Adapt or die...

Last Wednesday, I told you how online education company Chegg (CHGG) is being dismantled by artificial intelligence (AI).

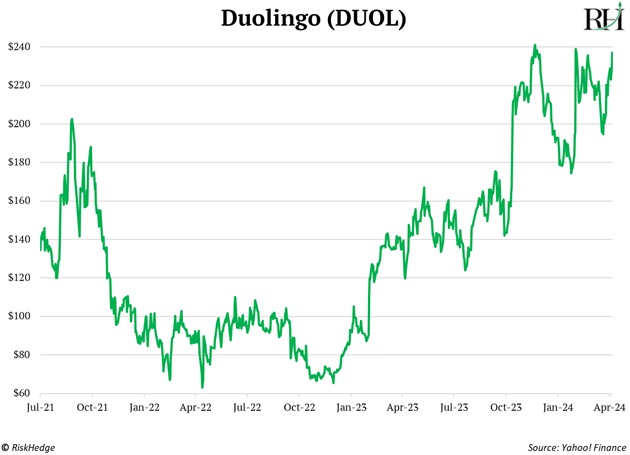

But others—like Duolingo (DUOL)—are using AI to their advantage.

Duolingo integrated ChatGPT into its language learning app. Users love it, and so do investors.

Look at its stock surging to new highs:

There will be many winners and losers as AI transforms America’s most broken industry: education.

Let’s get after it…

- Imagine your kids have a one-on-one AI tutor coaching them…

The tutor has known them since kindergarten.

It understands how your children learn… their interests… what they’re good at… and where they struggle. It designs tailor-made lessons with all this in mind.

Stephen. Third grade. Visual learner. Math. Star Wars… go!

This reality is only two years away, tops. AI tools like Synthesis and Duolingo are early versions of it.

Remember, one-on-one tutoring is the Holy Grail of learning. AI essentially allows us to clone the world’s best teachers and give them to every kid in the world. How awesome is that?

This tech will finally let us realize the dream of no kid left behind AND no kid held back. Slower, unconventional learners will get the one-on-one help they need.

And if your kid’s a genius, AI will help her explore Newtonian physics in third grade. It will allow every kid to achieve their full potential.

This doesn’t mean human teachers will all be replaced. AI will make their jobs far more enjoyable.

Teachers spend less than half their time actually “teaching.” There’s a lot of planning lessons and grading homework.

AI can handle much of this drudgery and free up teachers to spend more time doing one-on-one lessons with students. A win-win for everyone.

|

This little-known, incredibly simple way of investing has beat the market for 50 years while letting you sleep easy and profit when others are scared... |

AI is unlike any other disruption I’ve invested in. The profits are nice… but even greater gains may come from using AI.

I’d trade my Nvidia (NVDA) profits for my daughter becoming a straight-A student.

If you have kids (or grandkids), it’s time to start playing around with AI learning tools like Synthesis.

- Blockchain: What is it good for?

How about a payments system that handles more money than Mastercard (MA) or Visa (V)?

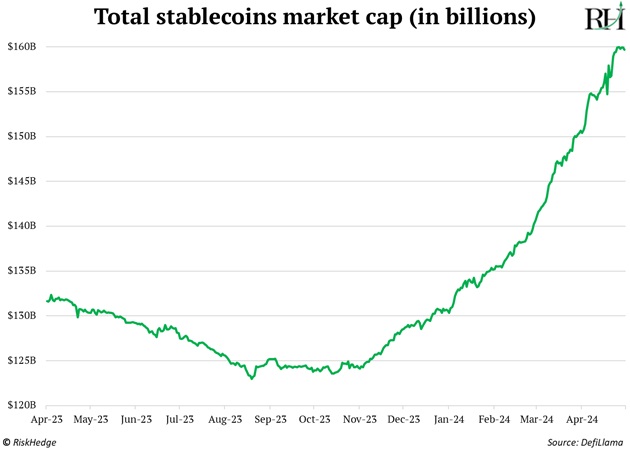

Stablecoins are cryptocurrencies designed to be worth exactly $1. And they can be transferred anywhere around the world, virtually for free.

