Rotation is in full swing.

During the first half of 2023, “high beta” stocks led the way.

I’m talking about consumer discretionary, technology, and communications stocks.

These sectors gained 31%, 38%, and 34%, respectively, during the first six months of the year.

This is what you’d expect during a bull market. After all, it’s not like these stocks are “defensive.”

Of course, a bull market needs other sectors to participate if it’s going to have real legs.

And that’s exactly what we’ve seen lately.

Over the past couple of weeks, healthcare, energy, and consumer staples stocks have woken up in a major way.

As I’ve explained before, this is perfectly normal. Rotation is the “lifeblood” of bull markets.

And I expect other sectors to get in on the fun soon.

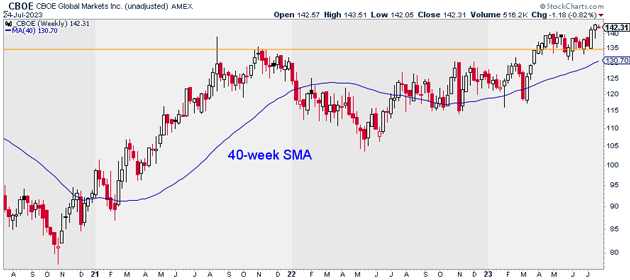

One area in particular I’m watching closely is financials. And that brings us to our Trade of the Week: CBOE Global Markets (CBOE).

CBOE owns the Chicago Board Options Exchange and BATS Global Markets. More important, it’s one of the strongest stocks in its sector.

You can see what I mean below. Back in April, CBOE broke out to new all-time highs after spending several months trading sideways:

Source: StockCharts

Source: StockCharts

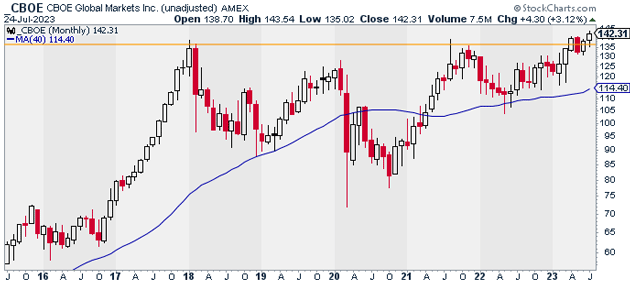

As good as CBOE looks on the weekly, it’s even more enticing when we pull up its monthly chart.

Here, we can see that CBOE didn’t just break out of a multi-month base. It broke out of a base that dates back to early 2018:

Source: StockCharts

Source: StockCharts

This is a very bullish development.

It suggests that CBOE could be in the early innings of a new multi-year rally… making now an excellent time to get involved.

I suggest buying CBOE at current market prices, and I’m targeting $220/share over the next 12 months. That’d be about a 40% move higher from today’s prices.

Exit your position if CBOE closes below $135. That gives us a risk-reward ratio of 5:1 on this trade.

Action to take: Buy CBOE at current market prices.

Risk management: Exit your position if CBOE closes below $135.

Justin Spittler

Chief Trader, RiskHedge