Editor’s note: Happy Thanksgiving from everyone here at RiskHedge!

Today, we’re sharing an important adaptation from Chief Analyst Stephen McBride’s recent issue of Disruption Investor…

One that’s more important than any one specific stock recommendation…

This is about a simple mindset shift that can make or break your retirement, so you’ll want to read closely.

We hope you enjoy the holiday.

***

“Most American investors now expect the stock market to crash.”

That Business Insider headline flashed across my screen recently.

Over half of American investors think stocks are headed for a crash, according to a survey by insurance giant Allianz.

New data from The American Association of Individual Investors paints a similarly gloomy picture. The number of stock market bulls is near its lowest level in a decade.

Judging by how investors feel, you’d think the market is struggling…

But did you know the S&P 500 hit new record highs last week?

US stocks are up 23% since January. They’re now on track for their fourth-best year since 1999.

Why are folks so pessimistic when things have never been so good?

I’ll let you in on a dirty little secret of investing: we’re hardwired to be pessimistic.

The skeptic who talks about what could go wrong sounds intelligent. He sounds smarter than the oblivious optimist. That’s why you see so many gloomy Wall Street analysts on CNBC.

Overcoming our negative bias is one of the biggest challenges we face as investors. If you can conquer this bias, you’ll unlock huge opportunities in the stock market.

Let me show you how this simple mindset shift could help you make millions of dollars in extra profits over your lifetime.

-

The first person I heard talk about the stock market was one of my college professors.

I owe that guy a lot.

Maybe I wouldn’t have started investing without him. I used to think investing was an activity reserved for rich London stockbrokers.

Problem was… my mentor was a total pessimist. You know the type… always convinced the next stock market crash was right around the corner.

He owned a few stocks. But the majority of his money was in gold and silver. One day, he even brought in a 100oz silver bar in a plastic bag to show me. His arguments for buying hard assets sounded convincing.

Governments printed trillions of dollars after the financial crisis. This “funny money” pumped up stocks, which could collapse any day. To protect yourself, you had to own assets that couldn’t be created out of thin air.

I fell hook, line, and sinker for this argument and threw all my money into “smart” investments like gold and silver. It felt like I was in on some secret only intelligent investors knew about. Buy stocks? That was for suckers who were going to lose all their money.

But the joke was on me. US stocks went on to have one of their best decades ever... while precious metals were one of the worst-performing assets over the same timeframe.

Luckily, I figured this out early: betting on the end of the world is a surefire way to go broke. I started investing the vast majority of my net worth in the stock market.

I learned to stop obsessing about what might go wrong and instead look at the facts. And the facts show markets reward optimistic investors.

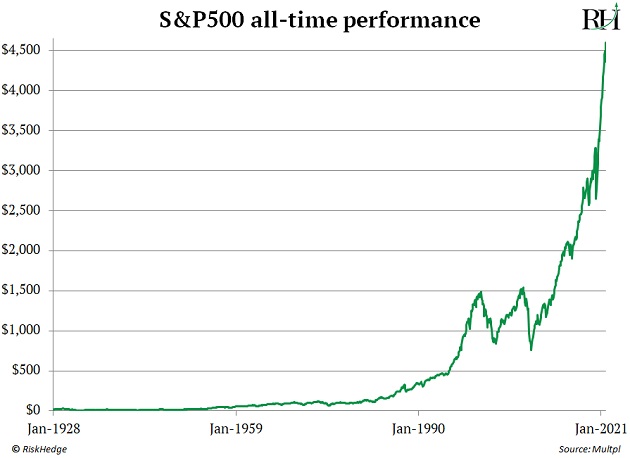

Take a look at this chart of the S&P 500’s all-time performance.

US stocks have risen roughly three out of every four years since 1945. Folks who invested $30,000 in the S&P 500 in 2010 have over $100,000 today. And despite many crashes, the odds of making money in US stocks is 100% over any 20-year period in history.

Let me repeat: the odds of making money in US stocks is 100% over any 20-year period in history.

Unfortunately, many folks are still trapped in a pessimistic mindset today. It’s why most US investors expect stocks to crash, even when markets are surging to new highs.

-

Why are we hardwired to be pessimistic?

It dates back to hunter-gatherer times. In those days, focusing on what might go wrong was a matter of life and death. For example, if you didn’t store enough food, you starved to death. If you didn’t guard your camp, a bear might eat you.

You must train yourself to tame this instinct in order to achieve investing success.

As legendary Fidelity money manager Peter Lynch once said, “More money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

In short, buying the best stocks in history required you to have a bullish mindset.

Imagine telling someone Netflix (NFLX) would disrupt the powerful cable industry 15 years ago? They would have called you crazy.

Yet today, Netflix has more subscribers than all the cable networks combined. And the stock has rocketed 4,000% over the past 10 years.

Same for Amazon (AMZN). In 1999, former 60 Minutes host Bob Simon laughed out loud at the thought of “a couple of geeks who sketched out some software” destroying Sears Roebuck.

We know how that story played out. Amazon handed early investors 100,000% profits.

Don’t get me wrong, I’m not saying optimists always make money. Or that they always get in early on the next big thing. But being willing to take chances on potentially world-changing businesses is a virtue. You can make life-changing money by getting in early on just one incredible disruptor stock.

Pessimists have no chance of catching the best-performing stocks. They’ll come up with 10 reasons why it won’t work. They’ll talk themselves out of buying it.

But remember: the story of the US stock market over the past century isn’t one about pessimists. It’s about optimists and new record high after new record high.

Stephen McBride

Editor — Disruption Investor