Money is moving down the cap scale.

Last week, I explained how the back half of 2024 could look very different from the first six months.

Specifically, I said I expect small- and mid-cap stocks to catch up in a major way.

To capitalize on this rotation, we made Onto Innovation (ONTO)—an $11.5 billion semiconductor equipment stock—our Trade of the Week.

And our timing couldn’t have been better…

Last Thursday, we got the latest CPI inflation number. It came in lighter than expected, causing interest rates to fall.

Without getting too far into the weeds, this is bullish for smaller, more speculative stocks.

So, we’re going small once again this week…

That brings me to my new Trade of the Week: Dutch Bros (BROS).

Dutch Bros operates a chain of coffee shops. As of May 2024, the company had 835 stores nationwide.

We’re putting on this trade for a few reasons. For starters, we want to own smaller stocks in the current environment, and BROS currently has a $4.5 billion market cap.

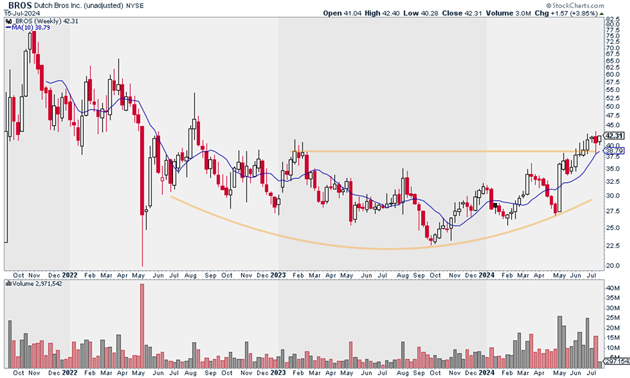

BROS also has an explosive setup. As we can see below, it just recently broke out of a massive stage. This tells me it's in the early stages of a new uptrend.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest putting on a starter position in BROS. I believe the stock could hit $60 over the next 12 months.

Exit your position if BROS closes below $38. That gives us a risk-reward ratio of 4:1 on this trade.

Action to take: Buy BROS at current market prices.

Risk management: Exit your position if BROS closes below $38.

Justin Spittler

Chief Trader, RiskHedge