Are you getting tunnel vision?

If so, you’re not alone.

During raging bull markets (like we’re in right now), traders get lazy. They only focus on stocks that have been crushing. Think Nvidia (NVDA), e.l.f. Beauty (ELF), and Eli Lilly (LLY).

I love trading these market leaders as much as the next person.

But this is no longer a “thin” market. All sorts of stocks are now working.

And often, the best trades to take are the ones that don’t get talked about nearly as much. That brings me to my latest Trade of the Week: HubSpot (HUBS).

HubSpot helps companies grow their businesses with its marketing, sales, service, operations, and website-building software.

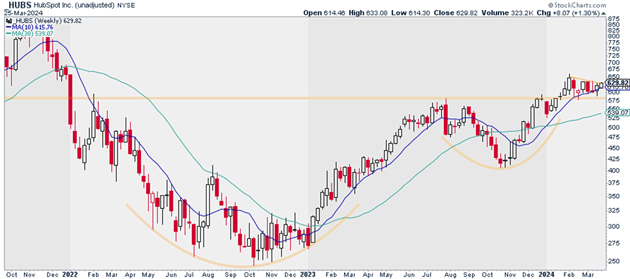

We’re picking up shares of HUBS today because it has one of the cleanest charts in the market.

You can see what I mean below. HUBS has successfully flipped its summer 2023 highs into support. It’s also spent the last seven weeks consolidating over those former highs:

Source: StockCharts (Click to enlarge)

Source: StockCharts (Click to enlarge)

Long consolidation periods like this often precede major moves higher. In other words, HUBS is on a breakout watch. And I expect its next leg up to begin any day now.

I say that because HUBS’ short-term moving averages have caught up to its share price and should now act as a launch pad.

I suggest picking up a half position in HUBS today. I believe it can hit $870 within the next 12 months.

Exit your position if HUBS closes below $595. That gives us a risk/reward ratio of nearly 8:1 on this trade.

Action to take: Buy HUBS at current market prices.

Risk management: Exit your position if HUBS closes below $595.

Justin Spittler

Chief Trader, RiskHedge

|