The rubber band is getting stretched…

It’s been a bloodbath for stocks the past few days.

And it’s no secret why. Tariffs are rocking the market.

As I’m sure you saw, President Donald Trump held his “Liberation Day” press conference at the White House last Wednesday.

He first announced 10% tariffs on 180 different countries and territories. That’s a big deal. But it was in line with expectations.

Stocks initially popped on this news. But the enthusiasm was short-lived.

Minutes later, Trump unveiled more tariffs, including heavy reciprocal tariffs on many of our most important trading partners. These included 46% tariffs on Vietnam… 49% tariffs on Cambodia… and 34% tariffs on China, which were later revised to 54%!

To be fair, the market was weak heading into Liberation Day. But this kicked the selling into overdrive.

Fear carried over into Thursday and Friday, culminating in one of the worst two-day stretches for US stocks in history.

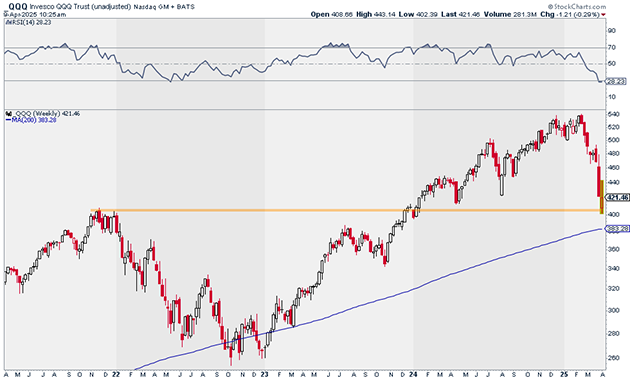

When it was all said and done, the S&P 500 (SPY) closed the week down 9%. The tech-heavy Invesco QQQ Trust (QQQ) dropped 10%.

SPY and QQQ have now plummeted 20% and 26%, respectively, from their all-time highs. In other words, we’ve entered a bear market.

Unsurprisingly, fear is through the roof. The Volatility Index (VIX) has soared more than 200% over the past two weeks. Yesterday, it closed at 52—the highest reading since the COVID crash. We often see extreme readings like this near major bottoms.

Market “breadth” has also taken a nosedive.

Currently, just 2% of the stocks in the S&P 500 are above their 20-day moving averages. That’s on par with what we saw during the 2020 COVID crash and near the bottom of the 2022 bear market.

At the same time, QQQ has pulled back into major support. As you can see below, it’s back at its 2021 highs. This is a level where I would expect buyers to enter the market.

Source: StockCharts

So, while the news cycle is downright awful, this is not the area where I’d look to aggressively short the market.

Instead, I’d be looking to play short-term bounces. I’d also pay close attention to the names showing the most relative strength, like gold stocks. These names have the best chance of becoming market leaders once things settle down.

Justin Spittler

Chief Trader, RiskHedge