Stablecoin volumes passed Mastercard last year. And with monthly transactions hitting $2 trillion, they’re on track to knock Visa off its payments perch this year.

More money now moves along crypto rails than on the world’s most widely used payment networks.

You probably take it for granted that you can access dollars whenever you want. Most folks around the world aren’t so lucky.

When I lived in Argentina, the locals were begging for dollars. They were always more than happy to swap their pesos for my greenbacks.

Digital dollars (stablecoins) are much easier to get your hands on than physical dollars.

They’re like offshore bank accounts for billions of people around the world who were helpless against money-printing governments eviscerating their hard-earned savings.

Mark my words: You’ll soon be using stablecoins too.

Just last week, payments giant Stripe integrated stablecoins into its platform. You can now buy billions of goods on the internet using crypto.

|

The advantage is stablecoin payments settle in seconds compared to days… and fees are fractions of a cent versus the standard 3% cut Visa takes.

Fast, cheap, global payments brought to you by crypto. The financial middlemen are in trouble.

This isn’t some wild futurist prediction. It’s happening right now.

The majority of stablecoin transactions flow through Ethereum’s (ETH) blockchain. ETH holders profit from all the fees.

That’s one of the reasons we own Ethereum in RiskHedge Venture.

- The beginning of the end of cancer…

I recently told you about Moderna’s (MRNA) cancer vaccine, which had a “positive response” in patients suffering from head and neck cancer.

And we just saw another major breakthrough.

Researchers in Florida designed a cancer vaccine to attack glioblastoma, the most lethal form of brain cancer. A disease which typically kills its victims in 15 months.

We are going to make more progress against cancer in the next five years than we have in the past 50. And it’s all thanks to mRNA (messenger RNA) technology.

Remember, “mRNA” is the tech that helped scientists develop a COVID vaccine in less than a year, which was a record.

It allows us to immunize ourselves against all kinds of viruses and diseases and do it faster than ever.

Researchers from the University of Florida used mRNA to create a personalized vaccine. The vaccine taught the patient’s immune system to see tumor cells as a dangerous virus and attack.

Within 48 hours, the brain cancer was in retreat!

Biotech is the next transformational trend. mRNA, gene-editing, and wonder drugs like Ozempic are helping us fight today’s biggest killers.

I talked to Matt Ridley (the original rational optimist) about biotech at The Strategic Investment Conference last week. Matt agrees it’s the next big wave of innovation.

I love how he describes mRNA: “Synthetic messengers that reprogram our cells to mount an immune response to almost any invader, including perhaps cancer, can now be rapidly and cheaply made.”

Investors must pay attention to this industry. We own two world-class biotech companies in Disruption Investor. Upgrade here.

Let's finish what President Nixon started in 1971 and win the "War on Cancer."

- Today’s dose of optimism…

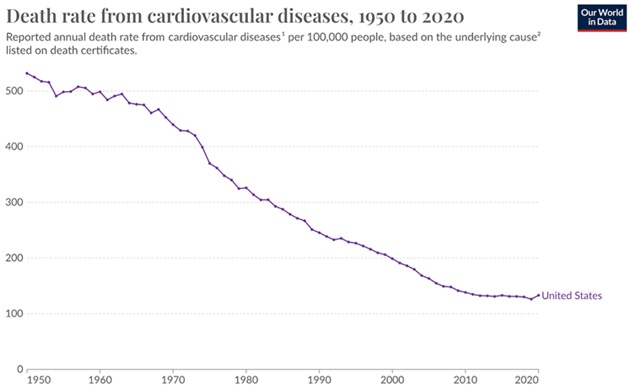

Heart disease killed almost 700,000 Americans last year.

That’s far too many, and we must do better. But it’s important to understand we’ve made great progress.

The death rate from heart disease has plunged 75% since 1950:

Source: Our World in Data

Americans ditching cigarettes is the biggest contributor to this decline.

Innovations like statins, stents, and defibrillators also helped save millions of lives.

And remember, if you’re over 35, consider a calcium CT scan which helps determine your risk of heart disease… heart attack… and stroke.

I’ll see you on Wednesday.

Stephen McBride

Chief Analyst, RiskHedge