The election isn’t the only thing on investors’ minds right now.

We’re also smack dab in the middle of earnings season.

This is when companies tell the world how their business is doing. They reveal how much their sales grew and if they turned a profit.

Good quarterly results, as I’m sure you know, can cause a stock to race higher. Bad earnings, on the other hand, can send a stock into a tailspin.

In fact, it’s quite common for a stock to move 20%... 30%... or even 40% in a day based on earnings!

- More importantly, earnings can set the tone for a stock going forward…

They can dictate a stock’s trajectory for weeks… months… or even years.

But here’s the thing. Not all good earnings ignite powerful rallies.

Sometimes, companies crush earnings and barely move… or even fall on the news. We’ve been seeing this play out a lot recently.

- Just look at what happened with Amazon (AMZN) last week…

The online retail giant reported stellar results last Thursday. Its sales soared 37% during the third quarter. That’s phenomenal growth for any company. For a $1 trillion company, it’s mind-blowing growth. It also reported stronger earnings than analysts expected.

You’d think Amazon would rally on these incredible results. But it plunged 5.4% on Friday.

The same thing happened with Facebook (FB). The social media giant also reported blowout quarterly results last Thursday. Its revenue jumped 22% compared to last year, beating analysts’ expectations. Net income also increased 29% year over year.

Facebook initially shot up on the news. But the stock quickly changed direction. Facebook closed Friday down 6%.

Same thing happened with Shopify (SHOP). The e-commerce pioneer shared impressive quarterly results last Wednesday. Its sales soared 97% to $767 million. That’s $115 million more revenue than Wall Street anticipated. It delivered MUCH stronger earnings than analysts expected.

And yet, Shopify fell 7% on Thursday, and another 5% on Friday.

Twilio (TWLO) and Tesla (TSLA) also sold off despite reporting strong earnings.

- That’s why I’m avoiding these stocks like the plague right now…

Most folks don’t realize that a stock’s reaction to earnings is the single most important thing to watch.

When a stock falls on blowout earnings, many rookie investors will buy more. They assume the market is being irrational and that a bounce must be coming.

This is almost always a mistake. When a stock falls on great earnings, the market is telling you something is “off.” It’s best to avoid that stock in the short term.

That’s why I focus on companies that post strong earnings AND jump in price. In just a minute, I’ll tell you one of my favorites right now.

But I want to make something clear…

- An initial jump on earnings, by itself, isn’t enough…

I want to see the stock close strong, too. In other words, I want to see it maintain its initial gains, or even add to them, before the close of trading that day.

I also like to see:

- A big “gap up.” This is where a stock shoots up much higher than where it closed the previous day. Ideally, a stock will also break out to near all-time highs… or at least break through prior resistance levels.

- Heavy volume. I like to see volume that’s at least 100% greater than the stock’s average trading volume.

When I see these three things, I know the move likely has staying power.

- When you find an opportunity that checks all these boxes, massive rallies often follow…

You could have used this approach to buy Facebook for just $34 after it surged on earnings in July 2013. Today, Facebook trades for over $270. That’s nearly a 700% gain... or enough to turn every $10,000 into almost $80,000.

Source: StockCharts

Source: StockCharts

You also could have used this strategy to buy Advanced Micro Devices (AMD) for just $17 in 2018. Today, AMD is trading 388% higher... and it was the #1 performing stock in the S&P in 2018 and 2019.

Source: StockCharts

Source: StockCharts

You could have used it to buy streaming giant Roku (ROKU) in August 2018 for just $25. Less than two years later, Roku’s share price had 7X’ed!

Source: StockCharts

Source: StockCharts

That’s right. This pattern isn’t just for nimble traders. Long-term investors can also use this strategy to grow their wealth. It can help you identify the true market leaders of tomorrow.

- Opportunities like this pop up every earnings season…

In fact, we just saw this play out with Snap (SNAP).

Snap owns the wildly popular app Snapchat, which is a massive hit with kids. In fact, 90% of 13- to 24-year-olds in the US use Snapchat. To put that in perspective, only 39% of young folks use Facebook.

Despite its massive popularity, Snap was a hated stock. It plummeted 77% during its first eight months as a publicly traded company.

This was mainly because Snap was a criminally misunderstood stock. Wall Street didn’t see Snap for what it really is, which is an augmented reality (AR) pioneer.

But we recognized Snap’s huge potential way back in January. Now, the entire world can see what we saw.

Last week, Snap delivered stellar earnings. Snap’s daily active users climbed 18% year over year… and revenues increased 52%, exceeding analysts’ expectations.

- Snap soared more than 30% the day after reporting blowout earnings…

And it did so on massive volume. It was a textbook explosive earnings move.

Snap went on to climb another 12% over the next two trading sessions.

That’s a tremendous move. But I see Snap headed much, much higher in the months ahead.

So, consider investing in Snap if you haven’t already. I see it delivering huge returns for years to come.

Justin Spittler

Chief Trader, RiskHedge

Hot New Stock Research

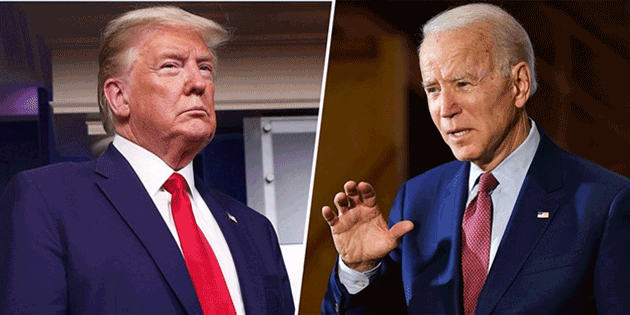

It’s election night in America!

As the country anxiously awaits what happens next… And investors make last-minute changes to their portfolios…

Our Chief Analyst Stephen McBride has one simple piece of advice:

Own world-class “disruptor” stocks set to thrive in the years ahead… no matter who wins tonight.

One of his favorites (the only stock he owns in his daughter’s college fund) is a screaming buy right now.

That’s because it’s about to take down one of the most dominant companies in history… and soar a potential 200-1,000% in the process. Go here to get Stephen’s full writeup.