Who can you trust these days?

When it comes to election odds, you don’t have many options.

The polls are a joke. They’re biased and derived from a small sample size.

What about the betting odds on sites like Polymarket?

There’s real money on the line, but the volume is still trivial. A single whale can skew the odds.

Also, let’s face it. Men are more likely to gamble on the outcome of a presidential election than women. So, the betting odds don’t always tell the whole story.

The good news is that there’s a third option.

You can look at REAL financial markets. I’m talking about the stock, bond, and cryptocurrency markets.

These are deeply liquid markets… available to everyone. And right now, they’re telling a story.

They’re pricing in a Trump victory.

In my Jolt essay from a couple weeks ago, I explained how financial stocks, bitcoin (BTC), and even meme stocks were pricing in a Trump win. Since then, that argument has only gotten stronger.

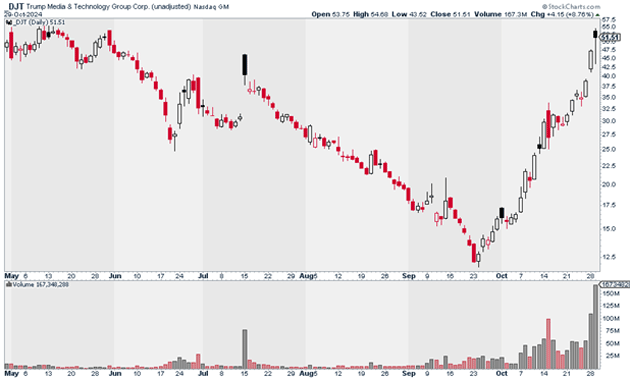

For example, look at the Trump Media & Technology Group Corp. (DJT) chart below.

As you may know, DJT is basically a meme stock. Most people don’t take it seriously. Others take it way too seriously.

Personally, I think it gives us a good sense of Trump’s election odds. After all, it’s a big, liquid asset.

Interestingly, DJT bottomed right around the same time the betting odds on Polymarket and other sites started to reverse course in favor of Trump.

Since then, DJT has rallied 357%. And it’s not like this is some penny stock anymore.

As of yesterday’s close, DJT is now worth $10.3 billion, making it larger than The New York Times.

Source: StockCharts

Source: StockCharts

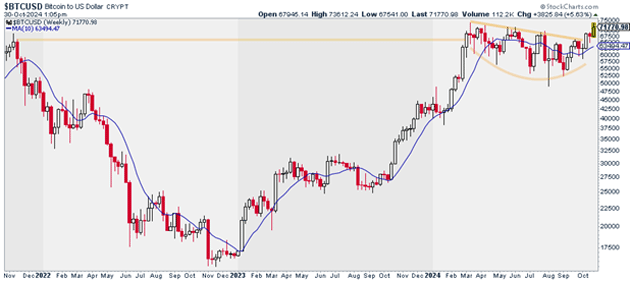

Meme stocks not your thing? Well, the crypto market also appears to be pricing in a Trump victory.

Just look at bitcoin. We can see it’s breaking out of a multi-month base… and approaching its spring all-time highs:

Source: StockCharts

Source: StockCharts

I take this move seriously…

Remember, Trump is widely considered the more pro-crypto option of the two candidates. He’s repeatedly said he wants to make the United States the global leader in digital assets and bitcoin mining. He’s even launched his own NFT series.

So, the fact that bitcoin is breaking out AHEAD of the election could mean the market is anticipating a more crypto-friendly administration to take the White House.

And get this…

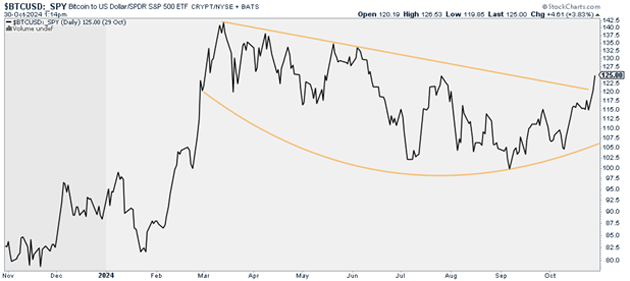

Bitcoin isn’t just breaking out on an absolute basis. It’s also breaking out relative to the S&P 500. This tells me that bitcoin should outperform stocks for the foreseeable future.

Source: StockCharts

Source: StockCharts

If just one of these moves was happening, we could write it off. But collectively, they tell a story.

I just recorded a more in-depth video talking about the specific price moves I’m seeing heading into the election… and the larger market implications they could have.

As I’ll explain, I expect to see plenty of exciting trading opportunities over the next few years no matter what the election outcome is next week. But how and where you put your money to work will be crucial over the coming months.

Stay tuned for that video.

Justin Spittler

Chief Trader, RiskHedge