Today, we’re buying the king of ride-sharing…

Uber Technologies (UBER) operates the world’s largest ride-hailing service, as well as one of the most popular food delivery apps: Uber Eats.

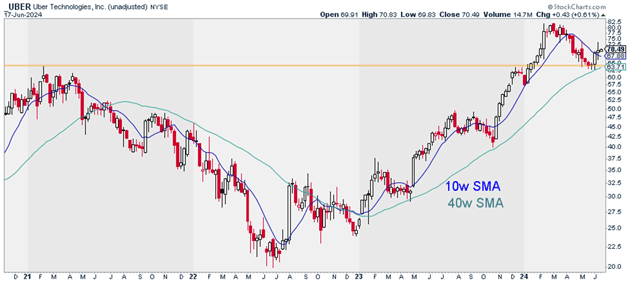

Uber is also one of the leaders of this bull market. Its share price surged more than 300% between June 2022 and February 2024.

It’s since taken a much-needed breather. Over the past few months, UBER has pulled back 23%.

However, the worst appears to be over. You can see what I mean below.

UBER recently retested and bounced off its prior cycle (early 2021) highs. It also found support at its rising 40-week moving average:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

In short, UBER appears to have bottomed. Not only that, but it looks poised to begin its next leg higher.

Last week, UBER closed above its 10-week moving average for the first time in months. That’s why we’re putting this trade on today.

I suggest putting on a starter position today. I believe UBER could hit $100 within the next 18 months.

Exit your position if UBER closes below $65. That gives us a risk-reward ratio of nearly 6:1 on this trade.

Action to take: Buy UBER at current market prices.

Risk management: Exit your position if UBER closes below $65.

Justin Spittler

Chief Trader, RiskHedge