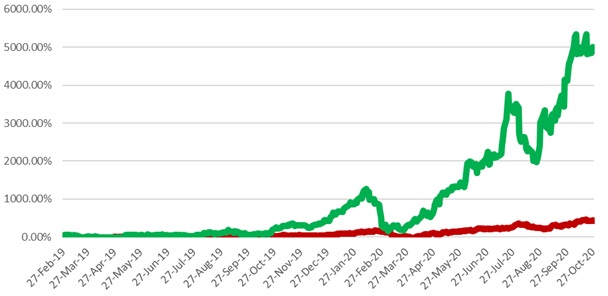

Look at this chart.

The green line’s up almost 5,000%... the red about 400%:

Source: RiskHedge

What if I told you it’s the same company…

With two different ways to play it?

Chris Reilly here, and today I’m bringing in our new RiskHedge analyst John Pangere to walk us through what’s going on here.

***

Chris: John, we’re looking at Purple Innovation (PRPL). Same company, same time period. One line climbs a bit, the other goes almost vertical. Walk us through what we’re actually seeing here.

John: What you’re looking at is the stock versus the warrant. Like you said, same business.

Although you can’t really see it due to the scale of the chart, the stock did great, rising 431% in less than two years.

But the warrant—which I recommended—amplified that move. The Purple warrants soared 4,947% during the same timeframe.

Let’s add some labels. The stock ticker was PRPL. The warrant, which you could buy just as easily as the stock, was PRPLW.

Source: RiskHedge

Chris: A 4,947% gain is a 50-bagger, rarified air. And this wasn’t some hot tech name or momentum trade at the time. It was mattresses.

John: That’s what makes it such a good example. Purple wasn’t even exciting. It was a company executing well in a boring industry.

But the setup mattered. Revenue was growing. The business model was changing. And the warrants were cheap. Really cheap.

When I first recommended them, the stock was around $5.70. The warrant was trading for about $0.19. And again, buying the warrants was as simple as buying the stock in your regular brokerage account. No paperwork or special accredidation needed.

Chris: So you could buy the stock at $5.70… or you could buy the warrant at $0.19.

John: Right. With the warrant, you’re still investing in the same underlying business. You’re just getting more upside for a smaller amount of upfront money. Also known as “leverage.”

People hear “leverage” and assume big risk or big capital. This was the opposite.

You could take a few hundred dollars and get meaningful exposure to Purple’s upside with the warrants.

Chris: And this was a two-stage trade, right?

|

John: That’s right. About a year in, the warrants were already up over 1,000%. At that point, we took a “Free Ride,” which I know RiskHedge members are very familiar with. I use it, too. In short, members sold enough to get their original capital back and then some.

From there, it was house money. The warrants kept rising and by the time we closed the trade, they’d gone from $0.19 to $9.58.

Chris: Is this normal in warrants?

John: I mean, these exact results are not normal. This is almost a 5,000% gain, after all.

But the other characaterisitics of the trade are pretty normal. It’s common for warrants on a company to vastly outperform the stock when the company’s doing well.

And it is completely normal for the warrants to be available for a significantly lower price than the stock. Warrants are mispriced relative to the potential upside all the time.

Chris: Why is that?

John: Warrants are an underfollowed market. They’re too small for Wall Street to care about. And most independent investors assume you need special connections to private deals to get warrants.

That is not the case. Anyone can buy a tradeble warrant. You just need to know where to look.

Chris: And this is why I was excited to bring you into RiskHedge. Almost nobody is doing this.

John: Warrants have been around forever. Wall Street understands them. Institutions use them all the time. But once they hit the public market, they’re often ignored.

That creates opportunity for individual investors who are willing to put in the effort to find them. The lack of coverage means there are a lot of opporutnities in warrants where the odds are tilted heavily in your favor.

Of course, they will not all be 50-baggers. And not every trade will work out. But as long as you’re investing small amounts you can afford to lose—$200 is enough—the asymmetric nature of the gains can really pay off.

Chris: That’s what you walk through in your latest report.

John: Yes. I break down how I evaluate warrant trades from the start. What I look for. What I avoid. How I decide whether something is just interesting or actually worth putting money into. And, most important, how I think about risk.

Chris: Thanks, John. Reader, if today’s example got your attention, John’s report goes much deeper. John lays out his full framework, including how to spot the difference between an average setup and one with real potential.

It’s called The Modern Warrant Playbook: From Dimes to Dollars.

And you can claim it right here.