While the S&P 500 continues to struggle, down 20% YTD...

An overlooked group of stocks is thriving. I’m talking about high-quality dividend stocks.

Names like Merck (MRK), up 44% this year. Or McDonald’s (MCD) and Pepsi (PEP)... both flirting with new all-time highs. These stocks aren’t just running laps around the broad market... they’re handing investors steady, reliable income.

Our friend Kelly Green has 12+ years of experience in investment research with a focus on finding top-tier dividend stocks for her subscribers. She’s helped readers discover income plays with dividend yields over 4X the average yield of the S&P 500.

I’m bringing her in today to share one of her top dividend picks… and tell us more about what to look for in a winning dividend stock.

***

Chris Wood: Kelly, you say now is an excellent time for serious investors to buy high-quality dividend stocks. But first, what do you tell someone who’s never considered making dividend stocks a key part of their investing plan?

Kelly Green: Thanks, Chris. Let me answer that with a statistic.

We all know dividends are not the latest “hip” or “trendy” investment idea... In fact, most investors have been programmed to believe the stock market is all about making a quick buck.

But the reality is, since 1960, 84% of the total return of the S&P 500 Index came from reinvested dividends.

For over 60 years, dividends have been the boring secret to amassing long-haul wealth.

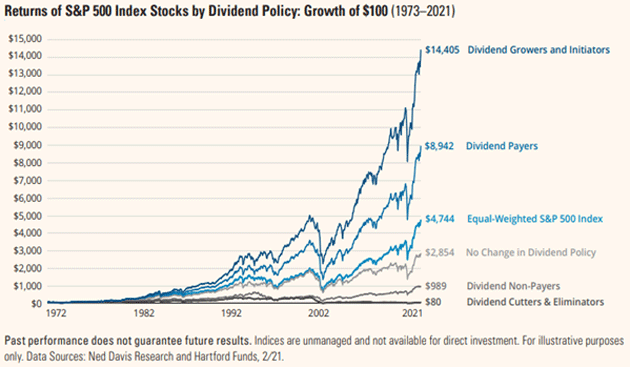

Study after study shows that owning dividend payers—and, more importantly, those that grow their dividend—will dramatically boost your total return over time. Below, you’ll see that companies that steadily grow their dividends run away from most other groups of stocks over time.

Source: Hartford Funds

Source: Hartford Funds

Many dividend payers are big, established, solid… and boring companies. Toilet paper, printing, and pickles aren’t the kind of products that make for splashy media headlines. But the companies that sell them can pay you 3.4%, 7%, and even 15% dividend yields.

Chris: And it’s not just about the yields. Dividend stocks have been clear winners this year. Not only are they holding steady... many are showing positive gains. McDonald’s (MCD) and Pepsi (PEP) are flirting with all-time highs...

Kelly: That’s exactly right. Dividend stocks enjoy a longstanding reputation of weathering storms in the market, and that’s certainly been the case in 2022. They also have a reputation of performing well when inflation’s high, like today, thanks to their sustainable and predictable cash flows.

Chris: Is there an ideal dividend yield to look for—one that’s high while also sustainable?

Kelly: I love this question. Between 2%–4% is a common answer. Sometimes you’ll see the upper limit pushed to 5% or maybe 6%. Anything above that and investors get suspicious that it’s not sustainable.

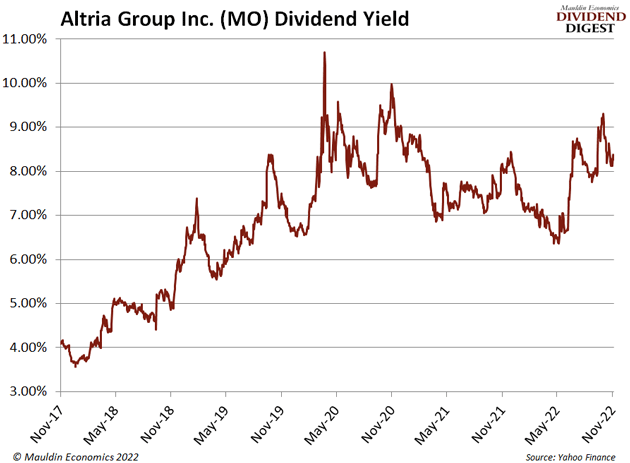

That can be true… but there are a lot of exceptions if you know where to look. Take tobacco giant Altria Group (MO), for example. It has not only paid a dividend for over 50 years, but it has raised its dividend 57 times in the last 53 years. And right now, this Dividend King has a dividend yield of around 8%.

