US stocks have been on a tear, surging 16% since January.

I recently mentioned making money in stocks feels a little too easy right now. And while the S&P 500 hit fresh highs last Monday, leaders like Nvidia (NVDA) sold off.

It’s a good time to think about doing a summer “cull” of your portfolio. There’s no better time to take some profits than when the market is making new highs.

Let’s get after it…

- Elliott had to jab a needle into his leg twice a week…

He suffered from hemophilia, meaning he risked “bleeding out” from even minor cuts or bruises.

But Elliot got a special kind of IV drip into his arm that allowed him to ditch the blood-clotting injections after 29 years.

Often referred to as “CRISPR,” gene editing allows scientists to “cut” out bad genes that cause disease and replace them with healthy genes.

Gene therapy was invented around a decade ago. After years of scientists toiling away in labs, we’re finally seeing real breakthroughs.

|

Elliot’s doctors basically infused a regular IV drip—like getting fluids at the hospital—with CRISPR technology. This sent tiny, engineered viruses flowing into Elliot’s bloodstream. These viruses “rip out” the bad genes and replace them with working copies.

Before CRISPR: Regular injections and constant worry about bleeding.

After CRISPR: No more jabs and a much better quality of life.

Go innovators!

RiskHedge readers know we’re entering a golden age for biotech. It’s the next big transformational disruption.

Over coffee, chief economist at The Abundance Institute Eli Dourado told me, “Pay attention to where innovation is getting easier.”

Today, a rookie grad student can accomplish more than the world’s top biologists could 30 years ago. That’s because the tools they’re working with are far superior.

Investors talk about biotech like it’s one big group of companies. But it’s really made up of distinct companies all trying to tackle unique problems.

Biotech is a stock picker’s market. Which stocks you own really matters.

The largest biotech ETF—the iShares Biotechnology ETF (IBB)—is flat this year.

We own a world-class biotech business in the Disruption Investor portfolio. It’s up 30% this year, and we’re hunting for more opportunities in this sector.

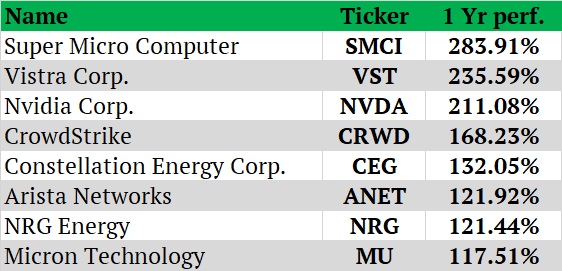

- Notice a common theme among the top-performing S&P 500 stocks?

Answer: They’re all making money from artificial intelligence (AI) in one way or another.

“Stephen… Vistra, Constellation, and NRG are all boring ol’ power providers. What do they have to do with AI?”

Electricity.

AI’s thirst for energy is off the charts.

Chatbots like ChatGPT are powered by tens of thousands of energy-hungry computer chips inside vast data centers. These systems generate so much heat, they need specialized vents and fans humming 24/7 to keep cool.

AI servers run 5X hotter than traditional data centers. The new state of the art is “liquid” cooling, as opposed to giant fans blowing cold air.

We own the world’s top liquid cooling company in Disruption Investor. It’s partnered with Nvidia and can easily double in the next year.

Great businesses solve important problems. Thanks to the stock market, we can piggyback off their successes. Don’t you love investing?

- I predicted last year: “AI will let you talk with deceased relatives.”

A Chinese company called Super Brain is creating AI avatars of dead relatives.

It uploads these to a special iPad, which looks like a photo frame when standing up in your house. You can pick it up anytime and talk with your loved ones who’ve passed.

Yours for only $1,000. Here’s what it looks like:

Source: Super Brain

I’m a big fan of using AI, but I think I’ll stick to Claude for now.

- Today’s dose of optimism…

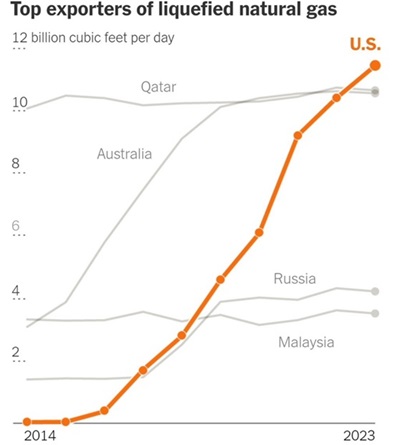

A decade ago, America was a minnow producer of natural gas.

Now, it’s the world’s largest seller of natural gas, as this orange line shows:

Source: S&P Global

It’s all thanks to the innovation of “fracking”—a process that releases oil and gas trapped deep down inside previously inaccessible areas.

Special machines then “liquefy” the gas at a frosty -260 degrees Fahrenheit so that America can ship its newfound fracking success across the world.

America’s embrace of innovative new technologies is what keeps it #1. Never forget.

See you Wednesday.

Stephen McBride

Chief Analyst, RiskHedge