There’s a repeatable secret to doubling your money in artificial intelligence (AI) stocks.

Buy the bottleneck.

Every few months, AI slams into a new physical limit.

And almost every time that constraint sits in some forgotten corner of the market…

And turns that group of stocks into the hottest thing on Wall Street.

- In September 2018, I recommended my first AI stock…

I said, “If I could only buy one stock for the next five years, it would be Nvidia (NVDA).”

I showed you why GPUs are ideal for “training” machines to think like humans. And how every big tech company was training its AI on Nvidia GPUs.

Of course, this was a few years before ChatGPT launched. But it was our first taste of the huge gains you can make once AI finds a new bottleneck. AI demand exploded, and every company was tearing the hinges off the door to get their hands on AI chips.

Nvidia has surged 1,000% since ChatGPT came out… and 2,600% since my 2018 recommendation.

- The next bottleneck was…

Networking.

Unsexy hardware that lets thousands of GPUs behave like one giant computer. Stocks tied to server racks, fiber optic cables, and cooling took off. Names nobody had talked about since the dot-com era.

Vertiv Holdings (VRT) surged 148% in 2024.

Then the bottleneck shifted to power. As AI models improved, electricity demand exploded. ChatGPT 5.2, for example, consumes as much power as tens of thousands of US homes.

|

Suddenly, boring old utility stocks became market leaders.

Constellation Energy (CEG), Talen Energy (TLN), and GE Vernona (GEV) all outperformed Nvidia last year.

- The latest AI bottleneck was memory chips…

Every AI task boils down to two things happening at extreme speed: A logic chip doing math, and that chip constantly pulling data from memory.

As AI models improve and grow more complex, memory becomes the limiting factor.

It’s why memory stocks are soaring today. Congrats to Disruption Investor members (upgrade here) who already doubled their money on Micron Technology (MU) since we bought it in October.

- The next AI bottleneck I’m investing in is…

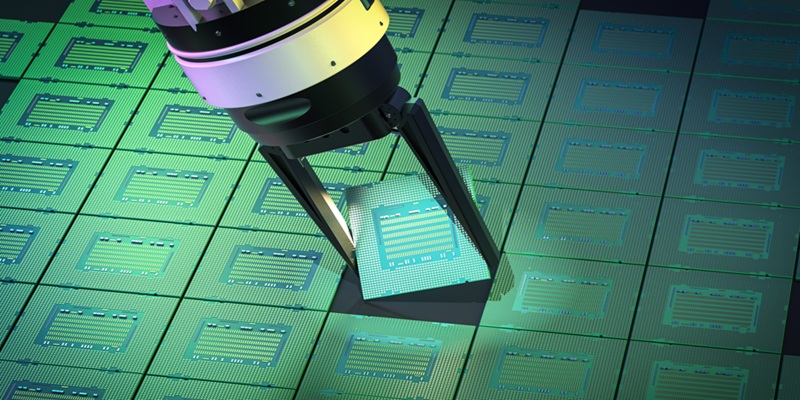

The companies that make the machines that build the chips.

The largest chipmaker in the world—Taiwan Semiconductor (TSM), or “TSMC,” for short—just announced it will spend a record amount of money expanding its factories and buying new equipment this year.

This is TSMC admitting it can’t make chips fast enough.

The chipmaking industry has always moved in boom-and-bust cycles.

When demand spikes, chipmakers rush to build new factories and buy new equipment. Once capacity comes online, that’s usually when everyone realizes they built too much. Then the cycle resets. Demand slows, prices fall, and spending gets cut. Then, the next shortage forces the whole process to start again.

During the pandemic years, that cycle went into overdrive.

TSMC overbuilt aggressively because the world was facing a historic chip shortage. You couldn’t buy a new car without waiting months. PlayStation 5s were rarer than Taylor Swift tickets. Entire supply chains froze.

That overbuilding created a cushion.

When the AI boom hit, chip demand exploded, but TSMC didn’t need to build new factories. Most of the surge was absorbed by spare capacity left over from the COVID buildout.

That phase is now over.

TSMC’s spending has finally pushed past its COVID-era peak, signaling that the slack is gone. The company now says it expects to spend $52 billion to $56 billion expanding production capacity, its largest investment budget ever.

- A handful of stocks will capture the majority of that spending.

Chip factories are insanely expensive.

A modern, leading-edge fab now costs close to $30 billion to build from scratch. Besides nuclear power plants, they’re the most expensive structures on Earth.

Between 70% and 80% of the total cost of a chip factory goes into the machines inside it. The tools that actually print, shape, and inspect the chips.

As chips get smaller, the number of manufacturing steps doubles. Double the steps = double the equipment needed for the same output.

Chips are absurdly tiny. A 2nm chip is about 40,000X to 50,000X thinner than a human hair. Making them requires extreme precision. And only a handful of companies build the machines capable of doing it.

ASML Holding NV (ASML) was my very first recommendation at RiskHedge. It makes the lithography machines that carve microscopic transistors with lasers onto silicon wafers. A single ASML machine costs around $350 million. That’s roughly the price of a Boeing 787 Dreamliner… for one tool.

Then there’s Applied Materials (AMAT). Its machines build chips by stacking and shaping hundreds of microscopic layers, one on top of another, until a finished chip emerges. Think of it like 3D printing at the atomic level. Each machine cost tens of millions of dollars. And fabs need several dozen of them to scale production.

Or consider KLA Corp. (KLA). Its inspection and measurement tools catch microscopic defects before they destroy yields. As chips get denser and more precise, these systems become non-negotiable. Top-tier chip factories easily spend over a billion dollars on KLA’s tools.

- Chip-making equipment stocks have already started moving.

KLA Corp. climbed 15% year-to-date. ASML jumped 17%. And Applied Materials rallied 26%.

These are the picks, shovels, and excavators of the AI boom. And now TSMC and other chipmakers are buying them by the boatload.

I think this is just the opening salvo. They could easily double in 2026.

I suggest you grab some before Wall Street rushes into companies that build the machines that build the chips.

Stephen McBride

Chief Analyst, RiskHedge