If you’re guided by a hard-and-fast rule that says all yields over 5% are dangerous, you’d miss out on this high-income opportunity. Altria hasn’t had a yield in that “safe zone” since 2018!

Altria is part of an elite group called Dividend Aristocrats. These are companies that have raised their dividends every year for over 25 straight years.

Some companies like Coke (KO) and Target (TGT), currently both yielding around 3%, have raised their dividends for 50 years! Checking out the Dividend Aristocrats is a great place to start your research when considering a high-quality dividend stock.

Chris: Can you tell readers how they can, as you call it, “turbocharge” the growth of their wealth?

Kelly: I discovered the power of dividends in my early 20s. I’m convinced they’re one of the best ways to earn extra income and grow wealth. And it’s thanks to the power of compounding.

Would you take $5 million today or payouts over the next 30 days that start with a penny and double every day? By day 15, that measly first payment of a penny has turned into $163.84. On day 30, your payout would be over $5.3 million. This is an extreme example... however, it shows the power of compounding over time.

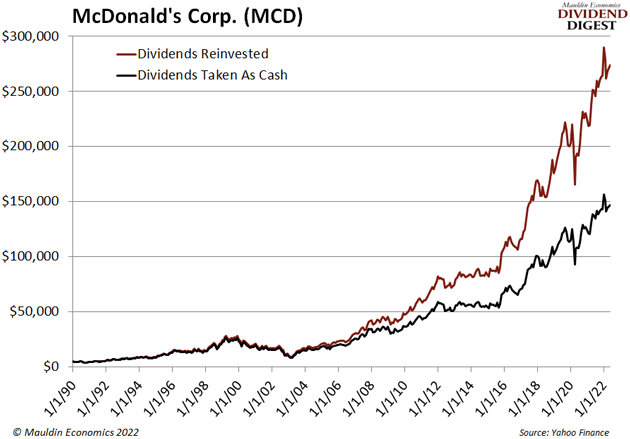

Instead of collecting your dividend payments as cash, you could opt to have the money reinvested in more shares of a company. Using this option means you’ll collect dividends on your dividends each and every time the next dividend is paid.

Here’s a real-life example of how dividend reinvesting will turbocharge your long-term total return. Let’s say you invested $5,000 in McDonald’s Corp. (MCD) back in 1990. If you took your dividend as cash, your shares would be worth about $150,000 today, as shown in this chart:

However, if you’d reinvested those dividends back into shares, your investment would be worth nearly double that amount.

Most brokerage accounts make dividend reinvestment simple. You simply check the appropriate box, and they do all the work. And you can decide to take your dividends in cash rather than shares at any time.

Chris: Thanks, Kelly. Before you go, could you share a smart dividend stock pick?

Kelly: Sure, I like Best Buy (BBY) here. Unlike most retailers, Best Buy doesn’t have a bloated inventory. The company said it will get regular inventory shipments through the holiday season to meet customer demand.

I’m also intrigued by its new Upgrade+ program launched in October. Qualifying customers can acquire Mac laptops and related accessories for a low monthly fee. Then, after three years, they can opt to upgrade to newer models and continue paying a low monthly fee. Affordability is top of mind for consumers right now.

Shares are 29% off their 52-week high and just slightly above their pre-COVID levels. That puts BBY’s annualized dividend yield at 4.4%. Very attractive for a retail giant. The company has paid a dividend since 2005 and raised it through COVID.

If you’ve been waiting to add BBY or another retailer to your portfolio, there’s sure to be some volatility in these stocks over the next few weeks. Use this volatility to buy shares on the dips.

Chris: For readers who want more great dividend picks from you, your popular Yield Shark advisory is on sale for 50% off—through Friday only. So, I’m sharing this link to the special page.

Kelly: Thanks, Chris. We currently have 15 buys in my premium portfolio, with a handful yielding over 7%. I also recently put the final touches on two reports that new subscribers will receive instantly, including my Inflation Survival Blueprint, which spills the details on the seven best companies I’ve identified to essentially “cancel out” the effects of 40-year highs in inflation.

Chris: Thanks, Kelly. We’ll talk soon.

Chris Wood

Chief Investment Officer, RiskHedge