Tired of hearing about artificial intelligence and crypto?

Today’s pick is for you.

It’s one of my favorite setups right now, but you won’t hear about it at the gym or your next party.

Carrier Global (CARR) sells heating, ventilation, and air conditioning (HVAC) solutions. It might not sound like the most exciting business, but CARR has performed incredibly well since it went public in 2020.

Between March 2020 and August 2021, CARR surged 391%. It was one of the hottest stocks on the planet! Then the stock cooled off…

CARR experienced a sharp pullback like many other high-flying stocks. But the worst appears to be over.

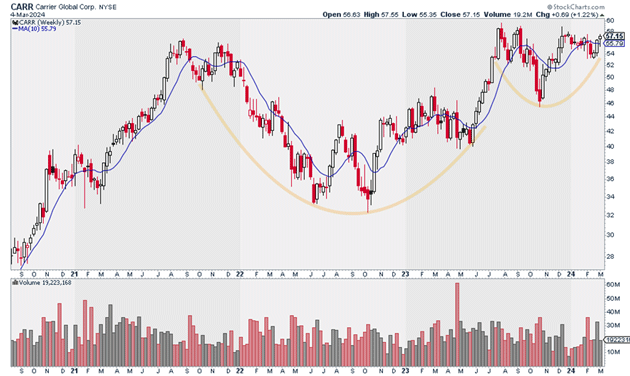

Below, you can see CARR is forming a massive cup-and-handle pattern. This is one of my favorite setups.

Source: StockCharts

Source: StockCharts

A breakout here would be extremely bullish. And there’s a good chance that’ll happen soon…

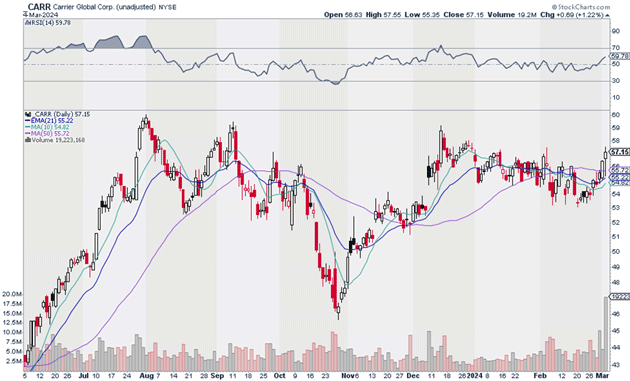

To understand why, let’s take a look at CARR’s daily chart.

Here, we can see heavy buying volume pouring into the stock over the past few days. This is very bullish. After all, big buying volume often precedes big moves to the upside.

Source: StockCharts

Source: StockCharts

I suggest picking up a half position in CARR today. I believe it can hit $80 within the next 12–18 months.

Exit your position if CARR closes below $53. That gives us a risk/reward ratio of 5:1 on this trade.

Action to take: Buy CARR at current market prices.

Risk management: Exit your position if CARR closes below $53.

Justin Spittler

Chief Trader, RiskHedge