a disappointment was because it was slow. It couldn’t produce things fast enough to compete with conventional assembly lines.

Desktop Metal, a private company valued at $1.5 billion, is changing that. Its giant 3D metal printers can create certain objects 100X faster than many other 3D printers.

In fact, a study from Desktop Metal found its machines can make 546 complex parts in a single day. General Electric’s (GE) 3D printers can only make a dozen!

Desktop Metal is also “printing” with stainless steel, aluminum, and other metals at assembly-line speeds. This is key. A major drawback of early 3D printers is they could only print in fragile materials like plastic.

- 3D printing is following the “script” of many disruptive trends...

Disruptive companies set out to accomplish things that have never been done before. If they succeed they can make investors rich. But along the way, they’re prone to hype and wild exaggeration.

It’s not unusual for investors to get carried away with dreams of riches. Their imaginations run wild and they bid disruptive stocks up to the moon. Eventually reality sets in. A correction or crash always follows.

Often, the best time to invest in these disruptions is after the cycle of hype has run its course. Smart investors can come in and pick up great disruptive stocks at a 90% discount.

3D printing is right around this sweet spot today. According to leading industry research firm Wohlers, the 3D printing industry grew by 33% to $9.98 billion last year.

The largest 3D printer company, 3D Systems, achieved record revenues in 2018.

And according to the latest IDC forecast, spending on 3D printing will hit $23 billion in 2022—up from $14 billion this year.

In other words, the industry is in the early stages of a quiet boom. Yet, 3D printing stocks are still at depression levels.

- Last time we talked 3D printing I recommended Autodesk (ADSK).

As I explained, Autodesk makes 3D-printing software. It counts many big, important companies like Airbus (EADSY) and General Motors as happy customers.

Autodesk has jumped 23% since I last wrote about it. It’s still a great “buy.”

I also have my eye on a handful of disruptive private companies in 3D printing.

Companies like Desktop Metal, Carbon, and Shapeways are achieving breakthroughs that will take 3D printing to the next level.

All three are still private, so you can’t buy their stocks today. Watch for them to “IPO” in the next year or two.

That’s it for this week. What other under-the-radar disruptions have big money-making potential? Tell me your thoughts at Stephen@riskhedge.com.

Stephen McBride

Editor – Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

Reader Mailbag

RiskHedge reader Bob replied to the question I asked last week about “average” companies being disrupted:

“Stephen, as to which mediocre company will be disrupted next, it may well be the competitors of Planet Fitness (PLNT).

Planet Fitness currently has ~1700 centers with a goal to increase to ~4,000. Note that their cheap monthly fees put them at the bottom analogous to Dollar General (DG), rather than in the middle or at the top. PLNT is a triple since end of June 2017.

I always look forward to anything in my inbox with your name on it.”

Bob, thanks for your thoughtful reply.

In the past couple of years big gym chains have spread like wildfire. Small local businesses simply can’t compete with their bargain basement prices. So you may be right—Planet Fitness will dominate other low-cost gyms.

One area I don’t see it disrupting are CrossFit gyms. Most of these gyms charge $100+ a month, and business is booming. In the past 12 months, 2,500 new affiliates registered with CrossFit. And there are now more CrossFit gyms than Domino’s Pizza stores!