Two “park $1K and forget” stocks… Chief Trader Justin Spittler on inflation… And why history suggests stocks will rise in 2023…

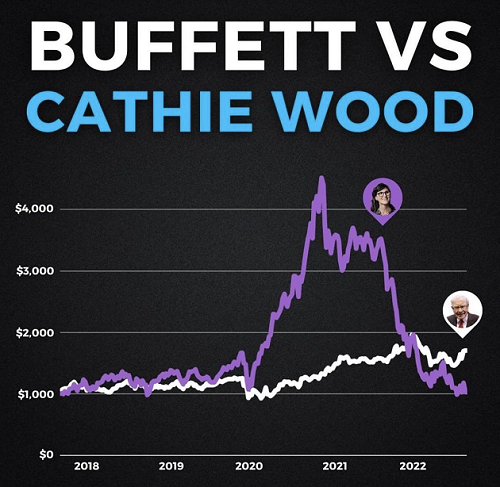

- This picture perfectly sums up where markets have been and where they’re likely headed in 2023.

The purple line is the infamous ARKK ETF—Cathie Wood’s fund dedicated to investing in disruptive technology stocks. Fueled by 0% interest rates and easy government money, ARKK skyrocketed a max of 384% in 2020 and seemed to be leaving “old” stocks in the dust.

Then, reality set in. ARKK has plunged nearly 80%. Meanwhile, Warren Buffett’s Berkshire Hathaway—comprised of stakes in big, safe, long-lasting businesses like Coca-Cola—steadily grew and surpassed the returns of ARKK.

Source: CarbonFinance

- This goes to show that nothing is more important in markets than interest rates.

ARKK was full of “promising but profitless” tech companies like Peloton (PTON). These types of stocks can be phenomenal investments when interest rates are low, and therefore money is cheap and plentiful.

But in the past year, the Fed has hiked interest rates from 0.25% to 4%... shooting down hundreds of companies that burned through money with no realistic plan to turn a profit anytime soon.

- But markets have come full circle.

ARKK has given back all its gains since 2018. This environment reminds me of the dot-com bust. Many dot-com companies went out of business. But the truly great disruptors survived… and became some of the greatest investments of all time.

Amazon (AMZN), eBay (EBAY), and Priceline (BKNG) went on to see peak gains of 67,275%, 2,789%, and 43,005%, respectively.

Buried in today’s tech wreckage, there’s a growing list of A+ disruptive businesses that I’m buying. Many tech stocks are in a much better place—stronger, bigger, safer, and more profitable—than five years ago. But their stock prices don’t reflect it at all.

At these low prices, it’s smart to take a stab at these names. I suggest investing a small amount, like $1,000. Then try to forget about it and ignore the short-term volatility. Check back in a couple years, and there’s a good chance your investment will be worth multiples of what it is today.

- Here are two of my top buy-and-forget stocks:

Shopify (SHOP): Shopify made a better, faster, and cheaper way for folks to start and run their own businesses. You can get a webstore up and running on the platform in as little as three clicks.

Last year, over 400 million people bought something through a Shopify website. Shopify has one of the most phenomenal growth stories of all time. Its sales have soared 30X since 2015.

But, after hitting an all-time high in November 2021... the stock has fallen 77%. This is a great opportunity to park a small amount of money, sit back, and check back in 2025.

Roku (ROKU): Roku makes devices that make it easier to stream TV.

Despite operating in a highly competitive market, Roku has grown rapidly over the last five years. Its sales are up 2,400% as more and more people ditch cable.

The stock peaked at around $460 in June 2021. It’s down 90% since and looks great at current prices.

- Yesterday’s CPI inflation reading clocked in at 7.1%—lower than expected.

This is now the fifth-straight month inflation has declined. And the news sent stocks surging as high as 2.9%.

Back in July, when inflation was red hot, our chief trader Justin Spittler was one of few to predict that inflation was peaking. His reasoning? After a sharp rise in 2021, commodity prices were beginning to trend lower.

Commodities are the building blocks of our world. Think oil, natural gas, and lumber. They’re the “inputs” forming the foundation of the economy.

Commodity prices can clue you in on inflation well before government readings—which are slow and fail to warn you until it’s too late. Justin’s call was spot on. A month after his prediction, inflation turned lower for the first time in over two years.

I checked in with Justin to see if inflation will continue falling in 2023...

Inflation is still a problem. But things are looking better.

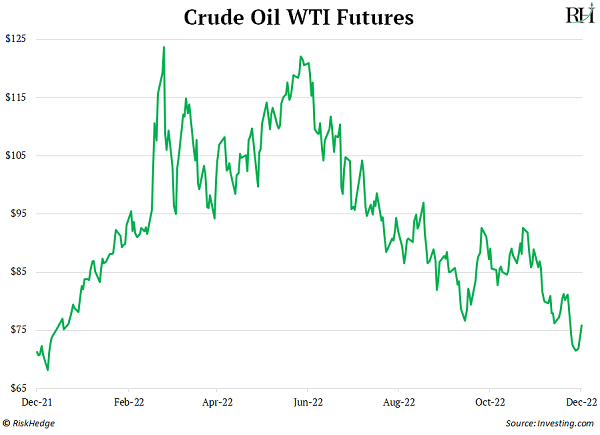

Look at the chart of oil. It’s the most important commodity in the world…

Crude is down 23% in the last month alone.

Remember when everyone said Europeans would freeze to death this winter because Russians won’t supply cheap gas?

EU natural gas prices have fallen off a cliff. They’re down 50% since August…

And natural gas declined just as much in the US. Yet another sign inflation is declining.

I could go on about other commodities in free fall—lumber, gasoline, wheat…

But here’s one more sign…

Not too long ago, everyone was talking about the backlog of ships off the Port of LA. And how it was driving up shipping rates... which made every product on the shelves more expensive.

Shipping rates have crashed 75% since October 2021... another good sign inflation will continue lower.

- Will stocks rise in 2023?

2022 was the worst year for stocks since 2008. I expect stocks to rise next year for several reasons. Here’s one: it’s extremely rare for US stocks to fall two years in a row.

In the last 100 years, the US stock market has only declined in consecutive years four times—2000–02, 1973–74, 1939–41, and 1929–32.

In all those instances, the market was in much worse shape than today.

In 2000–02, the stock market dropped for three straight years. That’s because it had a LONG way to fall after reaching its most overvalued level in history during the dot-com bubble. Today, the market trades at about 18 times earnings—which is in line with historical averages.

In both 1973–74 and 1939–41, inflation was rising rapidly. Today, inflation is falling.

And 1929–32 was the start of the Great Depression. The unemployment rate was as high as 25%. Today, it’s at 3.7%.

What do you think? Will stocks rise next year... or will we see back-to-back losses for only the fifth time in 100 years? Let me know at chriswood@riskhedge.com.

Chris Wood

Editor, Project 5X

In the mailbag...

Today, a reader responds to crypto expert Stephen McBride’s essay on the FTX blowup...

What do you think is going to happen to BlockFi? I had no idea they were involved or had any link to FTX, and I have some crypto with them, of course, that I cannot withdraw now. And, of course, they’re going through some kind of bankruptcy or re-organization. I try to withdraw it all the time, but it’s just blocked. What do you think the future of Block Fi will be? Will they honor their commitments to their customers and give us our money back? —Linda

Stephen’s comment: Sorry to hear, Linda. BlockFi users will likely get a portion of their assets back after years of the situation working its way through bankruptcy court. Maybe you’ll get 50c of every dollar owed back. But this is a great reminder for all serious crypto investors to move their assets OFF crypto exchanges and into a cold wallet like Ledger.