This crypto is like the greatest tech stock the world has ever known.

I believe it’s set to outperform the vast majority of other cryptos over the next few years.

And today, I’ll share three reasons why—and how to get started.

No, it’s not bitcoin (BTC), although my research shows it should continue to rise and potentially hit $250K this cycle.

Bitcoin was the first use of blockchain technology. Think of blockchain like a database. It’s a tool for recording and verifying transactions and asset ownership.

Using blockchain technology, bitcoin allowed anyone to send and receive money on the internet without banks or any other financial middlemen—for the first time ever.

Despite this, hardly anyone uses bitcoin to actually buy things today. Few Americans use bitcoin to transfer money, either. It hasn’t even dented Western Union’s money-transfer business.

Instead, bitcoin’s blockchain is like a database. That database can be used for many things. But it’s used for one thing and one thing only: keeping track of who owns bitcoin.

- My favorite large crypto, on the other hand, is a completely different beast. It’s a platform where anyone can create and launch “apps.”

I’m talking about Ethereum (ETH). As you’ll see, bitcoin and Ethereum don’t even belong in the same sentence.

Think of how the App Store works on your iPhone. You can download millions of apps for just about everything. The only limit to what “apps” developers can build on Ethereum is their imaginations.

Today, there are over 3,000 apps running on Ethereum’s blockchain—and it’s the home to many of the world’s top DeFi projects.

In other words, there’s one use case for bitcoin. But with Ethereum, the sky’s the limit.

- A real business making real revenue...

Bitcoin was revolutionary when it first came out. But it’s a finished product. All it will ever be is digital cash—or, as some folks call it, “digital gold.”

They call it this because bitcoin is a store of value the government can’t dilute, like gold.

Whatever you want to call it, the fact remains there’s almost nothing new being built on bitcoin’s blockchain. Besides acting as a store of value, bitcoin isn’t used for much. Like gold, it “just sits there.”

|

Ethereum, on the other hand, is a fountain of innovation.

It’s the “base layer” on top of which programmers are building world-changing disruptive businesses. Even better… it’s making real money from all the activity happening on its blockchain. Roughly $32 billion worth of value settles on Ethereum every day.

I don’t know about you, but I’d much rather own a fast-growing tech business than “digital gold.”

Don’t get me wrong. There’s a place in the world for bitcoin. It’s scarce, secure, and I think it will continue to rise in price.

But Ethereum is hands down the winner here.

- If you’re serious about crypto… you need to buy ETH.

It’s probably no surprise that Ethereum is my favorite crypto holding for the long haul. And full disclosure: It’s also my largest personal holding.

If you’re serious about investing in crypto, I recommend buying at least a little ETH and treating it like you would a long-term stock position.

Buy some, forget about it, then continue on with your life.

For the more skeptical folks out there, here are three big reasons I expect Ethereum to outperform the vast majority of cryptos over the next few years:

#1: ETH is considered a flight to safety

In 2022, the crypto market went through a major culling when fraudulent crypto exchange FTX collapsed and high-profile stablecoins (like USD and LUNA, the crypto it was tied to) crashed in value.

This led to a wave of selloffs and a loss in investor confidence. Many turned their backs on crypto, never to return.

But those who stuck around are likely to put money to work in dominant cryptos with solid fundamentals, like Ethereum. In fact, in conversations I’ve had with crypto fund managers, ETH is the top choice for allocators putting chips back on the table.

A similar trend played out in past crypto downturns. Bitcoin as a percentage of crypto’s total market value doubled during the last bear market. And I believe ETH will replace BTC as the go-to crypto asset moving forward.

#2: Fewer sellers, more buyers

Tokenomics is one of the most—if not the most—important drivers of crypto prices. Tokenomics sets the rules for how a crypto token operates.

Ethereum switched to “staking” in September 2022 and now boasts some of the best tokenomics of any crypto. Since the big switch, the effects on its supply schedule have been astounding. There have been fewer sellers and more buyers.

Today, you can earn around a 3%–4% yield staking your ETH through Lido (a decentralized staking network). That’s a big incentive for crypto investors. What’s not to like about getting paid to hold ETH?

Ethereum’s “burn” mechanism is comparable to companies buying back their own stock. It reduces the supply of ETH … and should result in higher ETH prices.

#3 The ETFs have arrived

Crypto achieved a major milestone when bitcoin ETFs got the green light to start trading at the beginning of 2024.

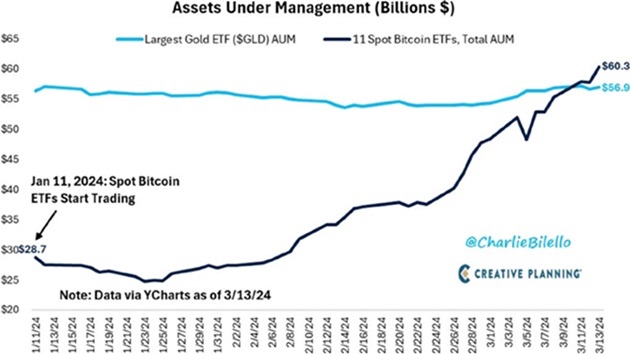

Just two months after their launch, $60 billion worth of investor money poured into these funds:

Source: @CharlieBilello on X

For context, the SPDR Gold Shares ETF (GLD) was formerly the fastest ETF to accumulate $10 billion in assets… but it took three years to do it.

BlackRock’s (BLK) iShares Bitcoin Trust ETF (IBIT) achieved this milestone in just seven weeks.

The world’s largest asset managers—including BlackRock, Fidelity, VanEck, and others—are now telling their clients to buy and hold BTC and ETH in their 401(k)s.

More important, Ethereum is only about one-fourth the size of bitcoin. That means it takes less money to move its price.

Even if Ethereum attracts 20% of the inflows bitcoin got, logic says that when billions of dollars start flowing into ETH, its price will rise.

For these reasons, I recommend heavily skewing your crypto portfolio toward ETH.

Stephen McBride

Chief Analyst, RiskHedge

PS: In my Crypto Masterclass, I explain exactly how to buy Ethereum on Coinbase if you’ve never done it before. I also share the ins and outs of storing crypto, tips on keeping your crypto safe, and much more.