Wall Street strategists are among the best-paid people in finance.

They get paid cushy six-figures salaries to gaze deep into their crystal balls and predict where markets are headed next.

They’re often totally wrong.

I’ve made a lot of money betting against strategists. And it’s paying off again this year.

- Wall Street’s crystal ball is cracked. Let’s look at its recent track record…

2022: Wall Street predicted stocks would rise 5%. Stocks crashed 18%.

2023: For the first time ever, it predicted stocks would fall. Instead, the S&P 500 soared 26%.

2024: It aimed way too low again, forecasting the S&P 500 would hit 4,860. The market blew past that by over 20%.

Now, for 2025, Wall Street has done a complete U-turn. Every major firm—yes, every single one—predicts stocks will rise. Not a single down-year forecast in sight.

I warned Disruption Investor members in early January this universal bullishness should set off alarm bells. The stock market runs on expectations. When everyone expects gains, those expectations become harder to beat.

I don’t own a crystal ball. Our edge isn’t predicting the future. It’s seeing the present with razor-sharp clarity. And there were other reasons to be cautious about markets heading into 2025.

- Is making stock market forecasts based on election cycles voodoo?

Maybe, but stocks have followed the four-year presidential cycle to a tee over the past few years.

This pattern was one of our secret weapons when we pounded the table to buy stocks in late 2022, while Wall Street’s finest were waving red flags. The S&P 500 surged 33% over the next 12 months.

It’s also another reason I warned Disruption Investor members to strap in for a turbulent 2025 back in January.

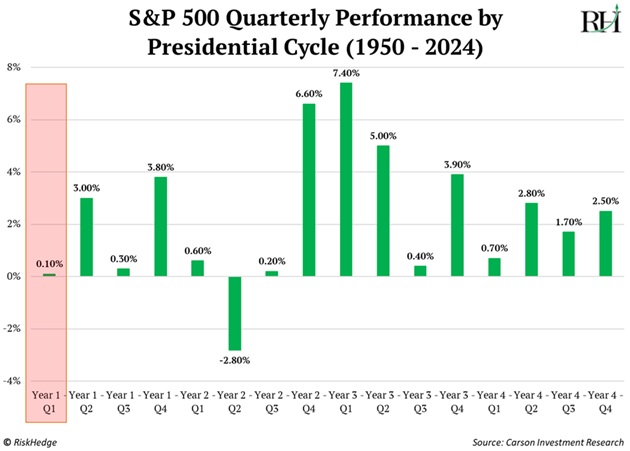

The first quarter of year 1 of a presidential cycle is typically rocky, as this chart shows:

On average, stocks gain just 0.1% during the first three months of a new president’s term. This isn’t voodoo; it’s markets and investors adjusting to a new set of policies.

The selloff we’re experiencing right now shouldn’t be a surprise. In fact…

- This selloff is healthy and necessary.

In 2023, the S&P 500 ripped 26%.

Last year, US stocks surged another 25%.

For perspective, the average annual gain for the S&P 500 since 1957 is around 10%.

The volatility we’re seeing right now is healthy. I’d argue it would be worse if stocks jumped 20%+ again this year. That would put us in bubble territory and likely set up a big crash somewhere down the line.

Coming into the year, the S&P 500’s valuation was at the highest levels we’ve seen since June 2000. We needed to cool off, and that’s exactly what we’re seeing.

Going back to 1980, stocks typically experience a 14% intra-year drop. In other words, this selloff could get a little worse and still be perfectly normal.

|

But don’t lose sight of the big picture. Remember: the markets have a strong bias to the upside over time. This is a buying opportunity to accumulate your favorite stocks on sale.

- Here’s how we’re investing in our brand-new advisory, Disruption_X…

As I’ve been writing about for months, we’re at the onset of an innovation avalanche.

I’ve been touting Ronald Reagan’s famous line: “It’s morning in America.”

And 2025 continues to look really bright.

Artificial intelligence (AI) is reshaping work, boosting earnings, and making us all more productive…

Fast-growing industries like crypto and drones are escaping regulatory hell…

Nuclear energy is making a comeback…

Robotaxis are finally rolling out across American cities…

Robotics is on the cusp of its ChatGPT moment…

And after a 50-year hiatus, there’s not one, but three spacecraft on their way to the Moon.

In Disruption_X, we’re hunting the dark-horse disruptors at the forefront of these technological breakthroughs. Ones with 10X potential that are on sale right now.

We own a space stock, an AI stock, and just recommended a robotics stock.

We know that whatever happens over the next few months is just noise, and as we told our members this week, it’s a golden opportunity to accumulate more shares of these fast-growing stocks at a discount.

If you’d like to join us, time is running out to lock in your charter membership with your special bonus.

After Monday, this offer will be closed for good.

See if it’s right for you here.

Stephen McBride

Chief Analyst, RiskHedge