Tech stocks have been red hot.

Over the past month, the Technology Select Sector SPDR Fund (XLK) has rallied an impressive 15%. It’s been the best-performing sector by a wide margin.

Ultimately, I see tech stocks heading even higher in the coming months.

But don’t be surprised if tech takes a breather after its recent runup. Not only would this be normal... it would be healthy!

Of course, that doesn’t mean we can’t make money as traders.

We just need to look at other areas of the market. And one of the most overlooked corners of the market right now is energy.

Over the past month, energy has been the worst-performing sector. It’s actually down slightly.

I expect energy stocks to play “catch up” in a big way over the next several weeks.

And that brings us to our new Trade of the Week: Cheniere Energy (LNG).

Cheniere is one of America’s largest energy companies. It’s also one of my favorite energy stock setups.

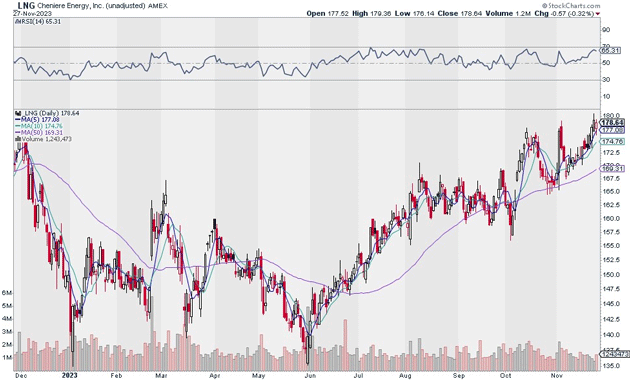

You can see why below. LNG has been grinding higher since the summer and is now closing in on new 52-week highs:

Source: StockCharts

Source: StockCharts

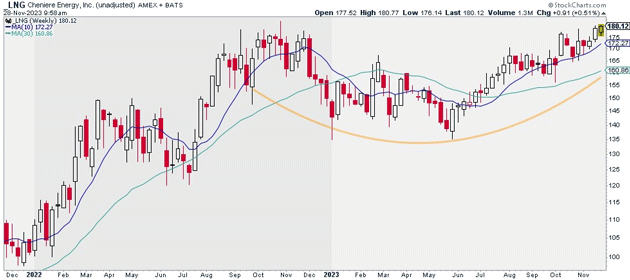

More importantly, LNG is close to breaking out of a base it’s been building for the past year—making right now an excellent time to get involved.

Source: StockCharts

Source: StockCharts

I suggest buying a starter position in LNG today. I believe it can hit $250 within the next 12–18 months.

Exit your position if LNG closes below $167. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy LNG at current market prices.

Risk management: Exit your position if LNG closes below $167.

Justin Spittler

Chief Trader, RiskHedge