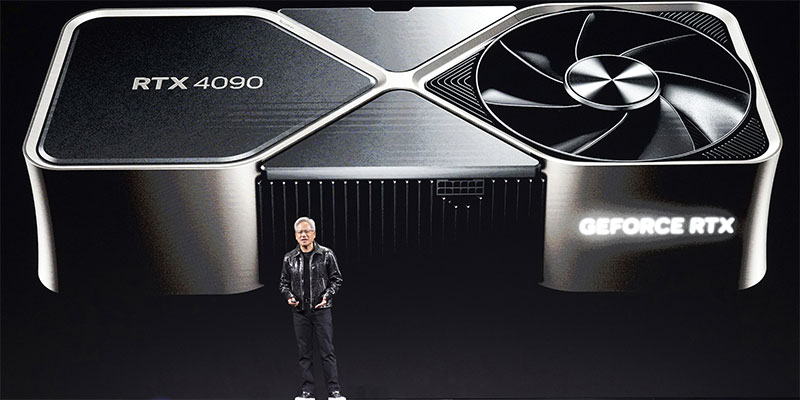

Everyone knows Nvidia (NVDA) is a stock of a lifetime.

It’s up 1,700%+ since we first recommended it in September 2018.

And it’s surged 1,000% since October 2022, thanks to the artificial intelligence (AI) boom turbocharging its business.

That means investors could’ve 10X’d their money in under three years.

How rare is that?

Rare… but maybe not as rare as you’d think.

My team and I conducted a comprehensive study and found 347 stocks that gained 1,000% or more in the last 20 years.

These winning stocks had several commonalities. But perhaps the most intriguing one was this:

The biggest winners tend to sprout up en masse during periods of huge technological disruption.

We’re in one these periods right now, as I’ll show you in a moment.

-

But first, let me take you back to the 90s.

Remember internet stocks?

Most folks remember them best by how they crashed in the aftermath of the dot-com boom.

But before that, they showered investors with profits for six long years.

It all started in 1994 with Netscape Navigator, the world’s first user-friendly web browser. Netscape Navigator made the internet “clickable” with images, hyperlinks, and graphics.

It brought the internet to the masses and forever changed the way we interact with the world.

The internet gave birth to instant messaging and email. It changed the way we shop, advertise, and consume media, among other things.

It also gave rise to brand-new 10-bagger stocks.

Amazon (AMZN) started out as an online bookstore in 1995. But its products soon expanded to CDs and DVDs, toys, consumer electronics, and more. Amazon’s sales grew from $0.5 million in 1995 to $2.76 billion by 2000. During that same time, its stock shot up 85X.

eBay (EBAY), another popular online marketplace where you could buy anything from a vintage comic book to a designer handbag, jumped 23X from 1998 to 2000.

Oracle (ORCL) was one of the first companies to help corporations manage and analyze data. Its stock shot up 100X during the dot-com boom and is still one of the biggest stocks in the world today.

I could go on and on. Broadcom (AVGO), Best Buy (BBY), Microsoft (MSFT), Cisco Systems (CSCO), Intel (INTC), Dell Technologies (DELL)... all soared 10X or more thanks to the birth of the internet.

-

Smartphones were another disruptive technology that changed the way we live and made early investors wealthy.

Apple (AAPL) launched the first iPhone in 2007, the most successful product in history. It sold over $2 trillion worth of these pocket-sized supercomputers since debuting in 2007. Since then, its stock has jumped 80X, making it the largest company in the world by market cap.

Social media giant Meta Platforms (META) allowed people to share moments from their lives with friends in real time. Its stock has soared 20X since it started trading in 2012.

Square (XYZ) introduced mobile payments to the world by allowing small businesses to accept card payments via smartphones. Just three years after its stock started trading on the New York Stock Exchange, it had already surged 10X.

Or consider what happened after the invention of “the cloud.”

The cloud allowed us to move files, apps, and even entire businesses from clunky hard drives to powerful, always-on data centers we could access over the internet.

|

Suddenly, anyone could store unlimited photos, stream movies on demand, and work from anywhere in the world. Businesses no longer had to buy massive servers—they could rent computing power as needed, scaling up in seconds.

-

The cloud unleashed another wave of 10-bagger stocks...

Netflix (NFLX) pioneered the streaming industry. It made streaming movies from the cloud its primary business in 2010. Its stock soared 27X over the next 10 years.

Adobe (ADBE) was one of the first big software companies to put its apps in the cloud in 2013. By 2020, its stock had reached 10-bagger status.

Microsoft has soared over 20X since launching its cloud service Azure in 2008.

See the same pattern playing out over and over again?

Big disruptive changes foster big investment opportunities.

-

The difference today is that many disruptive technologies are going mainstream at the same time.

Look at AI, for example. Over 300 million people use ChatGPT every week. Doctors use AI to help catch cancers early. AI-powered robots are assisting in surgeries. AI is transforming every industry in one way or another.

Or nuclear. After decades in decline, nuclear energy is making a comeback. Dozens of startups are developing next-gen reactors that are smaller, safer, and more efficient. Most important, they promise to make electricity cheap and abundant.

Often referred to as “CRISPR,” gene editing is helping blind kids see and deaf kids hear. mRNA technology is being tested for cancer cures, malaria, and even personalized medicine. Neuralink is implanting brain chip, which will hopefully help paralyzed patients walk again.

Drones, robotaxis, robotics, the space economy, the return of supersonic flights, 3D printing… We’re looking at an explosion of new disruptive industries.

And what do we know about new disruptive industries?

They create abundant investment opportunities. Including opportunities to 10X an investment… provided you know what to look for and how to control risk.

It’s why my colleague Chris Wood and I have spent the last few months working on—a special project focused on identifying 10-baggers (stocks that gain 1,000%).

We were able to zero in on the “Core 4” traits often shared by stocks that go up by 10X or more. It’s all in our new report—The Ultimate Guide to Modern 10-Baggers. Access it here.

I’ll share more details in the coming days. But for now, you can see all our initial findings in the report.

Stephen McBride

Chief Analyst, RiskHedge