Rotation is the lifeblood of bull markets.

This is when money flows from one corner of the stock market to another.

It’s a healthy process. Without rotation, bull markets tire.

Right now, rotation is underway in a big way.

Money is flowing out of “risk on” stocks. See for yourself…

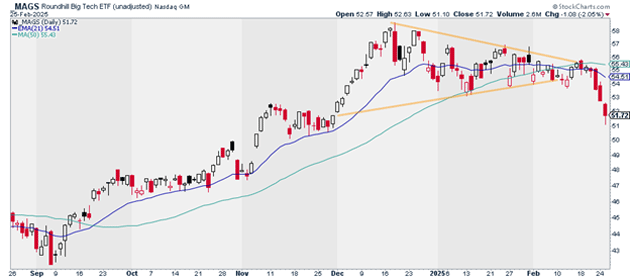

The Magnificent Seven ETF (MAGS), which invests in seven of the world’s most important stocks, has broken down out of a multiweek consolidation pattern:

Source: StockCharts

Source: StockCharts

We’ve also seen a violent rotation out of leading growth stocks.

Palantir Technologies (PTLR) has plunged 32% in a week. Robinhood (HOOD) has dropped 32% in less than two weeks. And Oklo (OKLO) has plummeted 50% in three weeks.

These stocks were among the market’s true leaders. It’s a big concern.

The other issue is that money isn’t pouring into other risk-on groups. It’s moving to defensive stocks.

The year’s top-performing sectors are healthcare (+6.9%), basic materials (+6.7%), and consumer staples (+6.7%). Healthcare and consumer staples are two of the most defensive sectors.

Basic materials aren’t normally viewed as defensive. But they should be this year. The group’s performance is being driven largely by gold stocks.

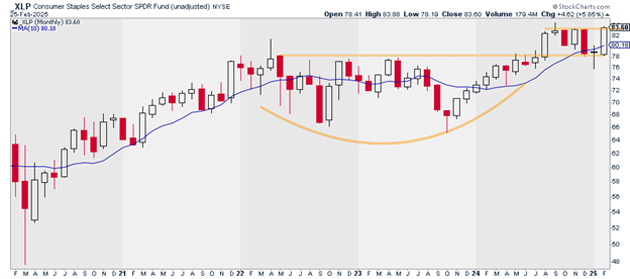

There’s good reason to think this rotation could just be getting started. This chart shows the performance of the Consumer Staples Select Sector SPDR Fund (XLP) over the past five years. We can see that the group is on the cusp of a major breakout:

Source: StockCharts

Source: StockCharts

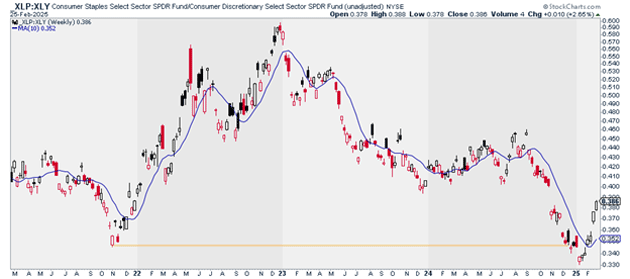

Here’s another way to look at it. Below is the performance of XLP versus the Consumer Discretionary Select Sector SPDR Fund (XLY).

When this line is rising, it means staples are outperforming consumer discretionary stocks. We can see that staples have been leading for the past several weeks:

Source: StockCharts

Source: StockCharts

We haven’t seen a move like this since late 2021… when the last bull market ended.

There’s no guarantee that things will play out the same way this time. But more and more major warning signs are appearing. I’m taking them seriously.

This rotation is one of the reasons I just recommended a hedge position to my RiskHedge Live readers. If the market continues to move to safety, this trade should perform well and cushion any potential downside.

I’m actively monitoring the market and positioning my readers for whatever comes next. If you’d like to join us for up-to-the-minute guidance in this turbulent environment, go here to sign up.

Justin Spittler

Chief Trader, RiskHedge