“Turn off the television. It’s rotting your brain.”

Ever hear this growing up? I sure did.

But as bad as TV is for kids… it’s much worse for traders.

See, the mainstream financial media isn’t there to help you make money.

Their job is to entertain.

They tell stories that cause investors to make poor decisions.

Last week, for example, there was a big story about Microsoft (MSFT) expanding its cybersecurity offerings.

The news triggered a widespread sell-off in cybersecurity stocks like Palo Alto Networks (PANW) and Zscaler (ZS).

And I get it. Microsoft is a behemoth. It has the money and the resources to enter any market it wishes.

But as often happens, this story was completely overblown.

And that spells opportunity for us…

Enter our Trade of the Week: Cloudflare (NET). This is one of the stocks that initially got hit hard by Microsoft’s news.

Cloudflare is one of the world’s most important internet infrastructure companies. It’s an edge computing pioneer… and a global cybersecurity leader.

If you're a long-time reader, the name might ring a bell.

Cloudflare was actually the first stock I ever officially recommended at RiskHedge. Since then, NET has rallied more than 400%.

That’s a tremendous return. But I believe NET is about to begin its next big leg up.

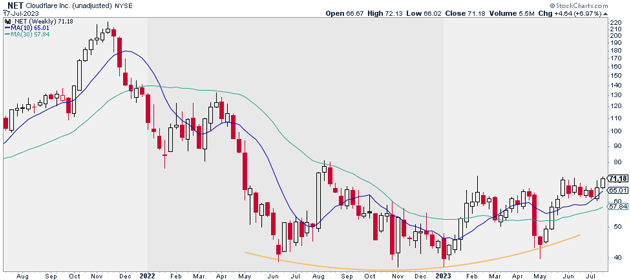

To understand why, check out NET’s weekly chart below.

We can see it’s been building out a base since last May. Huge, multi-month bases like these often act as a launchpad for stocks.

In this case, I think it’s only a matter of time before NET breaks out… making right now an excellent time to get involved.

Source: StockCharts

Source: StockCharts

I suggest buying a half position in NET today.

I’m targeting $135 for NET over the next 12 to 18 months. Close your position if NET closes below $60. That gives us nearly 90% upside, and a risk-reward ratio of nearly 6:1.

Action to take: Buy a half position in NET.

Risk management: Exit your position if NET closes below $60.

Justin Spittler

Chief Trader, RiskHedge