At the start of the year, I made a prediction in Disruption Investor:

“2026 will be the year investors stop valuing Tesla (TSLA) as an ‘automaker’... and start valuing it as an energy and robotics company.”

Last week, Elon Musk effectively confirmed that shift.

Tesla announced plans to terminate production of the legacy Model S and Model X. The two cars that marked its first step into mass manufacturing.

Those production lines aren’t being shut down. They’re being reassigned.

Tesla is repurposing them to build “Cybercabs” and to scale production of Optimus, its humanoid robot.

Musk is moving away from making cars and moving toward building autonomous systems.

As investors begin to realize Tesla is now a robotics company, I predict Tesla’s stock will double in 2026.

- A few weeks ago, a Tesla owner…

Completed the first-ever 100% intervention-free coast-to-coast drive.

He drove 2,700 miles from LA to South Carolina. For three days straight the car parked, charged, and drove itself. No human input needed.

Welcome to the age of autonomy.

|

Tesla’s full self-driving (FSD) 14.2 is at least 2X safer than human drivers. That’s why Tesla plans to offer a new type of insurance that recognizes this difference. Miles driven in FSD mode will cost 50% less than human-driven miles.

Tesla recently said the number of active FSD subscriptions just hit 1.1 million. Until recently, these features were only available for Tesla owners.

Now, Tesla robotaxis are going mainstream.

Tesla launched its “Waymo competitor” in Austin this past summer. When RiskHedge publisher Dan Steinhart and I were in town, we saw the robotaxis quietly cruising around.

Now they’re in the Bay Area, too, with roughly 100 Tesla robotaxis zipping from Sunnyvale to San Francisco.

Expect Tesla to launch robotaxis in at least half a dozen US cities this year.

Tesla is also preparing to launch its Cybercab robotaxi—with no steering wheel or pedals—for under $30,000. Elon Musk recently said Cybercab production will start in April. I’ll take two, please!

- Robotaxis are essentially drones, aka robots, on wheels.

They sense the environment around them. They process data in real time. They make autonomous decisions. And they move through physical space without human control.

The only difference is the form factor.

Instead of flying through the air like a drone, or walking on two legs like a humanoid robot, they roll on four wheels through city streets.

That already makes Tesla today’s largest robotics and automation company in the world.

It has millions of autonomous machines operating in the real world. They’ve logged billions of miles on public roads: in bad weather… across construction zones… alongside unpredictable drivers… and during unexpected situations no lab can recreate.

And crucially, Tesla runs a single software stack. Every improvement spreads across the entire fleet at once. A single update teaches every car how to better spot a child stepping off a curb. How to merge into traffic without hesitation. And how to reroute instantly when a road is blocked.

No traditional robotics company operates like this.

Most robotics firms train systems in narrow, predictable settings. Think factories, warehouses, or geofenced pilots. Tesla trains in the wild. Every mile driven is a live experiment.

This is why robotaxis matter more than almost anything else Tesla is building.

Once full autonomy works reliably in one city, it can be scaled to dozens more at the press of a button.

- Going “all in” on energy is classic Elon.

Ahead of the curve once again.

Elon brought electric vehicles (EV) to the mainstream over a decade ago when nobody else was doing it.

Now EV sales are slumping, with the fewest EVs sold in America since 2022.

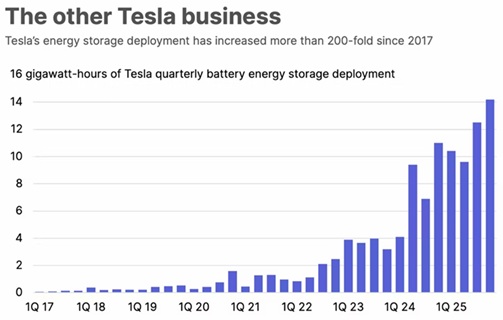

That’s why Tesla is going “all in” on energy systems, with sales tripling in the past few years:

Source: PV Magazine

Batteries are now Tesla’s fastest-growing business. This includes “Megapack,” a container-sized battery designed for utilities… and “Powerwall,” a home battery system.

- I’m less bullish on Optimus, Tesla’s humanoid robot.

General-purpose humanoids are likely years away from being cheap, useful, and scalable.

They’re also the wrong form factor for most real-world jobs.

Specialized robots already dominate Tesla’s factories. They’re faster, cheaper, and more efficient than any humanoid could be in the near term.

None of this really matters for the stock.

Elon Musk is exceptional at pulling future value into the present. Tesla stock soared for years before the company was meaningfully profitable in EVs.

The hype around Optimus will result in the same.

It doesn’t matter whether they’re ready or not. As excitement around humanoid robots builds, Tesla will be the only major public company investors can buy to express that belief. It’s the clearest, most liquid proxy for the entire robotics narrative.

- I expect Tesla—which we called an “absolute steal” in Disruption Investor last April—to break into the world’s five most valuable companies in 2026.

It currently sits at #9.

If you don’t own it already, buy Tesla stock today.

The recent dip is a huge buying opportunity.

Stephen McBride

Chief Analyst, RiskHedge