We got sad news last night.

Warren Buffett’s longtime investing partner and billionaire investor Charlie Munger passed away at age 99.

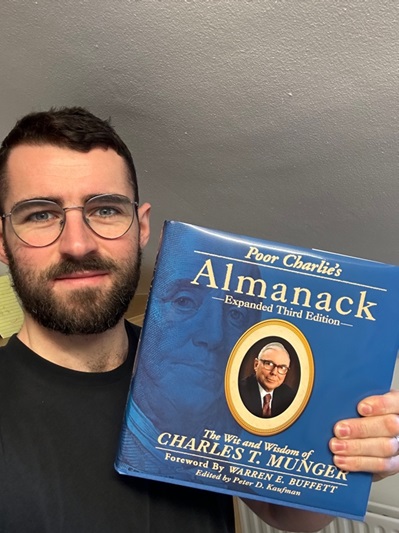

Munger is one of my inspirations, as I wrote about here. His Poor Charlie’s Almanack book is full of wisdom.

Charlie’s ideas helped me make money. But more important, they taught me how to think clearly and make good decisions.

And he didn’t use any fancy business school jargon—just good ol’ common sense.

Let’s toast to Charlie, a life well lived. This guy stayed second-in-command at the world’s seventh-largest company (Berkshire Hathaway) until the day he passed. Wow!

None of us get out of here alive. Let’s get after it while we can.

- I was promised a stock market crash.

At the end of 2022, Wall Street strategists made their 2023 predictions.

They expected stocks to fall this year.

Instead, the S&P 500 surged almost 20% and is now within range of minting new all-time highs.

As usual, Wall Street forecasts proved worthless.

Where do we go from here?

Although the S&P is up big this year, it hasn’t even recovered all its losses from 2022 yet:

A breakout to new highs would be extremely bullish. I think it’ll happen soon.

In any case, I’m a big believer in the Stoic idea of “control what you can; ignore the rest.”

We can’t control the direction of the market. But we can control the types of companies we own.

So why not target companies that can make you money no matter what markets do?

In Disruption Investor, we own great businesses profiting from unstoppable megatrends like AI.

- Full steam ahead for AI development!

The outcome of the OpenAI saga has made me more bullish than ever on artificial intelligence.

Quick recap: OpenAI’s board of directors was controlled by “decels,” or “decelerationists,” who want to slow down AI.

They fired CEO Sam Altman because he was, essentially, doing too great of a job pushing AI progress forward and growing the company.

After a dramatic few days, Altman was reinstated and the decels were instead ousted.

This guarantees full steam ahead for AI development.

Good riddance to the decels.

Am I being too harsh? I don’t think so. When now-ousted board member Helen Toner was asked if the board’s actions could trigger OpenAI’s collapse, she replied:

“That would actually be consistent with the mission.”

Call me crazy, but I don’t think a company’s board should include members who want to destroy the company!

Now, there are legitimate worries about what AI can do in the wrong hands. The one that keeps me up at night is the possibility of a government monopolizing AI and using it to control the populace.

But the decels are worried about silly things that might make for a good Terminator movie… but have no basis in reality. To quote Succession’s Logan Roy, “You are not serious people.”

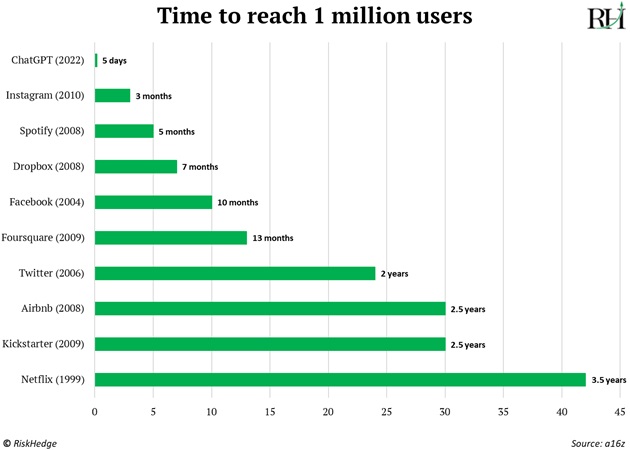

AI was already running at 10X the speed of the average tech cycle:

…and that was with the decels holding it back. Now, we’re about to accelerate even faster.

I’m pumped for the AI age.

AI will turbocharge the economy and produce many trillion-dollar companies.

The opportunities are profound.

- Google should be ashamed of itself.

The recent hoopla around OpenAI proved one thing: Google (GOOG) is eating dust in the AI race.

For years, Google bragged about how it was the AI leader. And in many ways, it was. Employees at Google literally wrote the paper on large language models, the tech behind ChatGPT. (All those employees have since left Google.)

But it’s clear Google blew its lead.

While OpenAI continues to release new game-changing services like the AI “App Store,” Google can’t even launch a half-decent ChatGPT competitor!

Google just announced its new AI model, Gemini, has been delayed once again.

The problem is that Google’s controlled by the same kind of “decels” who tried to freeze OpenAI.

More than two years ago, Google launched a ChatGPT-like system internally. Google developers pushed senior executives to release it. But they were too scared.

Google is not the nimble tech startup it once was. Its legal department is slowing killing it.

As AI expert Zvi Mowshowitz told me last week, “Google is an embarrassment. Why is Bard so bad?”

I just read an essay from a former Google employee titled, Reflecting on 18 Years at Google. This line stood out: “Having seen Google at its best, I find this new reality depressing.”

Avoid Google stock. This is a disruptor in decline.

- Today’s dose of optimism…

You know the problem with capitalism?

It creates “too much” prosperity, which gives people lots of free time to sit around and think and complain.

A farmhand toiling away in a field for 100 hours/week just trying to survive has no time to whine.

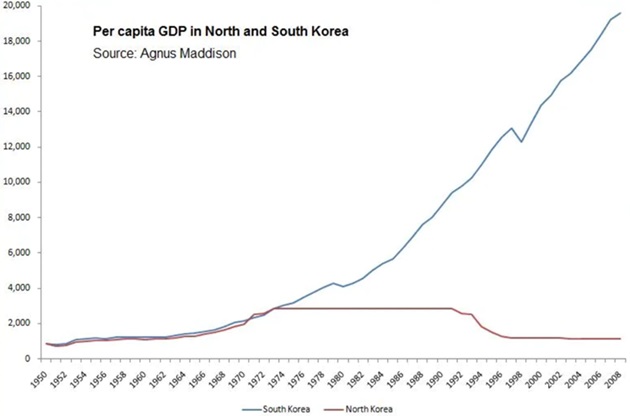

Check out this chart comparing economic growth for North Korea (communist) and South Korea (capitalist):

Source: Agnus Maddison

Source: Agnus Maddison

I’m not exactly breaking the news that South Koreans are infinitely better off than North Koreans.

But it’s important to stop and reflect on what got us here, so we never lose it!

Stephen McBride

Chief Analyst, RiskHedge