Forgive me.

I’m a little tired.

Last night, I was up later than usual reviewing charts.

You see, July ended yesterday. And that means one thing…

Fresh monthly charts.

Monthlies are among my favorite charts to analyze. They tell me a ton about the bigger stock market picture.

They can also lead to some incredible, long-term trading opportunities… like our new Trade of the Week: the Global X Uranium ETF (URA).

URA is a fund that invests in a basket of uranium stocks, making it a one-click way to bet on the nuclear energy renaissance.

More importantly, URA has one of the best monthly charts you’ll come across.

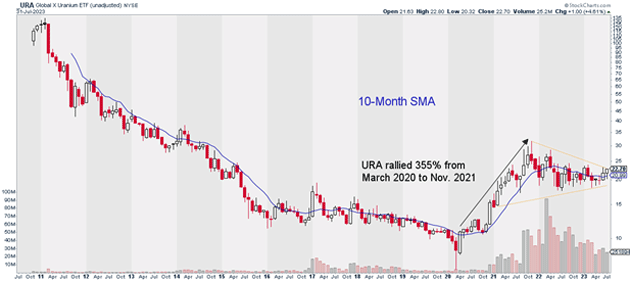

URA was in a brutal downtrend from late 2011 until early 2020… falling 95% from its highs!

Since then, uranium stocks have made an epic turnaround. Between March 2020 and November 2021, URA rallied 355%.

That’s a truly staggering return. Remember, we’re talking about an entire industry group… not a single stock.

After such an explosive rally, stocks usually need time to store up energy before beginning their next uptrend. And that’s exactly what URA has done.

It’s been consolidating within a wedge pattern for the past two years. But it’s likely only a matter of time before it breaks out of this consolidation pattern.

Notice how tight this wedge pattern has gotten?

This typically happens before a stock—or, in this case, a group of stocks—makes a big move. And all signs point to URA’s next move being an explosive breakout to the upside.

Source: StockCharts

Source: StockCharts

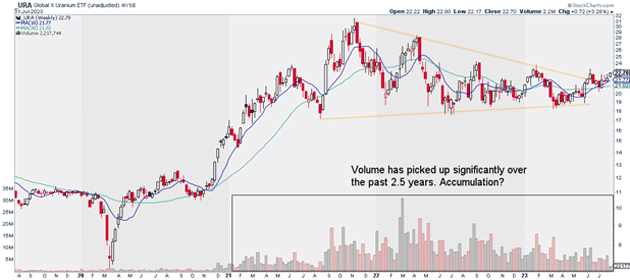

When we turn over to the weekly chart, URA looks just as good. Here, we can see URA is above both its 10- and 30-week simple moving averages, both of which are pointing higher.

We can also see URA has been under heavy accumulation for the past two and a half years:

Source: StockCharts

Source: StockCharts

I suggest buying URA at current market prices, and I’m targeting $30/share over the next 12 months. That’d be about a 32% move higher from today’s prices.

And that’s likely just the start for URA. In fact, I expect uranium stocks to be major outperformers for the next several years.

Exit your position if URA closes below $20. That gives us a risk-reward ratio of 3:1 on this trade.

Action to take: Buy URA at current market prices.

Risk management: Exit your position if URA closes below $20.

Justin Spittler

Chief Trader, RiskHedge