Energy stocks are red hot.

The Energy Select Sector SPDR Fund ETF (XLE) has rallied 25% since mid-January, thanks to huge moves in oil and gas stocks.

But, like any sector, energy isn’t just oil stocks. It’s made up of many different industries.

And there’s one area of energy that’s just now starting to wake up: coal.

Coal stocks, believe it or not, are among my favorite stocks to trade. They’re deeply hated despite having rock-solid fundamentals. They’re also highly explosive when they start trending.

And I believe that time has come.

That’s why I’m making Warrior Met Coal (HCC) my latest Trade of the Week.

Warrior Met Coal is a $3.5 billion “coking coal” company, meaning its coal is used to create premium steel.

We’re putting on this trade today for a few reasons. For one, energy stocks are working better than most sectors right now. Not only that, but Warrior looks like the industry leader within the coal space.

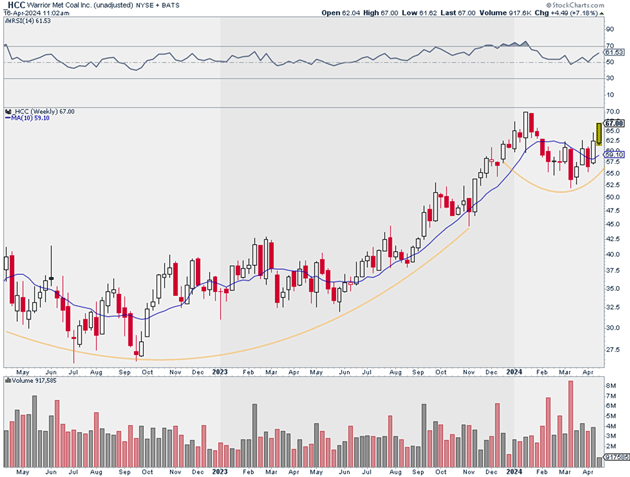

You can see what I mean below…

After a sharp pullback, HCC has spent most of 2024 consolidating. It’s now waking up in a major way and looks poised to make a run toward its recent highs:

Source: StockCharts (Click to enlarge)

Source: StockCharts (Click to enlarge)

I suggest picking up a half position in HCC today. I believe it can hit $90 within the next 12–18 months.

Exit your position if HCC closes below $58. That gives us a risk-reward ratio of nearly 4:1 on this trade.

Action to take: Buy HCC at current market prices.

Risk management: Exit your position if HCC closes below $58.

Justin Spittler

Chief Trader, RiskHedge